Image Credit: Michael Chandler

With the economic downturn, I’ve been looking for ways to get better value for overhead dollars, and one thing that really stands out is the cost of our company-paid health care insurance.

We first offered this back in 2006 or so and it seemed pretty expensive back then, but what cost us $1,500 for a single young employee had grown to $2,860 by 2010, a 190% increase in four years for a policy with a $1,500 per person deductible and 80-20 co-pay. The costs were crippling for the married employees with kids, including my own family. With every cost increase I was encouraged by my agent to save money by reducing coverage.

Co-payments are high, and pre-existing conditions lock you in

Every doctor’s visit seemed to come with some kind of co-pay and a letter telling us that we still owed more as part of our deductible. I had gotten used to feeling ripped off and trapped by the fact that I, and most of my employees, had pre-existing conditions, so we really had no option.

Imagine wanting to reduce the cost of your homeowner’s insurance and being told that because you once had a grease fire in your kitchen you would have to go through a two-year period where you would pay full rate for coverage — but your house wouldn’t be covered from risk of fire. That wouldn’t sit too well with your mortgage bank, but health insurance companies got away with it because the federal government was allowing folks to go the emergency room and just not pay the bill.

Now insurance companies can’t turn you down because of pre-existing conditions

Obama-care changed that. I could now put my insurance package for my little five-person company out to bid and the bidders would be able to ask about pre-existing conditions and quote accordingly but not to to exclude them so long as there had been no lapse in coverage.

I’m not smart enough to understand the fine print in an insurance policy, but I can realize the opportunity this provided when I read about it in the newspaper. So I asked my bookkeeper and my accountant to get quotes for replacement coverage and to make a recommendation. My accountant asked if we were allowed to look at Healthcare Savings Accounts (HSAs) and I said sure, if they make sense, let’s take a look.

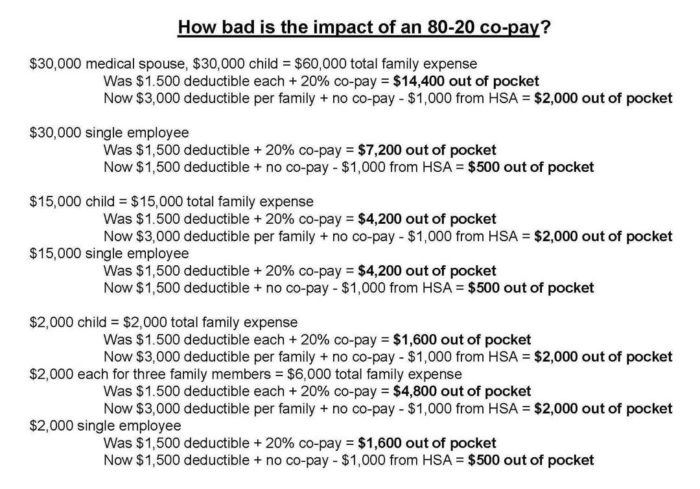

What they found first was how bad my existing coverage really was. With a $1,500 per person deductible and 80-20 co-pay after that a couple with three kids had a potential deductible of $7,500 before having to kick in co-pays. With just one kid I was liable for $4,500 per year and any deductible payment made was wiped out at the end of the year and started over again. The single guys had it better with just the $1,500 deductible and the co-pays but they weren’t tracking how much those co-pays added up to, and it was not insignificant.

Better coverage for the same price

They solicited bids from competing health insurance companies and we recently did get a new policy with a $1,500 deductible for single employees or $3,000 per family, no co-pay and company-funded Healthcare Savings Accounts. The cost of the policy is lower and the company puts the $1,000 per employee per year savings pretax into their Healthcare Savings Accounts to help pay the deductible. I can increase that contribution if it makes sense over time.

The attached chart shows how the new policy compares to the old pre-Obama-care policy and the impact of eliminating the 80-20 co-pay. It’s dramatically better coverage for the same money. If my team can be more thoughtful about their use of the HSA debit card, especially by using prescriptions economically, they can save money in their HSAs for future years tax-free.

Plus “preventive care” is generally free. This policy rewards people for staying healthy, which reduces sick days.

Surprise your employees by improving insurance coverage

When I first started looking into this, there was an undercurrent within the crew that since the company wasn’t doing so well I was just looking to save myself some cash on benefits. (Never mind that I cover my own family with the same policy I provide for my employees.) That stung, but in a way it turned out to be true. Shortly after we got the new policy up and running I had a major health crisis involving a 4½-hour surgery and ten days in the hospital. A quick back-of-envelope calculation leads me to expect to pay $7,000 less out of pocket than I would have with the old policy. My employees can look forward to the same kind of savings.

Your employees can look forward to savings like this as well. Take time now to re-examine your health insurance and see if the new rules can save you and your employees big money.

But do it soon. I hear some legislators are hoping to repeal Obama-care because it’s “socialist” or something to “attack the health insurance companies.” But don’t feel bad for the health insurance companies; I understand that they are all posting record profits this year.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

2 Comments

Health Insurance

Thank you Michael.

It's good to see a sensible real-world story from a small business owner about the effect of the Health Reform law. As you say, it may not be perfect, but it is a step forward.

Thanks Michael

Great topic, great post.

Log in or create an account to post a comment.

Sign up Log in