It will be the second quarter of 2022 before a production line in a repurposed Maine paper mill begins turning out wood-fiber insulation, but the startup behind the operation sees a ready market among mainstream builders and the potential for expansion well beyond the northeastern U.S.

Production facilities for TimberHP, an offshoot of GO Lab in Belfast, Maine, will occupy some 200,000 square feet of space in the former Madison Paper mill. The plant closed in 2016 as demand for paper declined, and the paper-making machines were later sold to a Chinese company and removed.

The company plans three separate production lines in what will be the first manufacturing operation of its kind in North America. Wood-fiber insulation is a $700 million business in Europe, says chief marketing officer Scott Dionne, and until the Maine plant is operational that’s where builders here will continue buying it.

European-made wood-fiber insulation, including the Steico and Gutex brands, is currently available in the U.S. through such retailers as Global Wholesale Supply and 475 High Performance Building Supply.

Ultimately, the Maine plant will turn out loose-fill, batt, and board insulation, all of it made from chips of softwood timber with additives that increase its fire and moisture resistance. Two of the production lines will be new. The third—for producing board stock—was purchased from a German company and is currently sitting in 120 shipping containers in a Maine port waiting for renovations in Madison to be completed.

Dionne says loose-fill insulation will be first, with batt and board versions to follow in the fourth quarter of 2022. When up and running at full capacity, the plant will be able to produce some $100 million worth of insulation a year.

Loose-fill wood fiber insulation can be used in attics or as dense-packed insulation in wall and roof cavities. It has an R-value of 3.8 per inch, Dionne says, and can be installed with the same equipment used for cellulose. The vapor-open batt insulation, at R-4 per inch, is made from the same wood fibers, which are blended with polyester fiber and then baked in an oven. The friction-fit batts will be available in four thicknesses, intended as both acoustic and thermal insulation. The board line, purchased from the German producer Dieffenbacher, will turn out panels of insulation from 1 in. to 10 in. thick with an R-value of 3.5 to 3.8 per inch, depending on density.

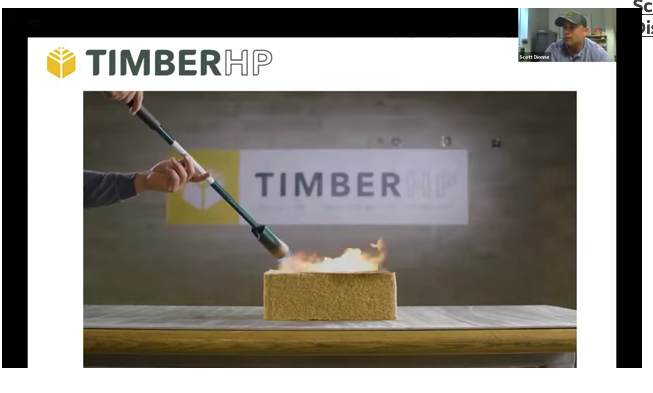

In a recent “B.S.* + Beer Show” devoted to the topic of wood-fiber insulation, Dionne emphasized the insulation’s low toxicity, vapor permeance, and low flame spread (ASTM E-84 Class A for loose and batt, Class B initially for board stock). It also sequesters carbon.

Wood-fiber insulation is not for use below grade.

A big market in the making

The success of wood-fiber insulation in a region where a quarter or less of buildings are wood-framed makes Dionne optimistic about the potential for growth in the U.S. There are currently 15 plants making the insulation in Europe, with another four due to open in the next several years, he said, with a total in annual sales headed toward $1 billion.

“In the U.S. residential market, 90% is wood-frame,” he said in a telephone call. “We can produce wood-fiber insulation at a much lower cost than Europe because the wood fiber we have is about half to three times less [expensive], and energy costs are half.”

Wood fiber in the U.S. is currently an expensive niche product, but with manufacturing spreading to North America, Dionne expects that to change. Loose fill will cost the same as cellulose, while batts will be priced between mineral wool and fiberglass, and board stock that can be used as continuous insulation on walls and roofs will be in line with rigid foam.

In time, Dionne says, GO Lab will be looking to expand into other parts of the country, not only because the insulation will be able to compete directly with mainstream insulation products now on the market but also because it makes use of an abundant resource.

“There’s not going to be just one production facility in North America for wood fiber insulation,” Dionne said. “It wouldn’t make any sense. This market is just getting off the ground, and we’re looking for additional opportunities to build out as we move forward over the next 10 years.”

Maine has lost six paper mills in the last five years as demand for paper products dwindled, leaving lots of unused wood fiber available for other uses. In that sense, the state is not unique.

“There’s a need in Maine to take advantage of low-value fiber,” Dionne said. “These days you look at OSB and lumber prices and they’re skyrocketing through the roof but the fiber we’re using is just low value that’s typically gone to paper production, and we’re not alone when you start looking across the U.S.

“People are facing challenges in every state with the loss of the paper industry,” he continued, “but they are also trying to come up with new ways to add value to low-value fiber instead of just leaving it in the forest, where it becomes tinder for forest fires.”

The privately held firm has raised $35 million from a variety of investors, including some from the forest and building materials industry, and is looking to close on $85 million in tax-exempt municipal bonds by July. The $120 million will cover the build-out of the entire product line. Dionne said the company will employ roughly 100 people at its Madison headquarters, but added that for every direct-forest manufacturing job in Maine another 17 jobs are created indirectly.

“This facility in Madison will be producing more than $100 million of insulation a year at full production,” Dionne said. “We have to penetrate the mainstream market. And having good paths to market and good relationships with distributors who have a firm handle on the market is absolutely crucial. We have those relationships in place.”

Scott Gibson is a contributing writer at Green Building Advisor and Fine Homebuilding magazine.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

7 Comments

I hope their pricing estimates hold -- if this was available now, at competitive pricing, I'd be ordering a house's worth! The product checks a lot of boxes for me, but the pricing of imported Gutex is unfortunately completely out of reach.

Thinking about embodied carbon, I don't really see the point of the loose fill version of this product (competing with cellulose, which both sequesters carbon and uses nearly 100% recycled material). Since the bat version is made by mixing in plastic I don't know how it compares to fiberglass - likely still better? But the board product could be a game changer as a competitor to mineral wool - since that product is manufactured by heating raw materials up to extreme temperatures using fossil fuels.

We really need to build several high volume factories for this product built on the West Coast. There is a real problem here from Pine Bark beetles causing large forest die offs. We are also seeing more and more forests dying off from both fire damage and drought that kills trees directly or makes them vulnerable to other problems that would not normally be serious problems for forests.

Currently those trees just remain standing for long periods of time until they either just fall over or are consumed in a fire. Either way that carbon is then released into the air in the form of CO2. Wouldn't it be great if we could solve three problems at once:

1. Create a financial incentive to harvest those dead or dying trees so they are no longer fuel for fires.

2. Create an alternative to cellulose insulation from paper which will become increasingly scarce as paper is used less and less.

3. Sequester all that carbon in the form of insulation before it becomes a link in the chain of ever more climate level CO2 in the atmosphere.

How did this product not take off years ago?

Shipping costs and lack of exposure to tract/production builders?

These companies need to be located in Southern US (eg Alabama) and the NW US in order to be able to offer a cost competitive product. Maybe license out the manufacturing? I mean would we rather see this product or pelletized wood shipped to the UK?

Interesting development. Looking forward to learning more about the difference in price and performance between wood fiber and traditional cellulose insulation.

A few manufacturers have been making cellulose batts for a while. I once considered Nu-Wool's Ecocel and it seems like a nice product but for some reason it has remained a niche and expensive form of insulation.

7 years ago the Boston Globe reported on a MA company attempting to make cellulose insulation primarily from recycled carboard -which is probably more abundant than paper by now. I just thought of looking it up and and it looks like they have started small scale production in Buffalo, NY under the name Clean Fiber. They position their product as being cleaner to install than traditional cellulose.

Sorry if this is Globe subscriber only

https://www.bostonglobe.com/business/2014/08/10/newton-startup-ultracell-using-cardboard-boxes-create-insulation-for-homes/UX1tjUrUPYAHdD2tXsA2mO/story.html

https://www.cleanfiber.com/faq/

It sure sounds good that the market appears to be growing in Europe. It would be nice to have an economic alternative to exterior foam board.

Log in or create an account to post a comment.

Sign up Log in