This post originally appeared at the ACEEE blog.

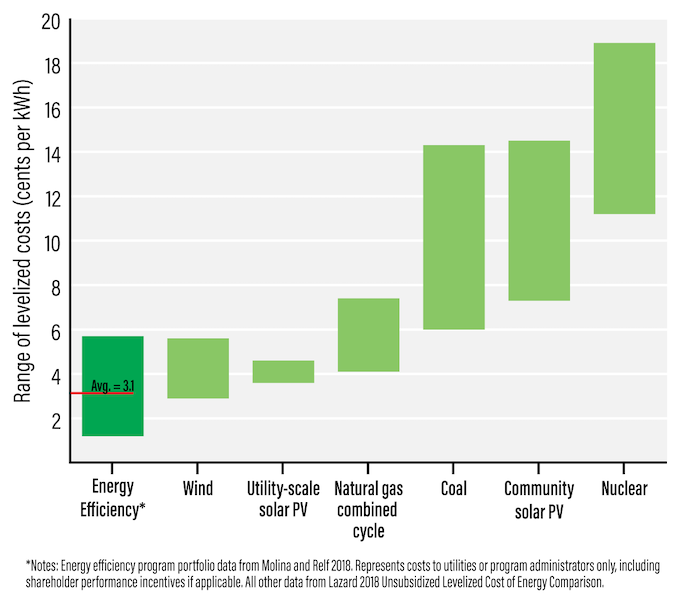

New data by Lazard, a financial advisory firm, show that prices for renewable electricity declined again last year, continuing their downward trend. But the data, released last month, miss another critical clean energy resource. Energy efficiency — the kilowatt-hours we avoid by eliminating waste — remains, on average, our nation’s least-cost resource.

Efficiency also delivers a host of other benefits. It improves electric grid reliability and resilience, can target savings where and when needed the most, creates jobs, spurs other economic development, reduces customer utility bills, makes homes and buildings more comfortable, and reduces harmful pollution.

What do the data show?

Research by the American Council for an Energy-Efficient Economy shows that energy efficiency programs cost utilities, on average, about 3.1 cents per kilowatt-hour nationally. It examines program costs and performance incentives for the 49 largest U.S. electricity utilities in the 2015 program year. (The data do not include additional participant costs.) Lawrence Berkeley National Laboratory (LBNL) has found similar results in an analysis of 2009-2015 program year data (with a few differences in approach). It has also examined the total cost of efficiency programs, including participant costs.

The average cost of efficiency to utilities is still generally less than that of wind or utility-scale solar. And overall, energy efficiency and clean energy continue to come in at a lower cost per kilowatt hour than more traditional resources.

Worth noting, these are national data; regional data will vary. Also, the levelized cost data in the Lazard analysis and our paper are a simplified and limited metric and they do not tell the full story of the benefits of energy efficiency (or other resources) to utilities. For example, the Lazard data do not include costs for needed storage or transmission and distribution.

How big are efficiency investments?

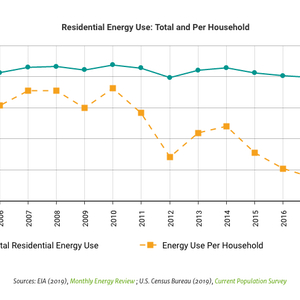

Investments in energy efficiency can have a big impact. Those made between 1990 and today have helped us avoid building the equivalent of 313 large power plants and have delivered cumulative savings of nearly $790 billion to customers nationwide. The need and opportunity for efficiency as a utility resource will continue in the coming years as states and utilities will need to meet evolving goals.

For example, investments in transmission and distribution have grown significantly over the past decade. This trend means higher costs for customers. Energy efficiency can help keep these costs in check by serving as both a broad-based resource and a distributed energy resource that meets specific time and locational needs on the grid. Efficiency also has a large role to play in reducing emissions and meeting aggressive climate goals for many states and cities.

The good news: Utilities are increasing efficiency investments, helping their customers use energy more efficiently, and meeting demand by saving energy rather than generating it. A recent LBNL analysis projects, in its medium case scenario, that utilities will increase efficiency investments from $5.8 billion in 2016 to $8.6 billion in 2030, a jump of more than 45%.

But will this, or even the LBNL study’s high scenario, be enough to meet states’ growing energy and climate policy needs? Not likely. New and refined policy tools will be needed, such as the next generation of energy efficiency resource standards, utility business models aligned with efficiency, and financing options that help businesses and households leverage public and ratepayer funding to drive deeper savings. Check out our State Policy Toolkit, which can help state policymakers and regulators increase use of our nation’s least-cost energy resource.

Maggie Molina is senior director for policy at ACEEE.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

6 Comments

It would be nice if this study would have included the cost average of kWh in homes vs. utilities, wind, etc. as the chart above shows. That would be great to show interested clients.

> The average cost of efficiency to utilities is still generally less than that of wind or utility-scale solar.

The key word here is "average". There are some old houses that are extremely inefficient. And there are others that are already so efficient that further efficiency improvements are considerably more expensive than producing more renewable energy.

Would be interesting to see an additional category of "residential thermal storage".

I would love to see a followup that dives into calculating where one's energy dollar is best spent.

In a super efficient home, maybe renewables are the best bet, and in a super inefficient old home, maybe air sealing is... but what about all of us in that murky grey area? How do I determine whether I should further pursue efficiency, or switch to focusing on renewables? That #0.031/kWh figure is somewhat helpful, but you can't really do the math without time in the equation, because you pay now yet reap the energy benefits over years/decades. And the time horizon will be situational (How long does air sealing last? How long do solar panels last? How long will you live there? Will you recoup the cost when you sell? etc.), but if there was something vaguely resembling a rule of thumb, it could help a lot of people make better decisions...

Nick: The 3.1 cents/kwh DOES have time in the equation. It is the contract price to the utility (over a longer term than most homeowners would ever consider), and based on the builder/ operator's levelized cost after incentives, capitalization costs, profit margin, and operation & maintenance estimates etc. Most homeowners aren't making 20-40 year investments, but it's rare for utilities or merchant power generation companies to make investments shorter than 20 years.

The levelized cost of a rooftop system will be much higher, but has still been dropping like a rock over time. Without incentives using reasonable discount rates the levelized cost of a home system is still over 10 cents/kwh, but in most cases under 20 cents. After federal state and local incentives it can come in under 10 cents.

This year the typical installed cost of small systems is averaging about $2.87/watt which is more than 2x, close to 3x the unsubsidized installed cost of utility scale systems :

https://openpv.nrel.gov/

To convert that to a lifecycle levelized cost requires estimating the annual output, but NREL has this handy calculator to play with:

https://www.nrel.gov/analysis/tech-lcoe.html

If you plug in $2870/kw a 25 anticipated lifecycle and 4 percent discount rate, a 17% capacity factor (about right for much of the northern US, low for the southwest) and $25/year O & M it comes in at 14. 2 cents.

If you apply the 30% federal tax subsidy it brings the upfront cost to $2009/kwh, yielding a 10.5 cent levelized cost over the 25 years. You can see how other incentives like SRECs or additional state & utility rebates can bring that under 10 cents. (That's about half my current retail rate, which in my state would still be net-metered at retail.)

But that's a 25 year bet. While most homeowners don't hold the house that long, many do. And that's at a 4% discount rate. Typical homeowner investment behavior indicates that they need double digit discount rates and three year time horizons before they buy in.

In Maine, where I live, the transmission/distribution companies are prohibited from owning generation assets. Consequently, they have little incentive to invest in efficiency. In fact, if people use less power, the T&D utilities lose revenue.

Does everyone agree that fiberglass batt insulation installed under the subfloor of a crawlspace must be in complete and constant contact with the subfloor to be working correctly? Huntsville, AL utilities through its new construction energy program requires R19 floor insulation. The catch is that it is not required to be installed correctly. Most installers just rest it on the lower lip of the I-beam floor framing. It does not perform at all. A short time later, it absorbs moisture and much of it falls completely out. The utility gives the customer (usually a production builder) deemed savings of properly installed R19 insulation. I do not think public utilities should be allowed to use deemed savings.

Log in or create an account to post a comment.

Sign up Log in