The Inflation Reduction Act (IRA), signed in August 2022, lays out a sweeping set of policies aimed at cutting energy costs and carbon emissions. The IRA’s provisions include updates to tax credits for residential efficiency retrofits, electrification, and renewable energy. In an article I wrote shortly after the IRA became law, I examined the specifics of these credits. Commenters responded with questions and noted a few ways their interpretations differed from mine.

The Internal Revenue Service (IRS) has issued a Fact Sheet that addresses these points and several others. I’ll use this fact sheet and supporting data from the Department of Energy and the EPA’s Energy Star program to clear up questions about what improvements qualify and the amounts allowed. In some cases, including projects that combine building envelope work with heat pumps, the credits may be considerably larger than I initially thought. (Disclaimer: I’m a contractor, not a tax advisor. Questions regarding the application of these credits in a specific situation should be referred to a qualified professional.)

The new credits apply to measures installed on or after Jan. 1, 2023.

The Energy Efficient Home Improvement Credit

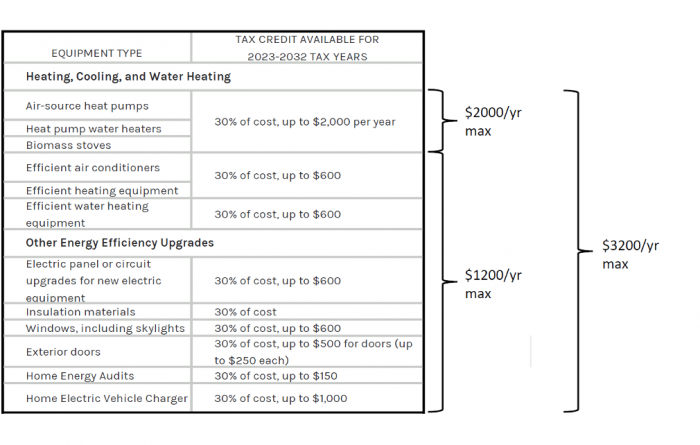

The IRA extends the Energy Efficient Home Improvement Credit, also referred to as the “25C credit,” through the end of 2032. Taxpayers can claim credit equal to 30% of a measure’s cost. 25C credits are “nonrefundable”: taxpayers can use them to reduce their tax liability to zero but cannot receive refunds in excess of taxes paid. The credit must be claimed in the tax year the measure is installed and cannot be carried over. Eligible improvements are summarized in the following table:

The IRS Fact Sheet clarifies the maximum amounts of 25C credits:

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

This article is only available to GBA Prime Members

Sign up for a free trial and get instant access to this article as well as GBA’s complete library of premium articles and construction details.

Start Free TrialAlready a member? Log in

12 Comments

Has anyone else questioned the ASHP minimum efficiency specs? A fellow energy advisor pointed out to me that Energy Star has adopted the HSPF2 and EER2 naming, but has left the minimum specs at 9.0 and 16, respectively. Which amounts to a roughly 15% and 5% increase in heating & cooling efficiency (https://www.ekotrope.com/blog/the-impacts-of-seer2-and-hspf2) for ASHPs in the 'National' region.

Our utility rebate program adjusted the minimum efficiency specs to maintain the same level of efficiency between HSPF/SEER and HSPF2/SEER2, lowering the HSPF2/SEER2 specs to account for AHRI doing a better job handling a duct system in the testing process.

With Energy Star maintaining the 9.0/16 minimum specs, is the higher efficiency requirement a feature or a bug?

It took me a little while to puzzle through this. It looks like, in some cases, the requirements for the higher CEE tiers (2, 3, and 4) can be stricter than those for Energy Star certification. If this is the case, folks will need to check specifications carefully, since not all Energy Star-rated ductless systems will be eligible for the tax credit. Here is a link to the CEE specifications:

https://cee1.org/node/729

and Energy Star key product criteria: https://www.energystar.gov/products/heating_cooling/heat_pumps_air_source/key_product_criteria

Does a heat pump clothes dryer qualify for this program? Also would air sealing qualify?

Air sealing (materials only) is eligible for a 30% credit. Heat pump clothes dryers don't qualify for federal tax credits but will be eligible for rebates of up to $840 under the High-Efficiency Electric Home Rebate program once it rolls out.

Thanks, especially for your quick reply.

For the Energy Efficient Home Improvement Credit electrical service upgrade qualification for $600, I'm not seeing adding a circuit for an induction range. Is that an oversight? Only briefly mentioned is the High-Efficiency Electric Home Rebate (HEEHRA) program. From your 9/14/22 GBA article Jon Harrow, the IRA provides tax credits for Electric load service upgrade: $4000, and Wiring upgrades: $2500 for an improvement, such as an induction range. Can these two program's tax credits be combined, not be subjected to caps? The $840 induction range incentive I understand will be provided at the appliance store, correct? Thanks for helping sort this all out.

I appreciate you pointing out that the IRA credits only cover the material costs of envelope improvements. And that this lack of a credit for installation labor is a missed opportunity for job creation and overall better insulation and air-sealing outcomes. Bummer.

Thanks for this helpful digest of the latest IRA Fact Sheet!

An interesting note - credits under the Energy Efficient Home Improvement Credit do no qualify for new construction. Without discounts, we will continue to see new houses built as they are.

Residential Clean Energy Credit does qualify for new construction. So Geothermal still gets a 30% tax break for new construction but air source heat pumps get nothing. That is an unfortunate miss I think.

I believe anything you claim credit for must be on an approved list by manufacturer. In the forms I did not see how you document this though, the honor system? Also, in general, the credits seem quite low compared to actual costs which I suppose goes without saying. One bright spot is that at least for solar which has no limit on amount of credit, the credits carry over for 22 years. So if you are retired and have a small taxable income, you can eventually get all the credit back.

Any update on the details on how a rebate or incentive for purchasing an induction cook top will be administered and when it will be available. We have been waiting to order an induction cooktop.

I'm very disappointed that rental units aren't covered. I have three units with 70 year old cast iron converted gas boilers that I hope to replace with air to water heat pumps.

Other than normal depreciation, are there any other tax incentives available?

Given that air sealing/wrb can qualify as long as a manufacturer's certificate is provided, I wonder if huber provides such a certificate for zip sheathing/tape.

Log in or become a member to post a comment.

Sign up Log in