Image Credit: Environment America

Image Credit: Environment America Solar-generated electricity offers a variety of benefits, including better grid resiliency, avoided energy costs, and reduced financial risks.

With the solstice behind us, summer has officially begun. Across the country, that means the sun is shining and the mercury is climbing, and our air conditioners and the electricity grids they rely upon are stretched to their limits.

In response, we’ve seen utilities urge customers to turn up their thermostats a notch or two to ease their burden. They’ve recommended the use of fans, energy-efficient bulbs, and double-paned windows — all good measures to reduce energy use.

What we haven’t seen is much action by the utilities to encourage people to go solar. In fact, in state after state, by proposing to increase fees for owners of photovoltaic (PV) systems or to lower their reimbursement rates, utilities are doing the opposite.

That’s a shame, because a new Environment America Research & Policy Center report shows that when people put PV panels on their rooftops and in their neighborhoods through programs like net-metering, they reduce the strain on our electric grid, lower prices for all electric customers, and cut pollution to boot.

Net-metering programs credit solar panel owners at a fixed rate — often the retail price of electricity — for providing excess power to the grid, similar to rollover minutes on a cell phone plan. These programs are the law of the land in 44 states, and have helped solar energy skyrocket across the country; last year, every two and half minutes, another U.S. home or business went solar.

The report, Shining Rewards: The Value of Rooftop Solar Power for Consumers and Society, examines recent analyses of net-metering programs conducted by utilities, public utility commissions, and independent groups to assess the value of solar power.

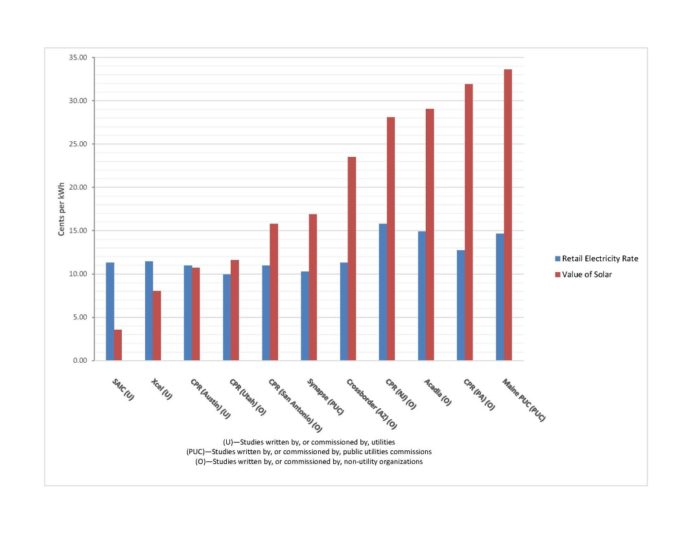

As the chart at the top of this page details, of the 11 net-metering studies reviewed, eight found that the value of solar energy was higher than the average local residential retail electricity rate; the three that didn’t were conducted by utilities.

The median value of solar power across all of the studies was nearly 17 cents per kWh, compared to the nation’s average retail electricity rate of about 12 cents.

In other words, despite utility claims that solar costs too much, and that solar users are benefiting at the expense of other customers, the opposite is more likely true. Solar panel owners are givers, not takers.

Even utility studies see benefits

Every single one of the studies — even those conducted by the utilities — found that solar customers offer net benefits to the electric system, as the second chart shows (see Image #2, below).

Solar panels connected to the grid help bring down ongoing energy costs. They reduce the amount of electricity utilities must generate or purchase from fossil fuel-fired power plants. And they reduce the amount of energy lost in generation, long-distance transmission and distribution, losses that tend to cost ratepayers.

Solar also brings down new capital investment costs. By reducing overall demand, solar energy production helps ratepayers and utilities avoid investing in new power plants, transmission lines and other forms of electricity infrastructure.

What’s more, solar power boosts the local economy, producing local jobs that can’t be outsourced. And as everyone knows, solar helps cut our dependence on dirty sources of energy and the global warming and air pollution that comes with it.

This study has real implications right now for debates raging across the country over net metering and other rooftop solar programs. Nevada, for example, is considering a new fee for solar panel owners who sell excess power. Arizona Public Service is proposing to lower the reimbursement rates for solar power. The Wisconsin Public Utility Board has approved a similar plan to lower payments to solar customers, which advocates are appealing.

As these battles unfold across the country, decision makers should take into account the report’s findings, which reinforce what advocates have long argued: solar power has far more rewards than costs. Instead of penalizing its use, we should be encouraging it, right alongside programmable thermostats and double-paned windows.

Rob Sargent is the energy program director for Environment America and oversees policy and strategy development for energy and global warming campaigns. This blog was originally published at Huffington Post.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

7 Comments

But the value decreases with PV's grid share.

The value of PV on the grid will never be higher than it is RIGHT NOW, since at low penetration it is primarily lowering stress on distribution grid infrastructure and offsetting peak power, lowering the amount of low-efficiency spinning reserves peakers. By the time PV is providing 25% of annual kwh going onto the grid it's value is much lower than the grid-retail price, and it begins to impart other costs for stabilizing the grid. It still has value, just not as much value.

The utility analyses tend to view it from the "after" picture of widely distributed PV at high penetration, the independent analyses tend to start with a snapshot of the value of the next 1k of PV going onto the grid, sometimes projecting forward, other times not. Net metering at retail forever is not a very good policy, but grandfathering in net-metering for 20-25 years for PV installed in the early years of the ramp up is a bargain for the average ratepayers, in most of the US. (But not Hawaii, where the penetration levels are large.)

Minnesota's Value of Solar Tarriff (VOST) methodology for compensating solar self-adjusts over the long term, as does Maine's recently enacted block-step "standard buyer" version. Just how fast the stuff goes up matters- it's accelerating, with an increasing exponent to the exponential growth rates in many markets, which is only making the stuff cheaper and more attractive under any compensation scheme.

New Yorks "Reforming Energy Vision" approach is much more nuanced, assessing the value based on geography & location within the grid infrastructure. eg: PV going into a congested point on the grid that has marginal throughput capacity has FAR more value than putting in on lightly loaded circuits, since it eliminates or reduces the size of the grid infrastructure investments necessary going forward. This approach to valuing solar (and grid batteries) is also being scrutinized in the CA-ISO region.

"Assessing the value of ..... "

Graph #1 shows in red "the value of solar". Proposals on "the value of solar" are prolific. They all have one thing in common: they tend to be the (PV) supplier's idea of what the buyer (local Utility) "should" pay. It's like a "supply and demand' graph with only a supply curve, no demand curve.

PV is beneficial and it's growing, with or without ever sweeter subsidies. I like that.

kWh Rates

Dana,

We are around .14 cents per kWh in my neck of the woods (Arizona). What do you think the price will be in the next 5-10 years with more people going to PV solar?

Response to Peter L

Peter,

Like you, I'm interested in how Dana will answer your question. I'd like to point out, though, that those who can accurately predict future energy prices should create a new hedge fund. They will soon be rich.

It's almost impossible to predict future energy prices because there are so many variables, and because utilities are monopolies that set prices based on political considerations rather than market forces.

Dropping prices for wind-generated electricity and solar-generated electricity are putting downward pressure on electricity prices. A future carbon tax would put upward pressure on electricity prices. Political developments in other countries can also affect energy prices in unpredictable ways.

Make your predictions here... and in 10 years we'll come back and see whose predication was most accurate.

No simple answers. (response to PeterL)

The regulatory environment in AZ is in a huge state of flux (disarray?) with the major monopoly utilities fighting the expansion of PV on their grids with fees, and smaller utilities fighting it with demand charge rate structures for PV owners and high per-kw fixed charges, high connection fees, etc. It's not exactly clear how that is going to shake out in the next 5-10 years, but the utilties are under extreme pressure from solar to adapt their business models to stay in business.

What IS clear is that the levelized COST of small scale solar right now in AZ (even without subsidy) is below 14 cents/kwh, and in 5-10 years it's likely to be well under 10 cents. Right now 20 year power purchase contracts from utility scale solar farms in Texas are now all coming in under 5 cents, and some under 4 cents. To finance those projects (even with the tax credits) the unsubsidize LCOE of those projects has to be under 5 cents. At the learning rate of solar, a small scale roof top project's LCOE in 2025 will be less than that of utility scale LCOE today.

If the AZ regulators & utilities adjust regulations & business models accordingly to allow the rapid deployment of small scale solar & storage the net per kwh cost to other ratepayers will likely be lower in 10 years than it is today. There are plenty of ways to screw that up, and the AZ utilities have been pretty creative on punitive stalling tactics to date. But the rising PV tsunami has reached the point of inevitability- if they keep screwing around grid-defection could become financially rational for those with the financial resources, which would lead to HIGHER prices for the remaining ratepayers.

This is currently a major food-fight in the AZ courts, primarily between third-party solar installers, who of course would prefer net-metering forever, or more favorable rates for paying for grid infrastructure, and the monopoly utilities who would of course prefer to live in a competition-free environment and not have to deal with creating a different business model, and in some instances would like to be able to leverage their monopoly position and access to cheap capital to compete directly against the solar company interlopers intent on eating what they presume to be THEIR rightful lunch.

http://www.azcentral.com/story/money/business/2015/06/24/srp-dismiss-solarcity-lawsuit/29227877/

http://www.greentechmedia.com/articles/read/tucson-electric-power-to-propose-a-new-distributed-solar-play

http://www.tucsonnewsnow.com/story/29503907/tep-seeks-to-expand-home-solar-program

http://www.azcentral.com/story/money/business/2015/02/26/srp-board-oks-rate-hike-new-fees-solar-customers/24086473/

http://www.seia.org/state-solar-policy/arizona

So, it's going to be a volatile ride, and it's not clear that the state regulators will be able to get ahead of it to prevent grid defection or utility bankruptcies. Penetration of roofop solar is currently on the order of 1% of all houses in AZ (compared to about 25% & rising in Australia, with similar amounts of sunshine.) But the rate at which it can (and eventually will ) expand is astounding, and the existential threat perceived by the utility companies is real. If the utilities & regulators don't get it together, it could be really rough for ratepayers in the nearer term. There absolutely WILL have to be write-downs of some existing power generation in AZ. Even without outright grid-defection (unhooking from the grid), solar will be cheaper than the fixed-rate energy portion of the residential bill within 10 years- the net demand for grid-sourced electricity will continue to fall.

For privately owned roof top solar that doesn't produce a net excess (which is most rooftop arrays), PV's effect on grid load and kwh sales is pretty much the same as efficiency. Are those high performance AZ homes built with extremely low cooling & heating loads and high efficiency mechanical systems also deserving of high connection charges or demand charge rate structures? What makes solar different? Should a code min McMansion with a 10 ton air conditioner and multiple tankless electric hot water heaters be assessed demand charges? These are the sorts of things that need to be scrutinized in greater detail when adjusting utility regulations and rate structures, rather than simply playing to the desires of utilities or the third party solar companies. I personally can't understand how residential demand charges for only PV owners can pass a fairness test, especially for the early adopters that are lowering the cost of the grid infrastructure for everyone. Demand charges across the board for all ratepayers are arguably a fairer way of paying for the grid infrastructure than fixed multipliers based on the total energy use, which has been the predominant method of paying for the grid in rate structures of the past century.

It's now amply clear that there isn't sufficient economies of scale with solar to fully rationalize monopoly utilities going forward based on the 20th century model, especially in places as sunny as AZ. Managing the transition to Utility Rev.X may pretty rough at first, but it should be cheaper for everyone in the end.

Questions for Dana and others

I have noticed people using the statement that utilities will have to 'write down' assets. Could you elaborate on that. I have a vague idea what it means, but I am not sure.

I also read somewhere that fossil fuel companies have 'capitalized' their coal reserves. I assume that means if the coal company is worth half a trillion dollars, most of that value is in coal in the ground. If the market for coal dries up, the coal company all of a sudden has no assets. Is that correct?

And now PV is upsetting the business model that for profit utilities have had for a long time. It is easy to see why the alliance between the utilities and the fossil fuel companies has developed to fight the scourge of PV. After all, they were mostly fat and happy until PV showed up with a new game plan.

Response to Steve Vigoren

Steve,

A utility might borrow $100 million to build a new coal-fired power plant, hoping to profit from the sale of the electricity produced by the plant. It might take 20 years to pay off the loan. Once the loan is paid off, the investment makes money for the utility. But in Year 8, the utility still owes a lot of money, and isn't necessarily receiving enough revenue yet to justify the investment.

If the plant has to be moth-balled and disassembled in Year 10, the $100 million loan will prove to be a bad investment.

A financial analysis might set the value of the coal plant based on the assumption that it will last 40 years. If it has to be demolished after 10 years, the utility has to "write down" -- that is, reduce -- the assumed value of the asset. At that point it is transformed from an asset (a good investment) into a liability (money down the drain).

Log in or create an account to post a comment.

Sign up Log in