Image Credit: Tomwsulcer / Wikimedia Commons

Image Credit: Tomwsulcer / Wikimedia Commons New government standards will increase the energy efficiency of residential water heaters. This chart shows how the Energy Factor (EF) of various classes of water heaters will change in April.

From the rustic 1850s pump shower to the 1920s Humphrey automatic to today’s modern units, water heaters have made great strides in performance and efficiency. On April 16, water heaters will take the next great stride when manufacturers must comply with new Department of Energy (DOE) efficiency standards.

The most common water heaters manufactured on and after this date will get a modest boost in efficiency, while units over 55 gallons will shift to next-generation technology, cutting utility bills by one-fourth to one-half depending on the technology.

What’s covered

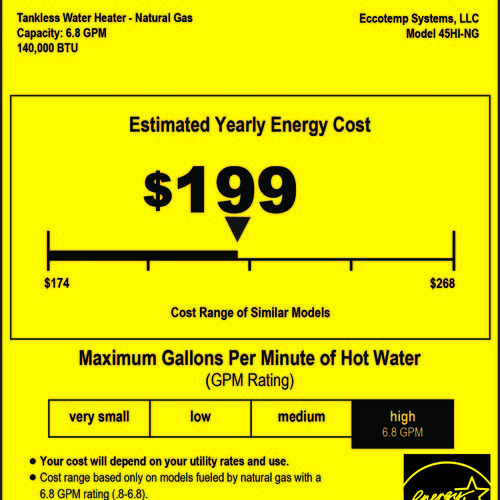

Completed by DOE in 2010, the standards cover gas, oil, and electric residential tank water heaters, usually between 20 and 80 gallons. (DOE also upped the efficiency levels for instantaneous — tankless — gas water heaters, but most models already meet the new efficiency levels.)

Water heating is on average the second largest household energy expense behind space heating, representing about 18 percent of total household energy consumption in the U.S. Consumers annually pay an average of about $170 (gas) and $300 (electric) to operate a water heater just meeting current efficiency standards. About 50 percent of U.S. households use natural gas water heaters, 41 percent electric, and the remainder propane or oil.

DOE estimates that the new efficiency measures will save 2.6 quadrillion Btus (quads) of energy over 30 years and net consumers up to $8.7 billion in savings. Over the same period, the standards will reduce CO2 emissions by 154 million metric tons. To put these long-term savings in perspective, the savings are enough to meet the total energy needs of 13 million typical US homes for a year, and the CO2 savings are equivalent to taking 32 million passenger cars off the road for a year.

Most storage water heaters to get a modest boost in efficiency

For storage water heaters with volumes of 55 gallons and below (representing the vast majority of sales), the new standards will increase the efficiency of typical-sized units by 4 percent on average. Manufacturers plan to meet the efficiency levels with incremental improvements such as improved heat exchangers (gas) and more insulation. Water heaters that comply with the new standards are already on the market, including models from the three large domestic manufacturers (A.O. Smith, Bradford White, and Rheem) that make most water heaters sold in the United States.

Water heaters larger than 55 gallons will see a much bigger jump in efficiency. The new standards for these larger water heaters can be met using electric heat pump and gas condensing technology. Heat-pump water heaters save at least 50 percent and condensing gas units about 25 percent compared to today’s conventional water heaters.

Heat-pump water heaters (also known as hybrid water heaters) transfer heat from the surrounding air to the water. When hot water demand is very high or the ambient air temperature drops below a threshold level, the hybrids switch from heat pump mode to electric resistance mode.

According to DOE’s analysis, a consumer purchasing these highly efficient units will save more than $600 over the life of the product compared to a water heater just meeting the current efficiency standards. While the upfront cost to purchase and install these products is higher, consumers will recoup the added cost in about six years on average through lower electricity bills. Consumer Reports tested heat-pump water heaters and found that “Those we tested provided annual savings of about 60 percent over electric-only models.”

One key concern about heat-pump water heaters is low temperature operation. When the heat-pump water heater operates in electric resistance mode, it doesn’t save energy or money compared to a conventional unit. Research by the Northwest Energy Efficiency Alliance showed that some early heat-pump water heater models were cutting over to electric resistance mode at relatively high ambient temperatures.

Manufacturers have been working to lower the minimum temperature at which water heaters operate in heat pump mode. Recent models have made significant progress, ensuring heat pump operation down to ambient temperatures as low as 35 degrees. The vast majority of utility programs in the Northwest point to the Northern Climate Specification Qualified Products List to determine whether a heat-pump water heater qualifies for utility incentives

Condensing gas water heaters are not as common as heat-pump water heaters, but consumers have more choices today than they did just a few years ago. Conventional gas water heaters lose much of the energy burned up the flue. Condensing water heaters are designed to reclaim much of this escaping heat by cooling exhaust gases well below 140 degrees F, where water vapor in the exhaust condenses into water.

Water heaters will get a little bigger

A review of manufacturers’ web sites shows that the height and/or diameter of some conventional products will increase 1 to 2 inches (some less than an inch) due to added insulation.

For many homes, particularly those with basement installations, the small increase in size will have little impact. Consumers with space constraints (e.g., water heaters in closets or crawl spaces) should consult manufacturers’ web sites or local installers for options. Consumers may find that a product from one manufacturer fits better in their tight space than a similar product from a different manufacturer.

Manufacturers are offering webinars, online videos, and educational materials to guide consumers, contractors, and installers through the changes. Several web sites include cross-reference guides to help consumers compare current models to models meeting the new standards. You will find most of the educational materials on manufacturer websites under NAECA (National Appliance Energy Conservation Act), the legislation that authorized appliance efficiency standards.

What about grid-enabled water heaters?

Utilities represented by the National Rural Electric Cooperative (NRECA) and the American Public Power Association, along with PJM Interconnection (regional grid operator) raised concerns that demand-response programs for water heaters over 55 gallons would suffer if they were required to switch to heat-pump water heaters.

In these programs, utilities control the use of grid-enabled (connected) water heaters to manage energy use at peak times, resulting in large savings. Though some stakeholders claim that heat-pump water heaters can provide the services that NRECA and others desire, not all stakeholders are convinced that they will work as well. A legislative fix to establish a class of water heaters for demand-response programs is pending in Congress. In addition, some manufacturers have petitioned for waivers for this application.

Marianne DiMascio is the outreach director of the Appliance Standards Awareness Project at the American Council for an Energy-Efficient Economy. This blog was originally posted at ACEEE and is used here with permission of the author.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

4 Comments

Checking the math.

"Consumers annually pay an average of about $170 (gas) and $300 (electric) to operate a water heater just meeting current efficiency standards."

...and...

"...Heat-pump water heaters save at least 50 percent and condensing gas units about 25 percent compared to today’s conventional water heaters."

... so, 25% of $170 per year is $42.50 per year, and 50% of $300 is $150/year.

"According to DOE’s analysis, a consumer purchasing these highly efficient units will save more than $600 over the life of the product compared to a water heater just meeting the current efficiency standards. "

To save $600 at $42.50/year means they must assume a either a condensing tankless or tank type gas HW heater has a lifecycle of 14 years or more, which seems a shade optimistic, unless they are also factoring in some energy price inflation into that number. There is also a presumption that the condensing HW heater has no maintenance costs only fuel cost, whereas in the tankless gas HW heater case would not true. Even at fairly modest levels of water hardness a gas-fired tankless will need to be de-limed at least once or twice in the presumptive 14 year lifecycle.

To save $600 over a lifecycle at $150/year energy savings with a heat pump water heater would only take 4 years, which seems unduly pessimisitic. But those savings don't necessarily model the costs of the increased space heating load or the savings of the reduced space cooling loads, which are highly dependent upon the local climate and where the unit is installed (inside or outside of the conditioned space.)

Methinks the details are important.

The recovery performance of heat pump water heaters is anemic enough that the hit from a grid-enabled demand-response enabled unit would barely register. Better than mere grid enabling for demand response would be to also use the resistance elements in hot water heaters as fast reacting controllable loads for voltage stability and frequency control, but I don't anticipating that showing up as a requirement any time soon. The value of those ancillary services is huge when it can offset power dumping and spinning reserves for providing those services, and since it's a distributed load it can be done on a circuit-by-circuit basis, unlike the centralized generator model.

Distributed energy storage

Interesting comments, as always, from Dana. As I was reading this article I was mentally going through water heating strategies for a new project that's just come into the office to see if there was anything here to change our standard approach, which for a country property like the one I am working on, without natural gas supply or a basement or an attached garage in close proximity to point of use would be a high performance resistance tank heater like a Marathon. Unsurprisingly, there wasn't. Then I read Dana's comments, and his last sentence in particular struck a chord. Distributed localized energy generation through photovoltaics gets a lot of press but it occurs to me that in parallel with rooftop PV we should also be making the most of the opportunity through load shedding for well-insulated electric tank water heaters to act as as a measure of localized distributed energy storage to assist in grid power management. In an age of explosive growth in grid-connected consumer-level PV, this seems to be emerging as the biggest problem faced by energy utilities.

The biggest problem facing the utilities...

... is the antiquated business model sometimes protected, otherwise fettered by equally antiquated regulations. The whole utility/regulatory environment was not set up for competition, which distributed PV really is.

As long as the utilities can still make money and make their shareholders happy they should be GLAD to embrace all of the benefits that come with independently owned & operated distributed generation. But the utility culture of the past century has been that of a protected monopoly incentivized to build more hardware, since the capital expense gets a guaranteed rate of return by the regulators. This started to change in many states 25-30 years ago when utility revenues were first decoupled from kwh sales by regulators in (then) a handful of states, but it still has a way to go.

Decoupling is just the frost on the tip of the iceberg of what's really necessary to make it work for all stakeholders, now that distributed PV is cheaper than retail rates. Beginning last year New York has taken it head-on, peeled the entire top off the can o' regulatory worms and dumped it on the table for open discussion & revision. The magnitude of the changes under way are impossible to overstate- this is really huge, and there will be many new business models and rate-structure types rolling out as it unfolds, but the benefits are huge. eg:

Con Edison was/is faced with a multi-billion dollar upgrade to the Queens / Brooklyn substations to be able to deal with creeping year on year peak load increases, along with anticipated substation congestion due to the impending closing of nukes on Long Island. It would be cheaper to selectively subsidize distributed co-generation, storage (thermal or battery), PV and other assets to manage the congestion problem based on location, where those privately owned assets were most favorable to the grid. But subsidizing some rate payers differently from others had been forbidden under prior rules due to the apparent fairness issue. But under the new evolving scheme it looks like they will be able to allow various alternative approaches to dealing with the problem, that should result in a lower capital expenditure by the utility, avoiding the rate hikes that would have been necessary to cover the financing. It's not only cheaper for the other ratepayers, it makes the grid more stable, and it extends the lifecycle of the existing equipment by lowering the peak operating temperatures.

As long as Con Ed makes money optimizing what privately owned assets go onto the grid & where with the lowest negative impact to ratepayers, everybody wins at this game. Under old rules they would be guaranteed a return on that gia-normous substation upgrade, but the ratepayers would have taken it in the neck- to the point where for those with access to the sun & capital, grid defection would become a financially rational response.

The distributed loads of electric vehicles is coming too, and that can either be done intelligently or insanely. Adding demand-response or price-sensitivity smarts to car chargers is a miniscule cost adder, and even making it 2-way, with the car batteries feeding the grid during load/price peaks or for local grid stability isn't super-expensive either, but potentially very valuable to the grid operator. The old model of fixed electricity rates & centralized power generation managed by a monopoly utility (or layers thereof) is really over. Even though it has yet to be replaced, the handwriting on the wall is clear. There is no point to sticking with the old model if it's more expensive, less flexible, and less reliable, and it's rapidly becoming clear that it is all of those. But utilities with potentially stranded assets and the industries that supported the old model aren't about to just fold their tents and walk away- it's turning into an unnecessarily ugly battle in many states.

efficiency vs. moderate usage

Sounds like another way to set up consumers - we can get you this high efficiency 75 gallon tank; or are you one of those mopes who wants to get by with a 50-gallon tank? This will work out like the Energy Star refrigerator program that has helped raise energy consumption in kitchens by encouraging people to get a big "efficient" fridge.

Log in or create an account to post a comment.

Sign up Log in