Fire retardant paint on closed cell foam

I plan to insulate my basement walls to R-21 with CCF as well as air seal the rim joists. I’d like to do this prior to framing so they can get continuous coverage without the studs in the way. I was told I need to put fire retardant paint on unless I’m going to use drywall as my barrier. I plan to do the firepaint in my mechanical room since we are leaving that as is.

Regarding the rest of the basement, my timeline to finish it off could vary among a lot of things, including time availability, cost/time getting bids, going over budget, doing the work myself, etc. It could be a month after insulating, it could be 6 months to a year. Is there anything codewise or insurance that could put me at risk between the insulation and drywall period without firepaint? Would having pulled a permit to do the renovation suffice? Frame out one wall to show progress?

I just see a weird intersection between insurance, manufactures installation requirements and local code if anything were to happen and the foam was a reason for a fire to spread prior to final sign off.

Thanks.

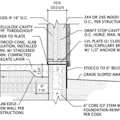

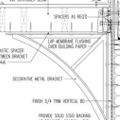

GBA Detail Library

A collection of one thousand construction details organized by climate and house part

Replies

Those are questions only your local code officials & insurers can answer.

When I was building, I was required to carry very expensive, builder's risk insurance. Something like that would presumably cover scenarios like you describe. But you have to ask your insurer. I was able to convert to regular insurance once the house was "dried in", which leads me to believe the main concern was theft and damage due to weather.

I agree with Dana here. You need to ask your local building people and especially your insurance carrier. Tell them your concerns, ask what you need to do, and get EVERYTHING IN WRITING. liability concerns are all about finger pointing. Make sure no one can point the finger at you.

Bill

Thanks, appreciate the responses. I'll reach out to my agent to see what they think. If I have to add a policy it may make sense to just paint it anyways. Good point about being "dried in" and how that may affect pricing.

Just a follow up in case anyone was curious, my agent reached out to my insurance company and they confirmed that an additional policy wouldn't be needed and I would be covered as usual. Always good to get an answer first from your agent. Thanks!

Have them provide you with a written letter stating that you're covered, and make sure the letter says in detail exactly what it is that you asked them to be sure is covered. Don’t accept a verbal OK here. If anything goes wrong down the road, you will want that letter to prove that the insurance company said you’re covered for the specific thing you’re worried about.

Remember: always get EVERYTHING in writing when it comes to things like liability concerns and insurance coverage.

Bill

I'm surprised an insurance company would provide that.

They should, if you ask. Insurance companies basically sell contracts that say they’ll pay you if bad stuff happens, and you’ll pay them every month for them to assume your risk for you. Then they detail out exactly what kinds of risks they will cover and how they’ll cover them.

You want them to either show you in your existing policy documents where it says you’re covered for the issue you’re concerned about, or have them provide a written letter stating that it’s covered if your existing policy doesn’t specifically say it is. If you have any problems, the insurance people will look for ways to NOT pay you. You need to have paperwork showing that they WOULD pay you if the specific bad thing that happened happened.

In my work as a consulting engineer, I’m sometimes contracted to find ways why things did or did not work, and I get all the excitement of dealing with the lawyers that contract me to do this. I’ve seen people get burned before by not having things in writing. You don’t want to find yourself in that position. Get things in writing before you do the work to make sure you don’t have any problems. I have seen fire code related insurance issues put contractors out of buisness before. You do NOT want to have problems with this stuff.

Bill