Georgia Power’s PV policy

We are under Georgia Power which does not allow net metering. Instead, I think we currently get reimbursed 4.2 cents/kwh for what our PV system produces, which is about 1/3 of what GA Power charges us for their power. Complicating matters is that during the summer, when our west-facing array is producing significant output, we are on GA Power’s “Nights & Weekends” program which charges 20 cents/kwh on afternoons and 5 cents/kwh at all other times.

Now they are offering a long-term contract for us to sell them 100% of our solar output for a minimum of 15 years for 8.9 cents/kwh, up to 35 years at 11.4 cents/kwh. And I have just no idea whatsoever whether this would benefit me in any way. Does anybody have a clue?

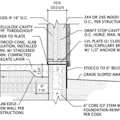

GBA Detail Library

A collection of one thousand construction details organized by climate and house part

Replies

Charles,

Let's say that you use 1,000 kWh of electricity in a month, while your PV system produces 1,200 kWh in the same month.

When Georgia Power talks about "a long-term contract for us to sell them 100% of our solar output for a minimum of 15 years for 8.9 cents/kwh," would they be paying you for 200 kWh (+$17) in the month I described?

Or would they be paying you for 1,200 kWh (+$106), and then charging you for 1,000 kWh (-$126) -- thereby charging you more than they are paying you?

Am I correct in assuming that if you are producing power and using it simultaneously, that production doesn't get metered at all? Or does all your production go through the meter?

Is GP offering any long term price for what it sells to you?

Georgia Power is a wholly owned subsidiary of Southern Company, and currently in a financial pickle due to the Vogtle nuclear construction albatross around their neck. It is poised to become a serious financial crisis for them now that Westinghouse is bankrupt, may be unable to finish it. The financial guarantor (to the tune of USD$3.7 billion) is Toshiba, owner of Westinghouse, and they are currently preparing to file bankruptcy protection in Japan over this project. Even though the GA regulators have thus far allowed GP to rate-base the costs of then new nuke, with ratepayers paying for some of it well in advance of it ever powering up, the financial pressure building on GP has to be huge. There will be hell to pay if they can't at least recover a substantial fraction of the guarantee from Toshiba, but even worse hell to pay if it never gets finished at all, which won't be easy to finance.

Even if they find financing to finish the thing, the levelized cost of any power out is going to be substantially more than 8.9 cents/kwh, and probably substantially more than 11.4 cents. As of last December Lazard was estimating the levelized cost of that plant to GP was going to end up being between $97-136/Mwh (9.7-13.6 cents/kwh), and that analysis was completed several months BEFORE Westinghouse bit the dust, based on a presumption that it would be finished on some kind of schedule. Every month of delay increases the eventual per kwh cost, and if they NEVER finish it they have a huge hole on their balance sheets which may push them toward bankruptcy even if Toshiba eventually pays up.

https://www.lazard.com/media/438038/levelized-cost-of-energy-v100.pdf

Entering into ANY long term contract with them at this point in time would be ridiculous, but a long term power purchase agreement at 11.4 cents is likely to be a real bargain for GP. It's already a super bargain relative to the cost of the gas peaker generator power that much of the PV is offsetting.

If the cards all fall the wrong way relative to Vogtle / Westinghouse / Toshiba and the state regulators allow them to rate-base any part of that loss (rather than letting the shareholders take the whole hit) you could see some truly extreme retail prices in the next 5 years- extreme enough that cutting the cord and buying some battery & perhaps more solar may become financially rational. But if you're stuck with a long term power sales agreement you will be contractually barred from doing that, since all your output is contracted out to GP.

http://www.reuters.com/article/us-toshiba-accounting-westinghouse-nucle-idUSKBN17Y0CQ

http://www.utilitydive.com/news/toshiba-said-to-be-preparing-for-bankruptcy-as-southern-faces-vogtle-deadli/442588/

Today is the last day of the agreement that keeps Westinghouse at work on the Vogtle plant. Maybe a white knight has stepped in earlier today to save the project, or at least further forestall the doom, but then again maybe the tooth fairy doesn't really have wings, and gets around via unicorn instead.

http://wsav.com/2017/05/11/georgia-power-deadlines-at-plant-vogtle-no-longer-feasible-is-cancellation-an-option/

[edited to add]

In their November 2015 analysis Lazard had pegged the levelized cost of the new Vogtle plant specifically a $124/Mwh (12.4 cents/kwh):

https://www.lazard.com/media/2390/lazards-levelized-cost-of-energy-analysis-90.pdf

But under the current falling domino bankruptcy series, getting their levelized cost as low as 12.4 cents/kwh would be unlikely, even if (against all odds) that project doesn't implode completely, potentially taking down Georgia Power with it.

It may be better to invest in some self-consumption technology smarts, to avoid exporting peak power at a pittance and having to pay the utility several times that for the use of the bus-bar between your export meter and import meter. Solar City was selling a complete package that included an electric water heater + Tesla Powerwall with some smart controls for the Hawaiian market last year. The water heater control part can be pretty cheap, if you have an electric water heater to soak up any potential export power and store it as hot water.

Forget Powerwall. Look into PowerStation 247

11.4 cents/kwh is pretty damn good, I'm buying eletricity at 4.5cents/kwh right now.

Could you have another solar system in the future and not sell that one to them?

Predictions about what would or would not be allowable in a future solar expansion/addition are bound to be fraught with error. At the moment Georgia Power is a vertically integrated state wide monopoly utility with a lot of political clout when it comes to protecting their revenue streams. It was only about a year ago that third-party owned rooftop PV became legal in Georgia, paving a path for lease, lease-to-own, or power purchase agreements between PV owner & homeowners. The small breach in that monopoly power status may eventually widen, but how & when it becomes a truly competitive marketplace takes a much clearer crystal ball than mine.

The power station 247 best I can tell is $30000. You can get two Powerwall 2s installed for half that hand have more storage.

Our utility has a similar program. We pay 12 or 13 cents/kWh and they pay us 3 or 4 cents at the end of the year. We got an electric car (Nissan Leaf) and 2 minisplits to use up the surplus and are working on other ways to use the energy we produce rather than give it away to the utility. On the other hand, other utilities in our area will pay close to 20 cents/kWh for all the energy produced and sell the consumer what they use at the regular rate.

Corporate & legal brinksmanship regarding Georgia Power's nuclear power plant construction continues, with no clear end in sight:

http://www.utilitydive.com/news/southern-to-take-over-vogtle-construction-from-bankrupt-westinghouse/442723/

"Southern has said it is owed $3.7 billion from Toshiba, but that it may not be enough to complete the reactor construction, which is years behind schedule and billions over budget."

"Southern's subsidiary Georgia Power will continue to work to secure $3.68 billion it says it is owed by Westinghouse, as well as assessing with other plant owners whether it should complete construction or abandon the project."

If they eventually opt out of finishing it, the value of a 30 year PPA for YOUR rooftop solar should increase, but whether they will increase the offer to private PV owners is highly speculative (to say the least.)

What a pickle! If this project can take down a company the size of Toshiba, it can also take down Southern Company (or at least it's Georgia Power subsidiary.) The reaction to this financial disaster may eventually result in the state breaking up the GP monopoly, even if they manage to avoid bankruptcy. The fact that ratepayers have been paying for this project years in advance of the first kwh coming out of it is a travesty. The grass roots can and will become far more prickly after this much of abuse, which has thus far been allowed at the discretion of the Georgia Public Service Commission . Are any heads gonna roll at the PSC over this? Stay tuned!

http://www.ajc.com/business/southern-company-weeks-before-know-cost-plant-vogtle/xKz0Ih0COdYqqTCJAfxDQN/

http://www.myajc.com/business/who-pay-for-plant-vogtle-overruns/MCvSypNyaklAFY3e0zf6mN/

Dana,

History repeats itself. This is WPPSS (pronounced “Whoops”) all over again.

WPPSS was a $2.25 billion nuclear reactor mistake made in Washington state in the late 1970s. I visited the abandoned plant in 2011 -- there is lots of very expensive, very useless concrete that will remain on the site for thousands of years.

Here's a link to my report: More Passivhaus Site Visits in Washington State.

.

What do you bet that this travesty of justice to rate payers in Georgia teaches all the wrong lessons. The lanterns and pitchforks will come out of course, but if history is prologue then Georgia will learn all the wrong lessons. I would hope that this teaches the citizens of that state to clean up their own state government by educating themselves about the issues and electing and appointing people who are conscientious about their responsibilities. Alas, the movement there will probably get dumbed down into an anti-government crusade because the majority of Georgians might be too lazy to educate themselves enough to elect and appoint responsible representatives (shrug). It's much easier to find scapegoats among the lowest and least powerful in society than to take down the powerful ones that are actually responsible - the history of the south in this country, along with some other parts of the country.

Eric,

It's not a south vs. north issue, as my example from Washington state makes clear.

It has elements of it. There is definitely a history in the South of trying to deflect issues by scapegoating. It happens in other states also, for instance Idaho, where there is a powerful neo Nazi center. The difference in Washington state is that they had a problem and they learned from it. From everything I've seen the southern states have a culture where they deflect from the powerful members of society to those who have less power to defend themselves, immigrants and minorities. I'm just calling it the way it has been.

@ Eric Habegger

State protected monopolies is not a phenomenon limited to southern states. This issue in Georgia is a perfect example of limited competition on more than one level.

"State protected monopolies is not a phenomenon limited to southern states. This issue in Georgia is a perfect example of limited competition on more than one level."

Yes, but Georgia is much more likely than other states, including mine, to take the easy route of just blaming government instead of electing responsible people that govern for everyone.

The pro nuke folks blame excessive regulations for the time delays and cost overruns. Of course, you could cut the construction costs in half and they are still uneconomic. And the long lead times between concept and power generation make it unlikely that anyone else will ever be crazy enough to finance a new nuclear power plant. By the time it could be finished, renewables will be even cheaper than they are now.

Those of us who live in states that prohibit the owners of the grid infrastructure from owning generating assets are much less likely to suffer like Georgia Power customers. In Maine, Central Maine Power owns the wires and poles, etc. Customers pay CMP to deliver power, but can choose from among a variety of electricity suppliers who in turn buy from a variety of generators. Neither CMP nor customers much care whether a power plant owner is profitable or even stays in business.

GP, as a vertically integrated utility, just needs a compliant regulator to allow it to continue to dump the costs onto the ratepayers.

This is a much MUCH smaller financial disaster than the WPPS fiasco- rabbit pellets, not BS. The number & size of the projects are better bounded here, but there are other significant differences.

In the WPPS case ratepayers of the utilities participating in WPPS projects were not fully on the hook for it (some utility ratepayer were much more exposed than others), but the publicly traded bonds financing it went up in smoke, taking some pension funds as well as many private investors to the cleaners. The bonds had been sold with high ratings (=low risk), and many small timers who had bought them as a "safe" investors were caught flat footed. If there is a regulatory agency at fault there, one might point to the SEC, though that blame can rightly be shared with the ambitions of the boards of the member utilities involved. After the lawyers got paid and lawsuits settled some bond holders got 10 cents on the dollar, some got more, but nobody got as high as 50 cents.

In the GP case there aren't any bonds, the US taxpayer is on the hook for $8B in loan guarantees, but the rest of the risk is take on by other. That risk SHOULD have been entirely on the shareholders holders of the stakeholder companies, including GP, Southern Company, Westinghouse, and Toshiba. But the Georgia PSC saw fit to allow GP (and by extension Southern Company) to push some of that risk onto the ratepayers in spite of increasing risk as the project bumbled along, allowing GP to charge the current ratepayers for some of the construction cost well before the project was even close to completion on the promise of cheaper power later, and kept compounding it by allowing those mounting costs to continue to be recovered by surcharges in the existing rate structure even as the project was continuing to spin out of control. IMHO the shareholders, not the rate payers should be stuck with that bill, but if GP or Southern Company also go into bankruptcy, recovering the money already paid by rate payers may be unrecoverable, even if the PSC changes their tune. It's also possible that the PSC will allow GP/Southern Company to continue to stick it to the ratepayers and allow them to recover even more of the sunk cost of that likely-to-be-stranded project just to keep them from going under so that the lights can stay on. GP is a protected monopoly utility, but that protection does not and should not extend to an absolute right to exist at the ratepayers' expense.

Even at the original cost estimates, it wasn't 100% clear in 2006 when permits for Vogtle units 3 & 4 were first issued, or in 2008 when the construction contracts were inked that it would have been in the best interest. the ratepayers, but GP was very effective at convincing the PSC that owning a large share of the project was essential, and that the power would be comparatively cheap & clean relative to other new generation to replace retiring plants as well as expansion for increased power needs. Even in 2008 it was well known that new extraction technology for natural gas was causing contract prices to utilities to fall, with even more reductions to come, which should have been the first hint that they should hold off, since combined cycle gas was already a financial threat to coal-burners. Very few in the power industry were anticipating that the growth in electricity demand would halt (or even reverse itself) for the better part of a decade, or that first wind power, then later, solar power would become cheaper than new coal, new combined cycle gas, or even the fuel & maintenance costs an existing nuclear plant before the first fuel rods could be loaded into Vogtle 3 & 4 (even on the original schedule.)

But by the time construction actually began in early 2013 the flatlining of demand growth was already clear, as was the crashing cost of combined cycle gas and wind power. At that time Georgia's somewhat tepid wind resources weren't economically exploitable, and solar was still pretty expensive. But fast-forward 4 years, the costs of both wind & solar, and the speed at which they can be sited, permitted, & built make continuing to pour money into Vogtle 3 & 4 a BAD deal for the ratepayers, but still a potentially GOOD deal for shareholders, especially if they are allowed to continue to stick the ratepayers with the bill up front. If GP/Southern Company can get the thing built and running, the PSC is clearly going to allow them to recover the capitalization costs out of the utility rates, but if they don't finish it, the probably won't, or at least not completely. So for some time now it's been in the shareholder's interest to keep pushing for them toward completion rather than take the write-down on billions of USD invested. But given the past & projected costs at this point, the levelized lifecycle cost of Vogtle 3 & 4 power ( even using some fairly rosy assumptions about the operating capacity factor and number of years they will run) is at best on par with unsubsidized distributed small scale rooftop PV. The cheapest thing for the RATEPAYER is to stop the project now, and NEVER fire it up. Once it is has been fueled & operated even for five minutes, they will be on the hook for the cost of eventually decommissioning the thing. (A cost that WPPS participants managed to avoid.)

But whether the PSC is going to do the right thing here is an open question. Thus far they have tended to protect the utility's interests more so than the ratepayers they are supposed to be protecting. If they continue to screw this up it's more likely to be attributable to incompetence rather than collusion, but they shouldn't be sleeping well, given the circumstances. The US taxpayers are likely going to pick up the lion's share of the tab if they stop now, but if they continue to forge on, the amount that could be conceivably pushed on the ratepayers grows quickly.