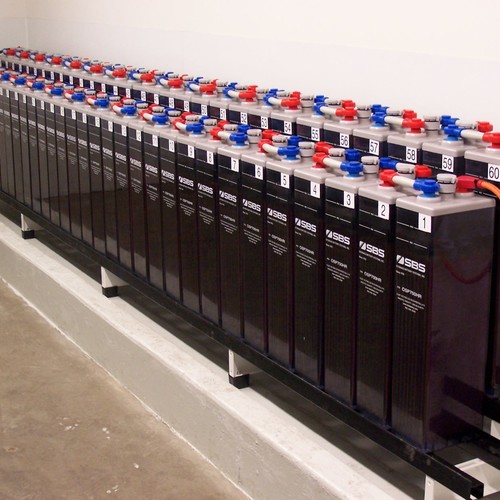

Image Credit: National Renewable Energy Laboratory

Despite falling prices for photovoltaic (PV) panels and cheaper and the prospect of more efficient battery storage on the horizon, it usually makes more sense to stay connected to the grid than to cut ties completely, a new report published in the journal Energy Policy says.

The authors, Rajab Khalilpour and Anthony Vassallo of the University of Sydney in Australia, write that in most cases a better choice than leaving the grid entirely is to minimize the amount of purchased electricity by installing “an optimized size” PV / battery system.

The full text of the report is behind the journal’s pay wall, but its contents were summarized in an article in The Washington Post on March 30.

Grid defection is a growing worry for U.S. electric utilities. Although the number of customers with their own PV systems is relatively small, cheaper panels and the growth of solar leasing companies is making PV more attractive. As a new generation of lithium-ion batteries becomes more widely available, and prices continue to fall, some customers may decide to cut ties with electric utilities altogether.

The trend has been called a utility “death spiral,” but the report suggests there are good reasons for most customers to stick with a grid-tied system.

Model considers various PV scenarios

The authors came up with a model, The Post reports, which allowed them to factor in the size and cost of a PV system, the energy demands of a particular household, and net-metering policies by which homeowners sell excess power to the utility.

“The surprising upshot is that leaving the grid rarely seems to make sense, for two reasons,” the story says. “First, with a relatively small and thus cheaper solar and/or battery system, you can’t generate enough power to be independent, so you have to stay connected.”

Complete grid independence, the report says, is “only possible with a very large PV-battery system which is subject to significant capital costs.”

Although a customer could install a PV system big enough to guarantee grid independence, a system that large would generate plenty of money when excess power was sold to the grid through a net-metering arrangement — a strong motivation for the owner of the PV system to stay grid-connected.

“The policy implication of this study is that, from an economic perspective, widespread disconnection might not be a realistic projection of the future,” the article’s abstract says. “Rather, a notable reduction of energy demand per connection point is a more realistic option as PV–battery system prices decline further.

“Therefore, policies could be devised to help electricity network operators develop other sources of revenue rather than increasing energy prices, which have been assumed to be the key driver of the death spiral.”

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

15 Comments

Stating the obvious?

It seems to me that the conclusions expressed in this study are obvious.

Of course homeowners with big PV arrays would prefer to sell their excess electricity production to the local utility at a favorable rate. We all know that. That's why it makes sense to be grid-connected.

Those who will consider defecting from the grid obviously aren't those who are offered a decent net-metering agreement. The ones who will consider defection will be the homeowners who live in PV-hostile states who aren't offered a decent net-metering agreement.

If the local utility doesn't want to buy your surplus electricity, or only offers you peanuts to accept it, going off-grid might eventually make sense (if and when batteries become cheap enough). But if you are offered a decent net-metering agreement, grid connection is a good deal.

politics of distributed generation

Thanks for the reality check Martin. The politics of discouraging net metering and dismissing the value of distributed generation are sadly the truth here in Wisconsin.When utilities are allowed to radically increase access fees and tax PV grid ties the economics of abandoning the grid start to look more interesting despite it's obvious environmental cost. This is stupid and short sighted fossil fuel subsidized policy but it's unfortunately the agenda of ALEC,the Edison Institute and their financiers.

In Australia the net metering deals are egregious

Martin writes: "If the local utility doesn't want to buy your surplus electricity, or only offers you peanuts to accept it, you aren't in the same category of homeowners as those discussed by the authors of this study."

Is there an unintended double negative in there? Peanuts is EXACTLY what the local Australian grid operators are offering, which is why grid-defection is a hot topic of study/discussion by those authors.

In Australia residential electricity purchased from the grid runs about 30 US cents/kwh, but the any time a homeowner's PV is producing more than the house is using, the metered power going onto the grid is being remunerated at 0-6 cents/kwh (depending on the local utility), whereas if the house is using more than the PV is producing even 2 seconds later, when the power flow reverses it's billed to the homeowner at the full retail rate.

This isn't net metering of the excess at the end of a billing period, arguing about what to pay the PV owner if they produce more than they use in a month or year, this is continuous metering on the direction of power flow, in 10 millisecond intervals (the time period of a half-cycle at 50 hertz, the nominal line frequency in Oz.) If say, your PV is churning out 3000 watts on a sunny afternoon and you are using only 600 watts, you are being paid peanuts for the 2400 watts you're putting onto the grid (which is being resold to your neighbor on the same transformer for 30cents/kwh!). But if your AC is running so you're actually using 4000 watts when it's running, you're paying 30 cents/kwh for the 1000watts you are pulling from the grid, even if you would be net positive on power generation for the hour if it's only running a 50% duty cycle (which makes modulating mini-splits a winner too!).

Due to the popularity of PV in Australia, this is a popular thing to complain about, and why grid defection kits are for sale there (though sales are slow, for now). More than 1 in 5 homes in Australia have rooftop PV, but partly due to the severity of the net metering deal the size of those arrays are half that of a typical US rooftop installations. SFAIK there are NO utilities in Australia net-metering at retail, which is the most common net-metering deal in the US.

There is an active market in power-diversion products to apply the PV generated power only to loads on the homeowners side of the meter, the most popular of which dump the excess power into a heating element in a hot water heater. But that's a lousy way to use that power, and it denies the other grid users of that $0 marginal cost peak power during peak load conditions. There is growing interest in local batteries for PV owners, which makes the diverted power more useful, and would allow bigger PV arrays without having to effectively donate power to the grid operators.

SolarCity's grid tied PV setups with Tesla batteries now have many months of real-world experience in CA, and are now beginning to market battery solutions in Australia. Even though it won't make sense to defect entirely from the grid, the local batteries under homeowner control will continue to erode utility company demand. Some utilities in Australia are adapting, even encouraging distributed PV, having adjusted their business models to suit. Others have completely missed the boat, and (like many in the US) are still in push-back mode.

Lyndon Rive (CEO of SolarCity) has gone on record as stating that putting the homeowner's battery under UTILITY control would make the best use of that resource for all, since it would reduce the infrastructure requirements for the local grid, stabilizing the grid more effectively than with traditional methods, and ultimately lowering everyone's utility bill without negatively impacting the benefit to the PV/battery system owner. But that won't be happening in lopsided net-metering situations, depriving the ratepayers at large of what would be a very favorable shared benefit.

Fortunately not all US utilities are on that mindset. Austin Energy (the local utility in Austin TX) became the first in the nation to compensate PV on a "Value of Solar" basis, with a transparent method of calculating the value, which DOES vary with the amount of PV penetration into the local grid mix. More recently Fort Collins CO broadened the business model of their local utility to a total energy services company, that includes building-efficiency upgrades and HVAC upgrades, and even rooftop PV with on-bill payments (guaranteed to be no greater than the previous utilities-only bill) to cover the upfront cost & financing & management costs, at a net increase in profit for the utility, and net decrease in cost to the ratepayers. The business model was developed over several years (under contract with the policy wonks at RMI, but only voted into existence about a month ago. See:

http://www.rmi.org/Knowledge-Center/Library/80FortCollinsReport-WEB_2014-02

http://fortzed.com/initiatives/rethinking-the-utility-model-integrated-utility-services/

Some grids are worth defecting from, and those utilities will be the most vulnerable to ever drooping revenues (even if without outright grid defection) as rooftop hit's a buck-a-watt installed price and lower. It's already down to about 2 bucks in Australia- it'll be a buck in less than 10 years. When local storage hits $150/kwh on it's way down revenues will plummet further. Those utilities that have adapted their business models to those realities and encouraged or participated in the implementation will make out just fine.

Response to Dana Dorsett

Dana,

I'm not sure I understand your comment on a possible double negative.

Scott reported, "Although a customer could install a PV system big enough to guarantee grid independence, a system that large would generate plenty of money when excess power was sold to the grid through a net-metering arrangement — a strong motivation for the owner of the PV system to stay grid-connected."

These hypothetical homeowners who might install a large PV system are in the "category of homeowners ... discussed by the authors of this study" -- in other words, homeowners with big PV arrays who have no reason to cut their connection to the grid.

In my comment, I noted that "If the local utility doesn't want to buy your surplus electricity, or only offers you peanuts to accept it, you aren't in the same category of homeowners." You're in a different category -- namely, "those who can't sell their surplus electricity for a fair price."

The grid isn't free

If all electricity could be created by renewable energy sources we would still need the grid and we would still need to pay for the grid. I'm continually amazed how folks in the clean tech sector don't want to pay for the grid. I'm in favor of renewable energy but I'm not in favor of my poorer neighbor paying higher electricity rates than my richer neighbor who can afford solar panels and may get a break because the source of electricity is cleaner. I'm confident I'm healthier than the majority of the population but I'm not getting a discount on my health care premium for keeping costs down. Maybe one day utility companies will offer a fair price for distributed energy producers and distributed energy producers will pay a fair price for the grid. That seems fair to me.

Response to Martin (then Bruce)

The authors are Australian, but without paying for the original article it's hard to say for sure if they were being Australian-deal specific. I know of no country/utility where annual net metered excess is compensated at retail, but perhaps they were postulating such a deal? From the abstract of the paper:

"We have developed a decision support tool for rigorous assessment of the feasibility of leaving the grid. Numerous sensitivity analyses are carried out over critical parameters such as technology costs, system size, consumer load, and feed-in-tariff. The results show that, in most cases, leaving-the-grid is not the best economic option and it might be more beneficial to keep the connection with the grid, but minimize the electricity purchased by installation of an optimized size of PV-battery systems"

I'd like to see that tool!

Even in the Australian situation it's important to do the math whether it makes economic sense for those who can afford the big PV arrays to simply defect, since they in fact ARE only being paid peanuts. The answer is still "not yet", but that will be evolving rapidly.

Bruce: Of course the grid has costs, but the presence of PV on the system doesn't drive those costs- peak draws do, and distributed generation lowers the capacity requirements of the distribution hardware, and lowers the average & peak draws, which extends the life of the equipment. When distributed PV penetration in the US hits Australian or German proportions it's appropriate to be discussing the level of payments by PV owners for grid services, but that's at least 5 years out. At the moment in almost all US locations (except Hawaii) PV owners are slightly LOWERING the grid costs for other ratepayers. This has been the conclusion of all independent analyses done during solar vs. utility discussions.

The dollar amounts of those savings are large, but not uniform- they are relative to the site location within the grid structure, and the needs of the local grid. For instance:

In NY under the rapidly evolving "Energy Vision" regulations, the major utility Con Edison is saving about a half-billion dollars in substation upgrades in Brooklyn & Queens by actively promoting distributed ratepayer owned assets based on where they are relative to the substations. Under previous rules they would have made more money by pushing back on distributed generators and building out massive substation capacity, since they would have made a fixed guaranteed profit on that capital expenditure. Under new rules they are making much more modest upgrades and incentivizing very specific locations to install PV, automated demand response, co-generators and other assets, at a total expenditure by the utility of about half what it would have taken to achieve the same grid capacity & stability goals with traditional means. Since it makes clear economic sense, under the new rules they will be compensated at a much higher rate for the lesser capital expenditure, so that from a profit point of view they are in about the same place as they would have been by spending the billion-plus at the lower fixed rate of return under old rules.

See: http://blog.rmi.org/blog_2015_03_31_how_to_deploy_solar_as_a_grid_resource

So, should those ratepayers in Brooklyn & Queens who are taking a subsidy and installing PV & cogens, saving a half-billion in infrastructure costs to the ratepayers at-large also be paying an additional fees to cover their "fair share" of the grid costs? If so, on what basis?

The simple rate structure of delivery charges on a per-kwh use basis is simple, but is it fair? A house with a modulating 1 ton mini-split that runs all day might use as much power as a house with an 8 ton air conditioner. The mini-split runs all day, pulling a peak of maybe 1.5kw during the mid afternoon. The house with the 8 tonner is off all afternoon, the occupants come home at 6PM and it can cool the house off in 30 minutes. Who is using more grid resources? Who is using more expensive peaker-generator power? Who is driving the capacity requirements for the grid as a whole?

The simplicity of the fixed rate structure also masks the fact that power sippers are disproportionately paying for the grid infrastructure needs of the power gulpers. This is a clear cross-subsidy at least as bad (actually quite a bit worse) than simple net metered PV. Some utilities are looking at assessing "demand charge" fees based on the magnitude of peak grid draws in a given billing to cover grid costs for distributed PV owners, but if it's going to be truly fair, it needs to be across ALL ratepayers, rewarding (or at least finally being fair to) the power sippers.

A hot topic sure to be on the front burner soon

Mark - 'The Edison Institute and it's financiers'. Those financiers are the investor owned power companies, and since 2012 they have been paying ALEC to lobby 'friendly' state legislatures to provide legislative and regulatory impediments to homeowner and small business PV for the sake of investor profits. They are willing to forego clean air and less polution to keep their business model in tact. And that business model needs to build expensive new power plants and install expensive grid upgrades to maintin those profits for the investors. PV makes those new power plants and grid upgrades not nearly as necessary.

Bruce - The poor paying more for the grid than the 'rich' solar guy is part of the package of untruths that ALEC and the utility companies have come up with, although they have not come up with a clear and believable analysis to prove this is true. They have basically just said it, and naturally, some folks are going to believe it. Now it is true that if you buy all of your power from the utility, and I generate some of my own, and we use the same ampount of power, you will pay more to the utility. But the power that the utility gets from me has significant value to you and the utility, and the grid as well. It helps significantly with peak power (the most expensive kind!) and it stabilizes the grid, (which means not as many expensive upgrades) and every watt generated is a watt not generated by burning coal.

http://www.washingtonpost.com/national/health-science/utilities-sensing-threat-put-squeeze-on-booming-solar-roof-industry/2015/03/07/2d916f88-c1c9-11e4-ad5c-3b8ce89f1b89_story.html

The future: to grid or not to grid, that is the question.

In Perth Australia, residential installed full pv system cost (on grid) $1.75 per watt. Wow, a first world country doing PV for half of the U.S. national average cost of $3.50 watt. Loan costs to determine the "levelized cost of energy" on the NREL site for the U.S. are calculated at 7.5% and at that rate in good California solar area at $3.75 per watt installed they say you are paying 13 cents kwh. Less than the 14cents grid price in San Diego say.

Solar city exec's say that for every 1% reduction in loan rate is equivalent to a 20cents reduction per watt of price. Now banks are loaning for solar at 3.5% so with all the gobbllty gook of the math one could say solar, at twice the cost of Perth still comes in at 8 cents kwh at a 3.5%loan on $3.50 per watt.

What am I saying? Basically that the U.S. will soon catch Australia and rooftop solar will be 4cents per kwh. 2018 would be a nice date for that! Meanwhile we need to decide on battery prices. Not easy since it is the Manhattan project of our time. The beautifully engineered Bosch/saft battery packs in Germany are hanging on closet walls silently providing battery management and inverter plus lithium iron batteries waranttied for 15 years and expected to last 22 years, or 7000 cycles. Elegant, no? Pricey? Yes. Twice at least what they should cost. In fact four times too much. Tesla's new pack to be announced on April 30 will be (guess) half the cost. $5000 10 kwh. Now we are talking 10 cents kwh. Clean reliable silent safe...not your fathers wet lead battery. By 2018 it could be $3000. So realistically a full off grid system can/will hit 11cents kwh by 2018. If the grid cost are 20 cents kwh you might be thinking "off grid, that sounds fun". Yes, what about the 5 cloudy days in a row in December? I won't answer that question, somebody else needs to answer that.

This subject is coming up more often these days.

There could be a whole website devoted to this subject, i.e. the future of electricity. The title of the study indicates that going off grid has "little" economic benefit. That could be understood as "has a little economic benefit". And to the homeowner that is where it is going to remain: a small economic issue which has a great ethical dimension attached to it.

Now here is a story: One of the infamous Koch brothers was interviewed on why they persist in lobbying for coal fired plants in this day and age. He said " we offered green electricity in California for 2 cents more per kwh but only 1 or 2 percent of residents were interested in it, so we realized people didn't care...why should we?" I am paraphrasing, and it may even be an urban legend, but it has a certain sickening truth to it, doesn't it? It says that the average person would abandon ethical responsibility to save 2 cents kwh. Hmmm. Maybe the Koch brothers know something about the dismal reality of human nature that we idealists who read green websites don't know.

Paying for the grid (reply to Bruce)

Bruce said: "I'm continually amazed how folks in the clean tech sector don't want to pay for the grid"

But here's the thing. I have solar on my roof, and I pay the exact same monthly grid connection fees as my neighbors, plus an additional monthly fee for my net meter.

Sure, sometimes I produce excess energy from my array and the utility pays me for it, as they should. Sometimes this payment exceeds the cost of my grid connection for the month. But that certainly doesn't mean I haven't paid for my grid connection.

Nobody demonizes the super energy efficient homes, or the single elderly homeowners using much less electricity per month than the average. But as soon as you lower your bills with solar, suddenly you're a grid freeloader? I don't buy it.

A few more comments on PV

I haven't read the paper yet but it is good to see some analysis questioning the current death spiral orthodoxy. The modeling I've done indicates that storage is not competitive in Australia for the electricity consumer under current billing practices, time shifting grid supply between peak and off-peak tariffs or time shifting renewable generation to peak periods. And it very soon gets prohibitively expensive with respect to the size of PV installation and/or battery storage to cope with extended periods of low insolation.

I've just done a modeling exercise with commercial prices on storage at a number of Australian sites. To use the batteries efficiently requires a smart inverter/battery manager/charger. This adds a significant delta to the system installation price. I'll be interested to see what the Tesla price is for Li ion batteries at cost/KWH including depth of discharge considerations and balance of system costs.

On a more positive note, systems at the 100kW size are going in at down to ~$1.10/W AUD after sale of the Small scale technology certificates. Individual rooftop projects getting serious analysis up to 500kW are underway. As I've said a few times in posts to GBA in the last few years, rooftop installations are much cheaper than utility scale when all installed costs and operations and maintenance costs are taken into account. But this changes the paradigm of how the electricity supply industry works with obvious impacts on the current utilities.

Response to Jason D

Jason,

Thanks very much for providing more details from this study. You're correct that the assumptions were so specific that it's hard to generalize from them -- and that the described rate structure is a far cry from the best net-metering arrangements in the U.S.

In your last sentence, did you intend to write "it does not make sense" rather than "it does make sense"?

After reading the paper

Martin, the paper does not look at favorable metering agreements like net-metering, instead it looks at a house in Sydney, Australia with time-of-use charges of $0.13/kWh off-peak, $0.21/kWh shoulder, and $0.52/kWh on-peak and an additional supply charge of $0.87/day. The utility pays $0.08/kWh feed-in-tariff for excess power sent to the grid. So a very unfavorable rates in the "getting paid peanuts" category.

Unfortunately there's a major problem with the conclusions - the analysis only looks at a ten year period. I suspect that's so that the study did not have to consider replacement of inverters, batteries, etc. The paper does a good job setting up the problem in order to do the analysis, so maybe they'll include long timelines in the future. But right now all the paper can conclude is that it does not make sense to go off-grid with a PV-battery system that only lasts ten years.

fixed typo

Martin,

Yes, I intended for it to say "it does not make sense". I edited the post.

I'll also add that the modeling assumes that PV panels and batteries are priced according to models in other papers (as opposed to trying to get actual prices). They did look at what happens when panel and battery prices go down and found that there's a price where grid-tie PV-battery systems can save money over the 10 year horizon. (I think it was $2/W DC installed panels and $400/kWh batteries, but that's going off my memory. And that's for the particular rate system in my previous post.)

The main purpose of the paper was to show the math could be setup as a mixed-integer problem, which can be solved efficiently by computers. I suspect the authors (and other researchers) will use that to do more modeling and analysis in the future.

If GBA was really, they’d keep articles like this up-to-date and would even correct for misconceptions. But no. They are paying people to write about others writing about others writing about:

“The full text of the report is behind the journal’s pay wall, but its contents were summarized in an article in The Washington Post on March 30.”

Log in or create an account to post a comment.

Sign up Log in