Image Credit: Rocky Mountain Institute

The U.S. residential real estate market is booming, with new home sales steadily rising over the last few years. In March 2017, over 621,000 new single-family homes were sold (at a seasonally adjusted annual rate) at a median sales price of $345,800. Imagine if most of these new home developments were net-zero energy (NZE), which not only delivers the homeowner annual energy savings but also enhances the overall performance, comfort, and resilience of these homes.

Now suppose residents could afford these high-performance NZE homes at no additional up-front cost using an innovative financing tool that would annually save them more money than they pay toward the financing.

Rocky Mountain Institute’s (RMI’s) latest insight brief, R-PACE: A Game-Changer for NZE Homes, shows how this dream scenario can be made a reality through a special application of residential property assessed clean energy (R-PACE) financing — a game-changing financing mechanism that has already financed over 158,000 energy and water efficiency retrofits in homes in California, Florida, and Missouri since 2008.

What are NZE homes?

NZE homes are smart single-family homes that produce or procure enough zero-carbon renewable energy to offset their annual fossil-fuel energy consumption. These homes present the U.S. real estate sector with an incremental $33 billion market opportunity by 2037, which will not only bring additional investment to the sector and create local jobs but also transform the market trajectory overall.

As policymakers decide on their strategy to build smarter cities and revitalize their aging infrastructure, they must consider the unprecedented opportunity to invest in high-performing NZE new homes, which are more comfortable, affordable, and resilient to power outages and weather extremes. Scaling NZE homes through concerted policy efforts will not only help states and local governments meet their carbon goals but also improve the housing stock and real estate values.

Overall, NZE homes are the next big frontier for innovation and competition in the residential real estate market, and they promise a future that is propitious not only for homeowners and real estate developers but also for the U.S. economy and the planet.

What are the market barriers to scaling NZE homes?

While the market potential and business case for investing in an NZE home is compelling for both the builder and the homeowner, the up-front incremental cost of developing a new NZE home has been the biggest deterrent for builders and developers looking to invest in NZE development to make it mainstream.

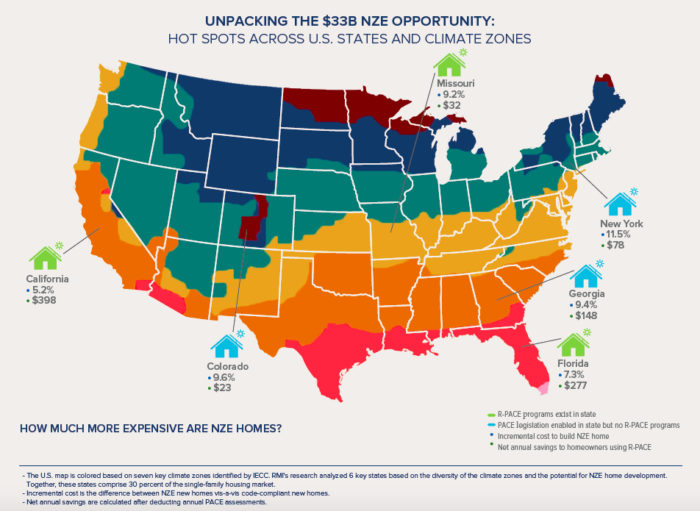

According to Rocky Mountain Institute’s research, the average incremental up-front cost of constructing an NZE home is likely to be $24,811 more than an average code-compliant new home (excluding the federal investment tax credit and other state-specific incentives). This estimate was derived by analyzing average code-compliant single-family homes across California, Missouri, Florida, New York, Colorado, and Georgia, which collectively comprise almost one-third of the existing single-family housing market.

Builders, who control almost three-fourths of this market, have been unwilling to invest their equity up front during the home construction process since they do not directly benefit from the operational cost savings and have no incentive to maximize them. The misaligned builder incentives and weak market signals coupled with the valuation uncertainty of how NZE home energy performance is presently valued by the market players are some of the main reasons for the latent consumer demand for NZE homes.

We believe that enabling R-PACE for new construction is an effective way to overcome these market barriers and scale NZE new construction around the country.

The role of Residential PACE in new construction

Residential PACE, also known as R-PACE, is an innovative financing mechanism used specifically to finance energy efficiency, renewable energy, resilience, and water-saving home improvements. This assessment is typically attached to a property’s tax bill, secured by the same type of lien against the property as tax bills, and repaid through property taxes.

It is unique because unlike traditional mortgages, it is transferable upon sale of the property and is tied to the property rather than the property owner. This feature allows seamless transfer and resolves the builder-homeowner cost-benefit split incentive challenge by lowering the need for builders to invest their capital equity into the project.

RMI’s research confirms that an R-PACE financed NZE home is also a great investment for homebuyers as it allows them to own a home at the same up-front cost while earning more annual cost savings than the amount they pay for the annual PACE assessments, yielding average net monetary benefits of $160 year-on-year. Thus, R-PACE can enable U.S. homes to be more resilient, affordable, innovative, efficient, and high performing while costing less than an average home.

How can we enable Residential PACE?

R-PACE has been extremely effective in tackling a significant market failure by increasing American households’ access to financial resources so that they can realize the benefits of a cost-saving, high-performance smart home. However, its use is ineligible for new construction and has been limited to home improvement retrofits in the existing state-enabled programs of California, Florida, and Missouri.

We believe that with a few minor alterations to R-PACE’s existing policy and implementation framework, it could serve as a transformative tool to scale NZE home development. Our insight brief proposes specific “R-PACE for new construction” recommendations for states and local governments considering policy instruments to bolster new NZE residential development. These include:

- Amending legal state provisions and the underwriting process to allow R-PACE to be used for new construction.

- Defining limits to the total eligible amount based on construction costs rather than home valuation to catalyze investment in the sector.

- Requiring lender consent for employing R-PACE during construction to promote transparency and credibility and build trust with the mortgage lenders in the process.

- Defining an eligible list of energy and water conservation measures that could count as qualifying expenses under R-PACE for new construction while ensuring that any expenses that do not qualify under the list are not financed through the assessment.

- Mandating performance criteria to ensure that the net savings in energy costs are greater than the cost of the energy conservation measures, and that the project meets or exceeds state energy performance code requirements.

- Certifying post-implementation energy performance to document all the measures installed within the new home to help increase the home’s valuation at the time of sale.

RMI is working toward a future where every homeowner in the U.S. has the opportunity to buy an NZE high-performance home for the same up-front cost as an average home while accruing net cost savings on the investment annually. This dream can be a reality if we use R-PACE to finance the incremental up-front costs to scale NZE homes in our states, cities, and communities.

RMI appeals to states and local governments to work together to enable R-PACE for new construction in their jurisdictions to scale new NZE developments and make a concerted effort to facilitate enabling policy design and stakeholder engagement to support the mechanism. This effort would not only promote innovation and development in the real estate sector, but would also help leverage the abundant solar potential in states, encourage more local job creation, and increase employment overall.

This is a win-win market-based solution with a business case for states, local governments, developers, and homebuyers across the country. We believe that R-PACE, when thoughtfully deployed for NZE home construction with robust state-level consumer protection measures, will scale NZE home development and set an example for other states to emulate. If you share this dream, we look forward to working with you. You can reach us at [email protected] to learn more about our work on R-PACE for new construction.

Radhika Lalit is a senior associate with the Buildings Practice at the Rocky Mountain Institute. © 2017 Rocky Mountain Institute. Published with permission. Originally posted on RMI Outlet.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

14 Comments

Still doesn't address the total cost of ownership.

PACE loans typically have amortization periods of 20 yrs or less and there is an issue with regards to having first lien position.

The PACE program also causes distortions in the market. First is the lien position. Their priority over the first mortgage lien acts as a subsidy from a risk perspective for the entity that provides the capital or buys the PACE loans on the secondary market. In turn it could make first mortgage liens more expensive than they otherwise would be and you can almost write off the possibility of anyone being able to obtain a second mortgage. Secondly the low cost of funds acts as a subsidy for the associated products purchased because it reduces the rate in price declines.

John, please expand your argument

I think those in favor of PACE funding would be in favor of "market distortions" since that's pretty much what it takes to move anything in this country, and the forces arrayed in resistance to energy efficiency could also be characterized as its own entrenched market distortion.

But anyway, the concept is underway in three states. Is there any data to suggest that PACE introduces trouble for homeowners? With the average cost cited as $24K, what is the attitude of banks toward this lien? FWIW, that's a small piece of the median cost of a new house. How are real estate appraisers handling this? Are homebuyers shying away from existing homes that carry one of these liens?

@John Clark

You raise some interesting points. I think we can all agree that the banking industry is an enormous obstacle to positive change in this country.

@Andy

PACE loans a guaranteed by the local taxpayer (hence the priority lien position) so there's no incentive to reduce prices for the product/upgrades purchased with the funds.

The vast majority of mortgage lending goes through the GSE (Fannie Mae/Freddie Mac) and FHA.

Here's a guideline (verbatim) from one of these entities, "...will not purchase mortgage loans secured by properties with an outstanding PACE loan unless the terms of the PACE loan program do not provide for lien priority over first mortgage liens. Lenders must monitor state and local law to determine which jurisdictions offer PACE loans that may provide for lien priority...". This guideline is there so investors who purchase the securities which contain these mortgages will get paid back in the event of default. The higher the risk with regards to getting paid back in full the higher the rate of return the investors are going to ask for using their money.

I believe FHA is the only lender which allows PACE loans to have priority over the senior mortgage lienholder. Then again the Federal Gov't directly guarantees FHA loans so the taxpayer at large is on the hook.

Appraisers do not know if there is a PACE loan because it's out of their scope. The title company would have to look for it because payment is collected by the local government via property taxes and lenders have to be aware of their potential existence. I also don't believe they're recorded on title like a mortgage lien, but buried as a line item on the property tax bill. Homebuyers only care if it limits their ability to obtain financing, and of course limit the ability of the homebuyer to refinance at a later date if they don't want to pay it off.

@Bennett, It's complicated, but in reality it boils down to

govt interference in the marketplace as a whole. Constantly trying to correct an imbalance of its own making, but hey it keeps the people in DC busy and the campaign contributions flowing.

Response to Comments

Hi all,

Thanks so much for all your comments. I wanted to offer some generic responses to some of your questions and comments:

1. Residential PACE is a special assessment (not a loan) that you can take for implementing energy efficiency, water efficiency, renewable energy or resilience retrofits to your home.

2.PACE financing is available to residential or commercial property owners within local jurisdictions that "opt in" to or create a program. Localities can choose to administer these programs, contract an administrator, or allow private organizations administer programs. For the most part, localities across the board are allowing private organizations to administer these programs.

3. Unlike most "loans", PACE assessment offers "0" upfront cost and does not discriminate the interest rates based on a person's FICO scores. Moreover, most PACE assessments can be prepaid or refinanced without any prepayment penalty. What is most interesting is that PACE is attached to the property and not the individual, which makes sense because the existing homeowners pays for the benefits they accrue during the period that they own their home. Once they sell their home, PACE lien travels to the new homeowner.

4. FHFA has offered significant resistance to resistance PACE due to the seniority of PACE's lien on the property. However, the truth is PACE is not accelerated at default, which means that only the payments that were defaulted on are the ones which need to be paid off. On average, if you were looking at a foreclosure, you could expect ~$3000-$4000 in PACE commitments which will be paid off before any mortgage. Moreover, despite the resistance, GSEs (Government Sponsored Entities)—Fannie Mae and Freddie Mac—are now offering loan programs which can refinance PACE assessments. So from the homeowner perspective, it should not be an impediment to selling or refinancing any home. It is important to clarify that PACE does not make first mortgage liens more expensive.

5. Appraisers do not react to PACE liens any differently than they do to any other home mortgage. What's important to note, however, is that by the virtue of having made energy efficiency/water efficiency retrofits or by installing renewable energy on your rooftop, your home value should be more. A green appraiser could use either the income approach or the cost approach to value the green features of your home, which invariably will make it more valuable.

6. RMI's analysis considered NZE (net-zero energy) homes instead of NZC (net-zero carbon) since all homes were modeled to be all electric, on an annual basis, the homes that are net-zero energy are also net-zero carbon. This assumes an average carbon intensity for the grid and doesn't take into account the carbon variance on the grid over time based on the source. With regards to purchasing offsite carbon credits, purchasing RECS typically costs between $0.01-0.03/kWh more depending on the utility. This never pays back and is not more cost effective.

PACE FAQ for your reference:

https://www.rmi.org/our-work/buildings/residential-energy-performance/faq-pace-for-homes/

@John @Andy @Jon More PACE details

Hi folks,

Thanks for the good discussion. I'd like to offer up a few more details, in addition to Radhika's, from the RMI perspective:

1) ZNC @Jon - While this paper focused on ZNE (as Radhika explained), RMI is a big supporter of ZNC and co-crafted the primary industry definition of it specifically as an alternative to ZNE: http://www.architecture2030.org/downloads/znc_building_definition.pdf

2) Market Distortion @John @Andy - One of the biggest market distortions and failures in this arena is the fact that appraisalers and lenders don't currently consider energy costs as part of the total cost of home ownership. We've been talking with the GSEs to address this, but it's likely to take a while. This market failure is one of the reasons why a tool like PACE becomes so important for being able to finance improvements that stay with the property. It's a direct response to addressing that market failure. If that failure were addressed, then property-tied lending would be less needed (although still a fine approach).

3) Primary Lien -- I think it's worth noting that while all current residential PACE projects are primary liens, some programs are exploring making it secondary. Having a primary lien is a big part of why some mortgage lenders have resisted PACE, and in my opinion it's not a necessary feature.

4) PACE resistance @Andy -- From what we've seen, most PACE loans have worked just fine, and despite the official wariness from the GSEs, they've continued to work with them in California and are working to work with them in the market (as per Radhika's comments). That said, there have been bumps along the way for a subset of homeowners. The market is new and evolving and the world of financial institutions is still figuring out how to respond to this disruption in the market -- but the trend is toward improving it (with things like the new consumer protections CA just put in place) rather than shutting it down.

NZE is irrelevant

NZE is itself a market distorting metric that that doesn't accurately represent what people care about. I suggest zero net carbon (ZNC) and making it clear that purchasing offsite carbon credits of any form (probably more efficient in terms of $/ton than many building upgrades) meets the definition.

It's not clear to me that RMI is doing this. The footnote on page 1 suggests an offset of the energy (ie, kwh), not carbon.

When you use utility electricity and how it is generated makes a big difference in carbon emissions. Let's reduce carbon emissions and do it in the most cost effective way possible. Think outside the arbitrary box of "the building".

Responding to Jacob C

With regard to energy costs as a factor in home mortgage calculations: a few years ago there was at least one lengthy discussion thread on GBA at a time when it was assumed that energy costs would be rising steeply at some point in the relatively near future. Since then fracking technology has led to abundant cheap natural gas and solar/wind energy costs have dropped precipitously and continue to decline. While responsible developers and builders continue to strive to create homes with minimal energy input needs it’s hard to make a case to mortgage lenders and their appraisers that this will result in a significant impact on the personal finances of mortgage borrowers and hence to a predictable enhancement in the long term market value of the house. Home owners love to believe that their low energy investments will deliver significant ROI in total cost of ownership in the medium to long term but absent that long predicted but so far unrealized spike in the energy markets it ain’t necessarily so.

@Radhika @Jacob

Radhika Point 1: Actually they are loans. The loans are bought and sold on the secondary market like mortgage loans. Payments are collected via assessment due to their unique priority lien status and local taxpayer guarantee.

Radhika Point 3: There's nothing discriminatory with FICO scoring. However it has shown, in California for example, that the lack of an "approval" process will get existing homeowners into trouble because they were mislead into believing that they could afford the energy upgrades.

Radhika Point 4: Perhaps, but nobody knows what will happen in the event of a localized downturn. While a $3k-$4k in commitments seems low but what is to prevent builders from tacking on $20k improvements for "High Efficiency HVAC" or "Higher efficiency solar". The DOJ is currently reviewing the practices of some PACE Lenders where existing homeowners found themselves having cash flow problems due to the costs of energy efficiency upgrades. High efficiency solar, water heaters, HVAC Systems, can all be financed via PACE.

Radhika Point 5: The income approach is largely irrelevant. Especially in the residential arena.

Jacob Point 2: Energy costs are variable, depend solely upon the market area, and in terms of usage and maintenance depend upon occupant behavior. You simply cannot place a value upon that.

Jacob Point 3: It's about the taxpayer guarantee. I suspect that the local/state governments carry these PACE loans as a liability on their balance sheet as well. They can't use "accounting magic" like the Federal Gov't can by excluding trillions of GSE MBS from their balance sheet although the explicit guarantee is there.

bad assumptions can justify anything

Interesting - the Vermont study (referenced by RMI to justify cost effectiveness) uses questionable assumptions for their reference. For example, would any rational builder select an 80-85% efficient combo propane boiler than costs thousands more than an ASHP and a HP water heater? That's more up front and more to operate.

Their result was $50K to get to net zero energy, about 1/2 for building upgrades and 1/2 for PV solar.

to James Morgan response

"While responsible developers and builders continue to strive to create homes with minimal energy input needs"

We have few of those here in WI (Walker land). I can count 5 out of 500 contractors who care anything about energy efficiency. You guys live in the fairyland of the NE. The Great Lakes and Midwest have thousands of homes being built like they were in the 70s except larger with thicker 2x6 walls but still completely energy wasteful. We need lots of changes everywhere!

From the other side, I am excited for the future houses though. Imagine having an autonomous house which is able to provide it with energy, no matter the place where are you living. This sounds very exciting, the only things that I am afraid of are the prices, because they are already high, but they might be even higher in the future. After reading this article by Tim Thomas https://timthomas.co/signs-of-a-housing-market-crash/, I understood that there is also a chance that the market will crash, so it would be a very smart choice to buy the house during that period.

I prefer the approach I outlined in this Q&A post:

https://www.greenbuildingadvisor.com/question/principal-interest-taxes-and-insurance-but-not-utilities

Log in or create an account to post a comment.

Sign up Log in