Declining costs for utility-scale wind turbines are one factor that has helped drive the price of wind-generated electricity to its lowest point ever, the Lawrence Berkeley National Laboratory says in its annual Wind Technologies Report.

The report said that utility purchasers were offered an average price of less than 2.5 cents per kilowatt-hour in contract negotiations in 2014, a year in which wind installations reached 4.9 gigawatts of new capacity. New projects were valued at a total of $8.3 billion.

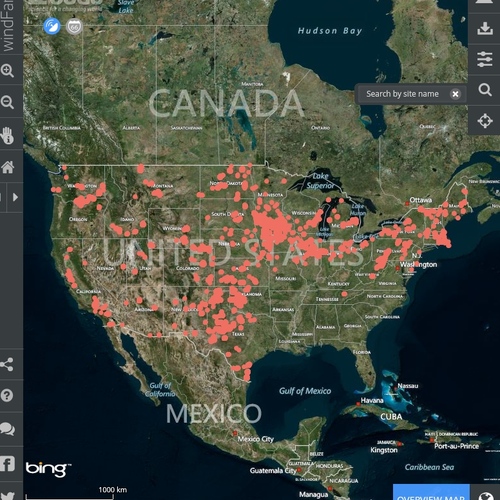

“Wind energy prices — particularly in the central United States — have hit new lows, with utilities selecting wind as the low-cost option,” Berkeley Lab Senior Scientist Ryan Wiser said in a written statement. “Moreover, enabled by technology advancements, wind projects are economically viable in a growing number of locations throughout the U.S.”

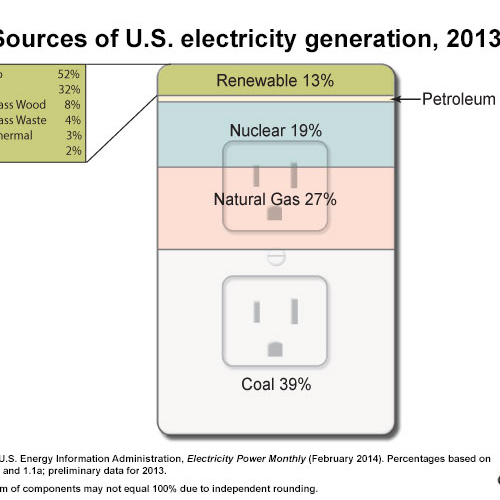

Wind energy has equaled 33% of all new energy additions in the U.S. since 2007, and now meets almost 5% of the country’s total electricity demand, the report says. In nine states, wind accounts for more than 12% of total generation; in three states it’s more than 20% of demand.

Better turbines, better pricing

The U.S. Department of Energy said there were several key findings:

- Wind turbines are getting bigger and more powerful. The average capacity of wind turbines has increased by 172% since 1998-1999, to 1.9 megawatts, and the average turbine hub height has gone to 83 meters (272 feet), an increase of 48%. The average rotor-tip diameter is now 99 meters (325 feet), more than double what it was just six years ago. These increases have allowed developers to build projects economically on sites with lower wind speeds.

- Wind turbines cost less than they used to. Prices for turbines have fallen by as much as 40% from their peak in 2008, and that means lower costs for wind farms. Projects constructed in 2014 had an average installed cost of $1,710/kW, a decline of nearly $600/kW from their peaks in 2009 and 2010.

- Wind energy is more competitive in cost. With prices falling for turbines and wind installations, the average levelized long-term costs of the power they generate has come down, too. Prices dropped to an average of 2.35 cents/kWh in power sales agreements signed in 2014. That’s the lowest it’s ever been, but the report notes that’s based on a sample of projects chiefly in the central part of the country where costs are less (see the chart below). Wind energy contracts signed in 2014 also “compare very favorably” to cost projections for gas-fired plants extending through 2040.

- Wind keeps a lot of people employed. Jobs in the wind sector increased sharply between 2013 and 2014, from 50,500 to 73,000, while the number of companies that supply turbines also has reversed years of declines and also is on the rise. U.S. manufacturers produced 90% of the nacelle assemblies (the box-like structure that sits on top of the tower), between 70% and 80% of the towers and as much as 65% of the blades and hubs. But only about 20% of the components inside the nacelle were manufactured in the U.S. Exports of wind-power components hit $488 million in 2014, up from just $16 million in 2007.

- Uncertainty lies ahead. “Far more” domestic manufacturing facilities closed their doors in 2014 than opened. An uncertain domestic market because of changes in U.S. tax law after 2016 has made some manufacturers uneasy and hesitant to commit long-term resources to the U.S. market.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

2 Comments

Tax changes?

What tax changes?

Tax changes

Nate G,

The Production Tax Credit for wind projects had run out in 2014, but two weeks before the end of the year Congress extended it until the end of the year--in effect, a two-week extension. Projects that were started in 2014 could qualify for federal tax credits, which was expected to keep wind projects moving in 2015 and 2016. But at the time, any further extension of the PTC was uncertain. After 2016, the authors weren't sure what would happen to the industry. You can read more about this on page 62 of the report (use the link in the story above). Tax incentives for both wind and solar projects were extended in the federal spending bill passed by Congress last month (you can read more about that here). At the time the Berkeley report was written, of course, no one knew that would happen.

Log in or create an account to post a comment.

Sign up Log in