This article originally appeared at Yale Environment 360.

Russian president Vladimir Putin’s invasion of Ukraine is sparking a wide-ranging revamping of energy policy in Europe with a bold new objective: to wean the continent off Russian gas—as rapidly and comprehensively as possible—and accelerate Europe’s green energy transition.

In late-night sessions, Europe’s leaders have been drafting a spectrum of crisis strategies not only to pivot to other natural gas suppliers—as the United States, which imports much less gas and oil from Russia than Europe, has vowed to do—but also to switch from gas to electricity where possible, and to scale back gas consumption across key sectors. The European Union says it plans to triple its renewable energy capacity by 2030. Some critics even advocate that Germany suspend its plan to shut down its three remaining nuclear reactors by the end of this year—an unthinkable prospect before the invasion of Ukraine.

The European Union has announced a new energy plan that will, according to a leaked draft, “scale up renewable energy in Europe by mobilising additional investments, removing roadblocks to renewables roll-out, and empowering consumers to play an active role in the energy market.” The strategy, which aims to cut EU dependency on Russian gas by two-thirds this year and completely end reliance on Russian gas supplies “well before 2030,” includes fast-tracked deployment of solar energy and renewable hydrogen, the quick implementation of far-reaching energy-efficiency measures, and the production of 35 billion cubic meters of biogas per year by 2030. European citizens will be called upon too: They are being asked to turn down thermostats by 1 degree C, which could shave about 7% off Europe’s gas consumption.

“Let’s now dash into renewables at lightning speed … The faster we move, the sooner we reduce dependency on others,” EU climate policy chief Frans Timmermans tweeted recently.

Sascha Müller-Kraenner, a German energy expert and author of the book Energy Security, said in an interview, “This is a whole new ball game now. Europe can’t be in exactly the same position it is right now [heavily reliant on Russian gas] at the start of next winter. Today climate policy and energy security policy are one. It’s a huge chance for Europe to finally make good on its climate goals.”

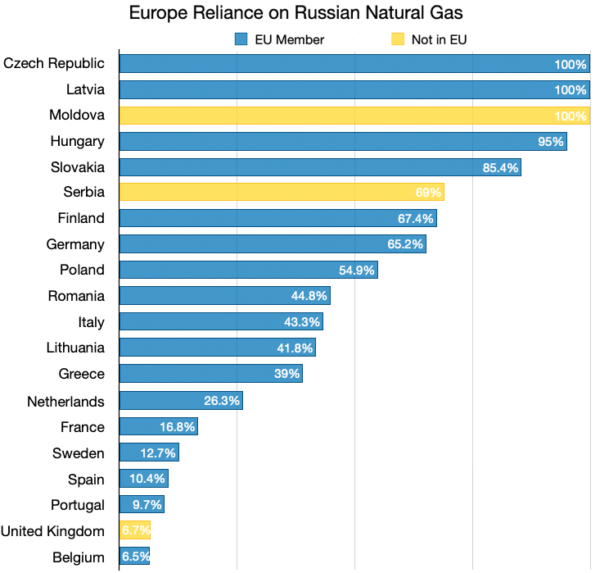

Still, experts warn there are prodigious challenges in rapidly accelerating the green energy transition and finding timely alternatives to Russian natural gas, which Europe relies upon for 40% of its gas needs, largely for heating and certain industrial processes. Russia also supplies roughly 35% of Europe’s crude oil and upward of 40% of its coal.

Gas a big part of EU’s energy mix

Even though the EU had planned to reduce natural gas consumption more than 25% by 2030, gas was expected to comprise a significant share of Europe’s energy mix for at least the next decade—and in Germany much longer. European leaders have been counting on natural gas as a cornerstone of Europe’s clean energy transition, an interim energy bridging the span from dirtier fossil fuels, such as coal and oil, to renewables. And while Germany is Russia’s largest customer—half of Germany’s natural gas flows from the East—other countries, such as Finland and Latvia, depend on Russia for nearly 100% of their gas.

For such nations, the road ahead will likely be slow. Not only are Central and Eastern European states more dependent on Russian gas, but their transition to renewable sources of energy is proceeding far more slowly than nations like Germany, Britain, and Denmark. Switching from gas to electric heating, and the rollout of renewable energies, takes time, and has proven more cumbersome and complex than many European leaders had anticipated.

Germany, which had long banked on Russian gas as a linchpin of its own energy security, is now forging the way in a determined drive to establish energy independence from Russia. Just days after Russia breached Ukraine’s borders, Germany took its first concrete steps to kick its chronic addiction to Russian gas and declared the immediate ramping up of its climate targets. With an extra 200 billion euros to expedite the new agenda, its goal now is a 100% renewable power supply by 2035, rather than 2050. Subsidies for rooftop solar installations are to increase, benefiting millions of homeowners, and German regulators will auction off more wind power concessions.

Off the table permanently is Nord Stream 2, the controversial Russian gas pipeline that would have doubled Russia’s delivery capacity to Germany. Germany’s Ministry of Economic Affairs and Climate Action, headed by Green Party leader Robert Habeck, has allocated an additional 1.5 billion euros for the purchase of liquid natural gas from Australia, Qatar, and the United States.

“Until now, there hasn’t been the political will in Europe to explicitly make clean energy sovereignty a goal,” explains Matthias Buck of the German think tank Agora Energiewende, who expects the EU to increase the speed of its renewables rollout threefold. “Now the logic is different and everyone is on board. The technology, particularly wind and solar energy, is already there and cheaper than fossil fuels. We now have to finally roll it out on a large scale.”

European leaders now see the purchase of Russian gas—previously viewed as a constructive bond between East and West—as fueling the Russian war machine and weakening the continent’s geostrategic leverage. In just a matter of days, Europe has found itself staring a stark new reality in the face: Russia could, at any moment, cut off gas deliveries to the continent, paralyzing industry and causing millions of citizens to go cold.

Were the West, for example, to fully suspend Russia’s access to international payment systems, it would be virtually impossible to compensate Russia for gas delivery, which would trigger its cessation. This is why the U.S. and Europe have thus far resisted halting the SWIFT electronic payment system for energy—meaning that even as war rages, Russian gas continues to flow.

Jonathan Stern, a distinguished research fellow at the Oxford Institute for Energy Studies Gas Programme, said that, try as they may, European countries dependent on Russian gas will not be able to stockpile enough gas in storage facilities to hold out over next winter. That’s chiefly because big natural gas suppliers such as Norway, Qatar, and others already export about as much gas as they can produce. “There’s no more natural gas to be had—it’s that simple,” Stern said in an interview. He said he did not expect either the Russians or the EU to terminate gas contracts anytime soon because of the financial penalties that cessation would impose.

How to accelerate the switch

Despite calls by some in Germany for a short-term prolongation of coal and nuclear power, Müller-Kraenner and others contend that these sources’ environmental drawbacks argue for turbocharging Europe’s low-carbon, smart-energy transition as the key to attaining energy independence. Habeck said recently that “coal and nuclear are not alternatives for Germany.”

“There’s every indication that we can reconfigure Germany’s energy supply and use it in such a way that we will be in a much better, much stronger position vis-a-vis Russia than we are right now,” says R. Andreas Kraemer, founder of the Berlin-based think tank Ecologic Institute. “We can meet ambitious climate goals as well as strengthen national security. Germany’s new government has already ratcheted up the clean-energy transition, and now it is ratcheting it up further.”

How will Germany, and indeed all of gas-dependent Europe, accelerate this switch?

First, says Kraemer, Europe has to utilize gas in a new way: much more sparingly, efficiently, and only in priority sectors. “Russian gas is gas of last resort,” he says. “It should be used only where there is no alternative or where it produces the highest value,” such as for heating homes in cold spells and in essential industries. Should push come to shove, and all Russian gas be terminated, the gas-intensive chemicals and plastics sectors might simply be forced to shut down for a time—a temporary blow to the German economy, but not a catastrophe, says Kraemer. One proposal soon expected from Habeck’s ministry: financial incentives for industrial operators to withhold production at times of high energy demand.

Indeed, energy efficiency and demand management are now top priorities rather than the afterthoughts they had previously been in European planning. Despite lip service, energy-efficient building renovation has dragged in the EU and currently faces a yawning investment gap. In 2020, the European Commission estimated that around 275 billion euros in additional investments a year were needed to renovate just 2% of the EU’s building stock annually. At that rate, it would take dozens of years to make EU buildings energy efficient, and in Central Europe, where renovation rates are lowest, even longer.

“The first thing that has to happen is that the EU gets serious about the targets it has,” says Heike Brugger, an expert at Fraunhofer Institute for Systems and Innovation Research. That will entail more low-interest loans and financial incentives for energy-efficient renovations, as well as carefully evaluating current incentives, which still support investments in gas infrastructure. According to EU calculations, if the bloc were to implement current energy efficiency and renovation legislation, it would deliver 17 billion cubic meters of gas savings by 2025, which is about 10% of Russia’s annual export volume to the EU.

Switching to electric heat pumps

Experts also say that electricity has to take over from natural gas in sectors where just weeks ago gas seemed a secure long-term bet. “We have to electrify all current uses of gas wherever and as soon as we can,” says Kraemer, including replacing many gas-fired heating systems with electric heat pumps. Until now, says Kraemer, new gas heating systems have been promoted in Germany, in contrast to Denmark, where legislation has has banned all new gas connections since 2013. Although such a ban probably will happen everywhere in Europe, says Kraemer, it will take years for Europe’s heating systems to entirely wean off natural gas.

Buck of Agora Energiewende says cutting back on natural gas consumption will hit many industrial sectors, such as steel and concrete, hard since they require high temperatures for industrial processes. But, he notes, they use 40% of their gas for lower-temperature processes. Electric heat pumps could take over a fair share of this kind of heat generation, says Buck.

Until now, Buck and others contend, clean energy expansion has been a second-level priority, easily derailed by other considerations. Local residents, conservationists, and far-right groups are increasingly blocking wind farms in many parts of Germany. But if the government gives renewable energy priority status—on a par with security—that would ease the permitting processes, says Buck.

He and others also argue that it’s time to fast-track legislation across Europe mandating solar panels on all new housing. Furthermore, advocates contend that state decrees should make public buildings, industrial spaces, farmland, and defunct open-pit coal mines open for solar installations. And the EU can adopt more comprehensive policies to reform the electricity system so that all kinds of battery storage, from units in homeowners’ garages to industrial battery arrays, are fully integrated into the grid.

“Switching from Russian gas is possible, but make no mistake, it’s going to be expensive, especially if companies want to terminate their existing long-term contracts,” says Stern, of the Oxford Institute for Energy Studies. “In the past, there have been more than enough nice pledges, but nobody’s been prepared to pay for substantial switching away from Russian gas.”

Paul Hockenos is a Berlin-based writer whose work has appeared in a number of publications.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

15 Comments

Nothing cures high energy prices as quickly as a round of EXTREME energy prices!

In the Netherlands at this year's utility pricing and rooftop PV pricing rooftop solar pays for itself in LESS than one year!

It's also currently cheaper there to heat with PV + resistance electricity (COP=1) radiator panels or infra-red panels than with condensing natural gas boilers, and (of course) cheaper still to heat with air-to-air or air-to-water heat pumps + PV.

This energy-nerd (https://www.youtube.com/c/KetelKlets/videos) covers the particulars & shows the math on many aspects of home energy efficiency in many of his videos, most of which are easy to follow for those who understand arithmetic (even for those with zero comprehension of Dutch.) This one is particularly on-topic for homeowners who can afford the upfront cost of both PV and heat pumps:

https://www.youtube.com/watch?v=SfQnmKzw9js&t=5s

(^^The title translates in 'merican to "Gas has become much too expensive- I'm going electric!")

It's 10 minutes of your life you'll never get back but it's fairly informative & useful for anyone in northern Europe anticipating ongoing high or very-high retail energy pricing. As solar gets cheaper year on year, this math will work for most Europeans (and many in North America) by 2030 even if gas prices are eventually restored to the pricing of the past decade. Restoration of gas pricing to prior levels not likely to ever happen in Europe (now that Putin has clearly showed his hand) since LNG shipped from North America or the Middle East will never be as cheap as pipelined gas.

Related Netherbabbelish, some with math:

https://www.youtube.com/watch?v=5ZNghjtlCKY

https://www.youtube.com/watch?v=4Z6P-tEyF-0

The author makes many good points and paints a clear picture of current European energy use.

But until an economic-viable, industrial-grade energy storage technology is available, renewable production by itself will not be able to meet European energy demand. Renewables, without storage, can deliver only about 35% of total demand. Ever. It’s physics.

The author is correct that Europe will need energy from non-renewable sources. How that energy is generated is an open question.

>"But until an economic-viable, industrial-grade energy storage technology is available, renewable production by itself will not be able to meet European energy demand. Renewables, without storage, can deliver only about 35% of total demand. Ever. It’s physics."

That's actually not quite correct, at least at the home-energy level, and not really true at the regional grid level either. Where does that 35% number come from?

Home energy use is FAR more dispatchable using timers/smart-switching to better align energy use than the armchair analysts tend to believe. Demand response works, and works VERY well when automated using relatively cheap load dispatch controls. (The Ketel Klets You-Tuber has multiple videos targeted at homeowners on how to better balance their rooftop solar output with their energy use and minimize their bills as the already legislated net metering deal in NL evolves over the next handful of years.)

The capacity factor, and diurnal & seasonal timing of wind power along the North Sea & Baltic shores (offshore & on) is also quite good, and increases during the winter periods when heating loads are higher. (It's still not as well timed as New England's offshore resources though.)

With reasonable demand-response utilizing demand response of dispatchable loads at both the household and regional grid levels the amount of grid storage required is at least an order of magnitude lower than the simple analysis would imply. The bigger the geographical spread, the easier it is. Right now Denmark & Sweden get a huge advantage from next-door Norway's extensive dispatchable (and some reversible) hydroelectric capacity- it's already there, and already cost effective.

But what means "... economically viable, industrial-grade energy storage technology..." ??

At this past winter's European gas pricing even lithium ion battery storage is cost effective. But efficiency improvements for low-grade heat energy use (such as space or water heating) are cheaper still. That may continue to be the case even after more LNG (liquified natural gas) import facilities go on line, since even distributed small scale solar is cheap (less than half the cost in Benelux & Germany than in the US) and still getting cheaper. There is very real and serious, permanent demand destruction going on for both gas heating & liquid transportation fuels, given just how much the cost of gas has increased relative to the (also increased, but not as much) record high retail electricity pricing.

Tesla just opened a massive EV factory in Germany, and a handful of the Chinese competitors are expanding distribution beyond Scandinavia this year. Smart car chargers (both one way and vehicle to grid versions) can do a metric shit-ton of load balancing to better match the variable supply to the dispatchable load. Denmark has been remunerating EV owners for use of their batteries for years now, and they're not the only ones. That's VERY cost effective for all parties concerned. The degradation of LFP batteries (used in most Chinese EVs, as well as all the standard-range Tesla Model 3s & Model Ys being built in Germany) is de minimis lasting 2-3x as long as ternary metal cathode lithium batteries used by most US & European vendors.

Even before this fuel price shock the European car market was on track to break 50% of sales by 2025, but with the tsunami of Chinese vendors getting in to the act (at pricing/value beating all European vendors) that market share point might happen as early as 2023. Some potential sales leaders: the BYD EA1 is a Toyota Corrolla sized car (but nicer, overall), that in China costs less than USD$15K. The Xiaopeng (abbreviated X-Peng on the latin alphabetized logo) P5 is more of a luxury sedan roughtly the size of a Toyota Corolla or Tesla Model 3, selling for under USD$25K. I'm not sure what the European pricing on these will be, but both of those companies, among others (including Geeley, which owns Volvo & Northstar now) are coming to Europe THIS YEAR. This will destroy used-car pricing, and only those who don't care or can't do math will be buying new or slightly-used internal combustion engine cars as the availability of moderately priced EVs goes up.

While deployment of distributed storage resources won't all happen in one year, the current natural gas & diesel/gasoline price spike has as further steepened an already steepening the deployment curve of distributed energy & storage resources.

The cost of storage just using batteries is already cost effective in the US, and cheaper than business as usual when combined with utility scale wind & storage. The mix of battery/PV/wind that's most cost effective varies by location, but the math does work, even without expanding transmission grid capacity. The energy report released by think tank Rethink-X last year did a deep analysis on decades of weather history, grid, load and the learning curves of battery/wind/PV, separately looking at CAISO (California), ERCOT (Texas), and ISO-NE (New England), downloadable via links on this page:

https://www.rethinkx.com/energy

While most of Europe has lousier wind & solar than those regions of the US, and parts of Europe suffer from less extensive transmission grid infrastructure than in North America, surely it works there too.

Dana-the 35% is the combined net availability of wind and solar MWh generation as a of % of total current electricity demand. Example-I’ve worked on a 20 meg wind project in New England and after a year of collecting wind data, it was calculated that the project could produce only 28% of the rated 20MW design. That’s just the turbine output based on wind resource and excludes conversion and transmission losses. Solar, at least in New England, produces power at its installed capacity on average 35%. That, too, excludes conversion and transmission losses. Certainly California is higher but I’m being selfish and considering only where I live.

None of these figures consider the timing of wind and solar generation, nor the complexity of load balancing on the ISO-NE grid. Being able to match demand with supply is hugely complex with wind and solar. Is our grid ready for this? If, not what investment is required? How long will it take to build this out? 2035 is a pipe dream.

Where are the large scale storage demonstration projects? Frankly, you’ll have to point me to some pilot project which both technologically and financially validates grid-level storage. I live in a 20-story high rise so a storage solution cannot be distributed.

Before committing to 100% renewables and decommissioning our conventional power generation capacity, I would want to see more than a home system YouTube demo or a hypothetical paper study. I would like to see a large-scale storage project actually working. Haven’t lessons been learned from Texas’s calamitous winter blackout debacle? People died. Or Germany’s struggling energy policy now hostage to Russian gas?

I’m all for 100% clean energy and EVs. But it hasn’t yet been demonstrated that wind plus solar plus storage is anywhere near ready to provide 100% of our energy requirements.

That 35% number as a capacity factor is reasonable. That does not set a ceiling on how much of the energy demand can be supplied by renewables. It means that you have to buy three times as much hardware as you expected if you did a naive calculation, but when people price out renewables and show that they are cost effective, they are already factoring that in.

There are other challenges in the timing of energy supply, but Dana has addressed those issues pretty thoroughly.

>" I would like to see a large-scale storage project actually working. Haven’t lessons been learned from Texas’s calamitous winter blackout debacle? People died."

One lesson from the Texas debacle is that renewables keep chugging away when gas fired systems (using less-than-dry fuel) freeze up. Unlike ISO-NE the ERCOT markets are energy-only, with no capacity payments, no regulatory requirement for freeze tolerance.

>"Or Germany’s struggling energy policy now hostage to Russian gas?"

The vast majority of Germany's gas is for heat, not electricity. I'm not a defender of Merkle's decision to put Germany's head into that noose, nor am I a fan of Germany's glacially slow bureaucracy regarding infrastructure projects. But note, geographically Germany is barely half the size of Texas, and similarly grid-constrained for import/export of electricity. That's a harder nut to solve than the eastern interconnect grid regions in the US, where the weather, loads, & renewables output can be moved around much more easily (not that a build-out of more transmission resources would be the least-cost solution in every case.)

>"Where are the large scale storage demonstration projects? Frankly, you’ll have to point me to some pilot project which both technologically and financially validates grid-level storage."

OK.

The Hornsdale Power Reserve's large battery (c0-located with a large wind farm) in South Australia has saved the system from crashing several times over the past 3 years, and paid for itself in less than 2 years by being able to under-bid fast peakers lowering cost to both the utilities & ratepayers. They're currently in the process of doubling that in size. Building out the battery capacity reduces the amount of renewables that need to be curtailed for grid balancing, but that's not it's primary value. The very fast reaction time is able to keep the grid alive even when transmission assets are fraying.

https://hornsdalepowerreserve.com.au/

Australia's grids are renewables-heavy (growing year on year) and light on transmission resources (far less robust interconnections than ISO-NE). That grid-battery model is being copied in several locations in Australia right now.

There are even bigger grid battery systems than the Hornsdale project currently being installed in both TX & CA, based on the favorable economics. In CA grid batteries can out-compete gas peakers, and can keep parts of the grid going when transmission lines need to be shut down during wildfire hazard conditions. Multiple grid battery projects are already under way in CA- stay tuned...

Gambit Energy Storage LLC is a Tesla spinoff building a mega-battery to support the ERCOT grid near Houston: http://angleton.tx.us/DocumentCenter/View/3793/Gambit-Energy-Storage-Park-FAQ?bidId=

Currently Tesla's Mega-Packs are all using the ternary cathode (3-metal) batteries used in their US-built cars, but will most likely be using cheaper-greener LFP (lithium iron phosphate- no cobalt, no nickel, no manganese) in the very near future, which are nearly half the cost of ternary batteries due to the cheaper chemistry. LFP can also cycle deeper (and for many many more cycles than) without damage than any current ternary batteries, and perform better across temperature. In EVs their only down side is somewhat lower energy & power density compared to ternary batteries, but it seems almost every week breakthroughs on that front are being made from multiple large battery vendors (almost all of them in China). LFP is also far more fire-safe than other lithium batteries.

At any energy density LFP works just fine for grid batteries, and the low cost & longer lifecycle make them something of a no-brainer move, at least for now. If CATL's Na+ ion batteries released to production late in 2021 prove to have similar longevity as LFP it will most likely have a cost advantage as well, since sodium is dirt-cheap compared to lithium. Tesla buys batteries from just about anybody who can deliver on time, in quantity, and I'm sure they are more on top of this than most of their grid-battery & EV competition.

>" I live in a 20-story high rise so a storage solution cannot be distributed."

Huh?

That's strictly a granularity issue. You don't need a very big battery to balance a 20 story residential high-rise, and it doesn't need be co-located with the building- anywhere on that side of the substation (or even AT the substation) is fine. Distributed behind-the-meter storage at the residential unit doesn't always work (though it might even in 20 story high rise if the fire issues can be worked out. A 10-20 kwh battery isn't very big), but distributed across the distribution grid or transmission grid isn't usually a problem except in very high density large cities. But even the Brooklyn-Queens substation upgrade project a handful of years ago made good use of distributed storage (after lengthy vetting and discussions of the equipment with the fire department.)

Battery COSTS have been cut by more than half since that project started, and they are continuing to build on that success with more, and even BIGGER distributed batteries:

https://www.coned.com/en/about-us/media-center/news/20201216/con-edison-174-power-global-battery-project-queens

>"That 35% number as a capacity factor is reasonable."

The offshore wind projects currently under construction in MA will have capacity factors north of 50%, and it picks up in winter, even more so at the beginning of cold snaps, improving the ability to balance the grid.

Once wind & solar capacity get's overbuilt by even a little bit managed curtailment becomes the cheapest way to balance the grid, most of the time, limiting the amount of grid storage necessary. The Rethink-X people correctly assumed that when storage is expensive it's more economically viable to just increase the over-build factor on renewables. While building excess capacity may seem expensive at last year's wind & solar pricing, the learning curves of PV & wind are still steep & relentless at utility scale. The levelized cost of PV at utility scale is already cheaper than anything else (traditional or renewables) , beginning to nose ahead of onshore wind over the past couple of years:

https://www.lazard.com/media/451905/lazards-levelized-cost-of-energy-version-150-vf.pdf

The PV learning curve isn't really slowing down, despite recent pandemic & international relations bumps in the road. The offshore wind learning curve is still pretty steep too- and may hit parity with onshore wind before 2030 (I'm not holding my breath, but maybe.)

Storage is on a roll too, and with breakthroughs on sodium battery technology the short to medium term storage may see a quantum step down in pricing.

https://www.lazard.com/media/451882/lazards-levelized-cost-of-storage-version-70-vf.pdf

And that is even without factoring in automated demand-response programs to harness the massive amounts of batteries that will be going into cars over the next decade. That's already working in Scandinavia, and will provide great service to Germany now that their car market shift towards EVs has been accelerated by the confluence of an insanely high fuel spike at the same time that the Chinese EV vendors are beginning to move in to the European markets in a much bigger way.

Dana,

Thanks for this detailed and well-researched answer. Your contributions to GBA continue to be much appreciated.

Charlie-you can’t build your way out of the storage problem. You can build 200% or 300% of what you need at peak capacity but without storage, that excess capacity is doesn’t solve the problem or make renewables alone capable of doing it all.

Dana had written much for me to read, but I believe we’re all in agreement that if long term storage technology exists, then renewables theoretically can work.

As I said, I’m all for clean energy as long as the transition from traditional generation sources is rational and 99.5% dependable.

"Charlie-you can’t build your way out of the storage problem."

That's not what I'm suggesting. I'm just pointing out that you are used data on oranges to support your conclusion about apples.

Will- If renewables are limited to 35% of total demand how did Iowa get 57% of its electricity from wind power in 2021? You also don't seem to be counting hydro as renewable. VT, SD, WA, ME all get over 80% of their electricity from renewables.

You're right 100% renewables probably is not possible with today's technology but from what I've read, here in the US 50% would be relatively easy and 80% is possible if we make the necessary grid upgrades. The remaining 20% would have to be nuclear and/or NatGas with CCS.

>"You're right 100% renewables probably is not possible with today's technology but from what I've read, here in the US 50% would be relatively easy and 80% is possible if we make the necessary grid upgrades. "

No, actually that's actually quite wrong.

Not only is 100% renewables possible (in all of the lower 48, Hawaii, American Samoa, and Puerto Rico- a bit tougher in AK) without transmission grid upgrades, it is in fact CHEAPER than business as usual, and both easier & cheaper to implement than with 20% nuke/cc-NG. The Rethink-X analysis was far from the first to point that out- there were smaller but similar analysis published even prior to 2010 showing how the PGM grid could go 100% renewables, and it would be cheaper than 80-90%. (Since then the price of battery storage has dropped by more than 90%, and PV by more than 80%, exceeding the cost-curve projections of that earlier analysis.) The Rethink-X analysis is more thorough in most respects, and studied three quite different US regions, with differing load, weather, and existing grid resource profile. Going 100% renewables (and overbuilding the renewables by 2-5x) is cheaper than keeping the existing powerplants operating, but it doesn't happen overnight, and there are political, regulatory, and other impediments to simply paying off the stranded assets of the fossil generators to negotiate if it is going to happen quickly.

A mix capable delivering 80% from renewables means that most days the fossil burners simply aren't needed, and that's an economic problem. The extremely low capacity factors on the 20% fossil burners makes their dramatically more expensive than simply adding more battery and further over-building increasingly cheaper renewables. The exact mix of wind + PV + battery that is most cost effective of course varies by region, and will evolve over time. The manufacturing cost learning curves are still quite steep on all three technologies, but while not needed, cost lowering technology breakthroughs in PV and batteries are likely come over the next decade, changing up the least-cost mix. It doesn't have to hit the lowest cost perfectly to beat business as usual.

Tiny geographically constrained Denmark is currently working through that higher cost point where roughly 25% of the grid power is from fossil fuels (~15% of the total mix is hard coal, less than 4% is natural gas) , and about 75% renewables, with roughly half of all power coming from wind, another ~20% from bioenergy (largely crop residue). About 4% is from oil, 4% from solar, under 1% from hydro. It's at a pretty dim latitude for solar, with unfavorable cloud factors to deal with as well, but as it all get's ever cheaper the lower uptake per rated watt begins to matter a lot less. With such a small fraction being from natural gas & oil, they are somewhat buffered from the current extreme price volatility, but the cost of getting rid of the remaining fossil fuel power is already affordable (and planned for), and getting cheaper every day. With ample transmission grid connectivity with Norway's dispatchable hydro resources the need for local storage is somewhat less than other countries & regions, but they can't(and don't) rely on that as the sole backup. Maintaining coal plants that almost never need to run becomes expensive, so they really will be going away.

By contrast, in nearby Netherlands (formerly a significant gas-exporting country) bit more than 20% of the total grid mix is from renewables (10% wind, 5% solar, 3% waste burning, 3% biofuel/other) , with the lion's share of generation capacity fired by gas, followed by coal, with fossil fuels combined comprising ~75% of all production. The decision to scale down production in the (beginning to be tapped out) gas fields in Groningen due to fracking triggered earthquakes quickly turned them into a gas importing country, and have significant exposure to the current gas price volatility. On the electricity front the high gas & oil prices have precipitated a sharp shift toward burning more coal and importing from neighboring countries , moderating the retail price spike, but the cost of gas for home heating has gone ballistic, which is affecting what the retail markets are doing.

For Dutch homeowner/ratepayers it's something of a financial disaster for the lower earning quartile of the population, who live in less-insulated homes, and have essentially zero capital to throw at home upgrades or home solar. But at the current now-higher electricity pricing rooftop PV (at about half the installed price compared to the US) is a no brainer even in dimly-lit NL for those with the credit or cash to buy in, paying for itself in less than one year (!), and heating with electricity (even resistance electricity) is cheaper than with gas. So while the Dutch grid is still a big fossil burner, cheap solar on the ratepayer's side of the meters is going ballistic, driving permanent demand destruction for both grid power and natural gas. The currently legislated net-metering plan for residential retail electricity in 2022 is still fully net metered at 100% of the PV output, which makes batteries somewhat less attractive right now, but beginning in 2023 that steps down by 9%, where only 91% is fully net-metered, with the remaining 9% remunerated at some wholesale price average. (IIRC it's currently 7 euro-cents, which may have to get bumped up to a higher number to reflect the change in actual wholesale prices). In 2024 and beyond it gets cut another 9% for the remainder of the decade reaching zero retail net-metering by 2032. But there are already several behind-the-meter equipment companies selling goods to balance home equipment loads to the home solar output to maximize home PV output on the homeowners side of the meter, and minimize imports & exports to the grid without resorting to a battery. Beginning in 2025 new fossil fired car sales in NL are banned, but even prior to that time EV sales are ramping quickly, and several lower cost Chinese models are coming to the country this year. Smart car chargers can pretty much slurp up ALL of the power output of a typical home-scale PV system, so the step down of the net-metering will be of no concern for many.

There are lots of moving parts, but there was already a HUGE and quite rapid shift going on which has only been accelerated by recent events. Going 100% renewables in Europe is both do-able and affordable, made even more affordable in the face of volatile fossil fuel pricing. In the US where it's both sunnier and windier than Europe getting to 100% is even easier/cheaper, but the long history of cheap domestic fossil fuel prices has kept the lid on until more recently. But with the related step up in US prices for gas & fossil liquids has made renewables (at all scales) more cost-rational now than ever before.

Thanks Dana. I read the Rethink Energy report and there’s a lot of good stuff in there to get excited about. Especially the learning curves solar/wind/batteries are on and seeing how low prices can go. I had not seen it modeled out like that with up to 7x demand capacity paired with short duration battery storage. I had always read some overbuilding would be economical but for 100% renewables we would need some sort of long duration storage system (6mo to multiple years).

I hope this is our future sooner rather than later but looking at some of the numbers it seems to me we’ll be supply constrained from this scenario for at least the near future. The 100% SWB numbers for just Texas list 2325 gigawatt-hours of battery storage and from what I can tell that’s more than 3x the current global production of lithium-ion batteries (700GWh is the number I found). Granted, the Rethink report doesn’t account for other externalities (demand side management, energy efficiency or building automation technologies, other renewnables, technological breakthroughs, etc.) and lithium-ion battery production will greatly increase. But if we’re also dealing with the battery demand for electrifying the vehicle fleet, it seems to me that 100% SWB would be something that’s 20 years or more away.

The remaining technology development we need to decarbonize the electric sector in New England is to clone Dana Dorsett many times over and hire out the clones to advise all the NE-ISO state PUCs. Replace the naysaying, "it can never work" consultants with Dana's rigorous analytical skills and we're set.

Seriously, though, the addition of 50% capacity factor offshore wind + the development of a vibrant demand response market here might make the grid operator's job easier than it is today.

Anyone ever lay eyes on monthly or seasonal power generation curve estimates for offshore in New England? That would be fun to look at, but I haven't been able to find that anywhere.

>"The remaining technology development we need to decarbonize the electric sector in New England is to clone Dana Dorsett many times over and hire out the clones to advise all the NE-ISO state PUCs."

I sure hope not! (Careful- I have several relatives who are research molecular biologists! :-) )

FWIW: In Massachusetts (within the ISO-NE grid region) the major utilities are already running state-regulated programs remunerating owners of home batteries for using their behind-the-meter assets for distributed peaking power. eg:

https://www.nationalgridus.com/MA-Home/Connected-Solutions/BatteryProgram

>"Anyone ever lay eyes on monthly or seasonal power generation curve estimates for offshore in New England? "

There used to be documents on the ISO-NE website detailing that sort of stuff buried in projections for the grid management planning. I haven't looked to see if it's still up there, but it probably is. Some older planning documents on that site from prior to 2010 presumed a way too conservative 40% capacity factor, but the state of the art (mostly hub height, but also blade design) has boosted that pretty dramatically. The intro to a MA state document from 3 years ago referred to the seasonal wintertime boost. Near the bottom of p.1 (p.7 in PDF pagination):

"Offshore wind energy generation has a greater capacity factor, approaching 50 percent on

an annual basis, than many other renewable energy generators such as solar, especially during winter

months."

That was before the release of GE's 12MW Haliade-X, which pushes the presumptive capacity factor north of 50%.

The actual contract prices of developers keep beating even the best case scenarios of the (appropriately conservative) state planners.

Getting back to the most recent levelized cost analysis from Lazard, new utility scale solar and new ON shore wind is approaching the the MARGINAL operating cost for combined cycle natural gas (cc-NG) generation, and that was at LAST YEAR's long term gas average US contract pricing (it's more expensive than that in the ISO-NE region due to pipeline & LNG storage limitations). With the international markets further driving the price of natural gas (including in the US) up, the $83/MWh projected pricing of US OFFshore wind is probably approaching parity with, if not already below the price of cc-NG power in New England. Take some time poring over the first chart in that document (including the footnotes):

https://www.lazard.com/media/451905/lazards-levelized-cost-of-energy-version-150-vf.pdf

With the current average LCOE of utility scale PV already half the average price of cc-NG power, it's easy to argue that building out PV at 2x what is actually needed and throw half of it on the floor it would still be competitive with cc-NG. The amount of storage needed would also be lower. The LCOE of PV is continuing to fall-when it's 1/4 the cost of conventional generation (which will happen prior to 2030) a 3-4x overbuild would be economically rational. There are similar (if not quite as steep) learning curves happening with wind, which if over-built by 2x could cover most of the diurnal shortcomings of PV before storage is needed. And as more of this near-zero marginal cost energy goes on to the grid, the capacity factors of the fossil burners drop, making them even more expensive. Investors in those assets can not and should not assume that just because cc-NG plants operated at a 45% capacity factor in 2021 that it would still be operating at that level in 5 years. A shortcoming of using Lazard's (and others') LCOE of fossil burners & nukes is a presumptive fixed capacity factor that simply will NOT be sustained over the lifecycle of the asset.

These facts are the fundamental underpinnings to the Rethink X analysis, along with the question of what use can and will be made of the excess, essentially free power that comes with overbuilding renewables & storage in order to meet worst case weather scenarios. Just because it's still cost effective against conventional power even when that power is simply curtailed doesn't mean that that "super power" MUST (or will) be wasted.

These are truly disruptive times in the electric power & transport biz. Most people won't see it until the first wave of the tsunami has hit, but it's really here, right now. Prepare for a bumpy ride (including retail utility price volatility) over then next decade.

Europe will survive foregoing Russian fossil fuels, but it will be very rough in the short term. Residential retail utility pricing in the Netherlands was already being screwed up by the structure of their retail energy markets allowing some dubious practices by energy brokers to happen, but the war related stuff is more than just icing on that cake. As noted earlier, it's now cheaper for those with the cash or credit to just buy more PV, with or without a battery. Indeed the Ketel Klets (= "Boiler Bang" in 'merican) YouTuber nerd has no battery on his home system, no heat pump, yet by obsessively monitoring & balancing his PV output with his loads, along with fine-tuning the efficiency of his gas boiler/radiator system pays very little to the utilities. Meanwhile many/most people have been stuck with € 1000+ /month energy bills this winter. This short video requires more than a passing familiarity with Dutch language, but is a pretty good arm-waving primer of how far he's able to push it:

https://www.youtube.com/watch?v=DTwR-osTdUM

I just wanted to leave a comment showing my appreciation for Dana in regards to the thought put into his posts. Thank you.

Log in or create an account to post a comment.

Sign up Log in