Image Credit: Spencer Cooper / CC BY-ND 2.0 / Flickr

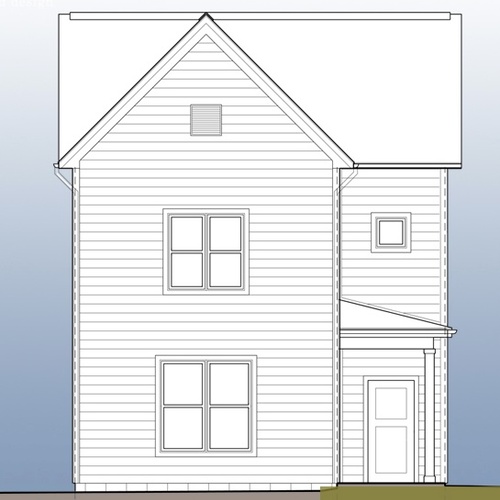

Image Credit: Spencer Cooper / CC BY-ND 2.0 / Flickr This is a screenshot of the company's online brochure. Blueprint Robotics promises high-quality building components at a "price where it's compelling to your business."

Fast, precise and uncomplaining, industrial robots revolutionized the automotive industry with production lines that rarely needed a break and mechanical employees who never filed an insurance claim. Now, a group of Baltimore-based entrepreneurs is betting the same approach can work wonders for the U.S. housing market.

Operating in a 200,000-square-foot factory in Baltimore, Blueprint Robotics has developed a process for building panelized building components — nearly complete wall, roof, and floor sections — with sophisticated machines that cut parts precisely and take the drudgery and errors, out of assembly. The company promises high quality and low prices and a finished product that will beat what conventional building techniques can produce.

Factories that make modular and panelized homes have long used production lines where workers build components indoors on giant assembly tables. The industry says the absence of weather delays, protection of building materials from the elements, and standardized techniques all are advantages over site-built construction. But Blueprint takes the process a step further, and it may be the only such facility in the U.S. using robotic equipment to build houses.

“There’s an old saying in building: Price, schedule, quality — pick any two,” Blueprint CEO Jerry Smalley says in a company video. “At Blueprint Robotics, we figured out how to let you have all three.”

The fledgling business was described in a recent article posted at Bloomberg. A person answering the phone at Blueprint said that the company isn’t actively seeking publicity, at least not beyond its cooperation with Bloomberg reporters. As a result, many details about the company and its operations are unknown. Still, there’s enough information at the company’s website to get a rough idea of how the company says the process will work. (A video in which Smalley discusses the company is featured below.)

Three separate production lines

The company’s message seems to be geared toward builders, not the general public. Blueprint invites developers or builders to submit floor plans, elevations, or completed construction documents, and says that it will respond with a “preliminary price” within days. Following a review, Blueprint provides a firm price and a set of drawings, with delivery based on the completion of the foundation by the builder.

Once the contract is signed, the building goes into production. Blueprint has divided the process into three production lines: one for walls, one for the roof, and a third for the floor. Wall construction revolves around a German-made machine called a WBS-160 beam center, which cuts top and bottom plates, and drills holes for plumbing, venting, and electrical rough-ins. The framing station, which is next, can produce 40 linear feet of wall in about 11 minutes, with robotically driven nails placed so precisely nary a one will miss a stud, according to the company.

OSB and drywall layers, wall openings for windows and doors, outlets, and switches are added robotically, although actual electricians are standing by to add fixtures, outlets, and switches.

The company offers several insulation options, including denim, rockwool, fiberglass and dense-packed cellulose. Robots also apply Huber’s Zip-R insulated sheathing. The part of the process that requires the most people is drywalling; tradespeople do the work.

Floors and roof sections — completed on separate production lines — are made in much the same way. Blueprint uses open-web floor trusses for most applications (and guarantees that floor deflection will be no more than 1/720), but can use I-joists or dimensional lumber if the customer prefers. Roof sections get Huber’s Zip sheathing.

When walls are complete, they are shrink-wrapped and set aside for shipment. A finished package — what Blueprint calls a “custom-built closed wall frame” — include doors and windows, rough-ins for mechanicals, electrical, plumbing, and fire protection, interior doors, sheathing, and insulation. Parts go out on standard tractor trailers, with no special over-the-road permits required.

Once on site, assembly is speedy

Like other panelized or modular buildings, Blueprint’s structures can be assembled rapidly. The company sends its own employees, with a Blueprint crane and fork lift, tenting to be used in case of poor weather, and scaffolding. A 4,000-square-foot house will be “assembled and fully watertight in no more than a two-day period,” the company says, with the rest of Blueprint’s work wrapped up in the following three or four days.

When the company leaves the site, the drywall will be ready to paint. The builder who ordered the house will have to take care of siding and roofing, connect the wiring to the meter, and take care of sewer and water hookups.

“Our terms are net 30 days, so you don’t need to make a deposit when placing an order with us,” the company says. “You will have a line item draw on your conventional construction loan. Our work is inspected by your construction lender.”

The price, the company adds, will be attractive to builders used to building on site: “Most importantly,” Smalley says in his video, “we’ve got the price down to a point where it’s compelling to your business.” Blueprint’s website says that means “faster and less expensively than you do it today — and do it with the best materials and the highest level of quality.”

Other factories, such as Ecocor in Maine and Phoenix Haus, headquartered in Detroit, produce panelized house components with Swedish-made Randek equipment, including computer driven saws and folding assembly tables that can flip wall sections over hydraulically. Unity Homes, a New Hampshire company, uses automated cutting equipment and computer generated plans to enhance precision. This kind of production is common in parts of Europe, but not the U.S. Ecocor, Phoenix and Unity can produce panelized components that are able to meet the Passive House standard or operate at net-zero energy efficiency — well insulated and essentially airtight. Whether Blueprint is capable, or interested, in that level of construction is one of many unanswered questions about the company.

Flying under the radar

Gary Fleisher, who blogs about the modular housing industry at Modular Home Builder, first wrote about Blueprint Robotics in a December 2015 post. He said Blueprint had international backing, mainly from Germany, and compared European interest in the U.S. housing market to Japanese interest in the auto market decades earlier.

Asked whether Blueprint had turned out a single house here, Fleisher said by telephone he didn’t know.

“My understanding is that the investors and developers who put money into it, and again I don’t have 100% knowledge of this, but I’ve been told they’re mostly European investing companies that have similar plants in Europe, and they opened up this plant to feed their own developments. So, apparently they have developments [in the U.S.] where this kind of product will work very well.”

Fleisher said he knows of no other manufacturer in the country using the kind of robotic equipment that Blueprint says it has on its production line, and suggested the company was skirting publicity not because it was secretive but because it was leery of creating unrealistic expectations.

“They are afraid if they don’t succeed right out of the gate that people will be suspect of them,” he said.

That was the case with a California company, Blu Homes, Fleisher said, which started big but eventually withdrew to a smaller market in the northern part of the state.

Can robots solve a labor crunch?

With the collapse of the housing industry in 2008, many construction workers fled to other industries. Construction has since rebounded, but not enough of those workers have come back to fill the growing number of jobs, and younger people are not entering the trades in enough numbers to meet demand. Just 3% of adults from 18 to 25 years old picked construction trades as a career goal, according to a recent survey from the National Association of Home Builders (NAHB).

That’s an issue weighing heavily on the minds of many builders. A NAHB survey published in January said that 82% of the builders it polled thought that the cost and/or availability of labor would be a significant problem this year. That’s more than any other single issue. (Fine Homebuilding magazine is addressing this problem with its Keep Craft Live effort.)

Bloomberg’s report suggests that companies like Blueprint Robotics might help solve that problem by creating openings for less skilled workers while filling some of the production gap caused by a labor shortage. People can be taught how to run house-building robots much faster than they can learn how to build houses by hand.

The report begins, for example, by introducing Cyndicy Yarborough, described as a 26-year-old former Wal-Mart clerk with no training or background in construction. She now works on the Blueprint production line, loading wall and floor sections onto a truck for shipment. The single mother, who has been working there for about a year, took a course in CNC production before joining the company and has no interest in learning about traditional construction. Rather, she’d like to be part of the team that creates design maps used by robots, Bloomberg said.

The industry has been slow to change

Would house-building robots really help ease a labor crunch?

“Absolutely!” Tom Hardiman, executive director of the Modular Home Builders Association, said in an email. “Modular factory workers have much more predictable schedules, can work during cold weather months, and work in a much safer environment. As a result, manufacturers generally have a very seasoned, experienced, and stable workforce. With a higher degree of technology and automation, this method of construction opens the doors to younger workers, women, and even disabled people.”

One problem is volume; it would take a lot more than a handful of robotically operated house-parts factories to make a dent in the problem. Although most modular manufacturers have adopted at least some automation and assembly line techniques, Hardiman said, Blueprint Robotics is “clearly on the leading edge” as the industry struggles to modernize itself.

“The construction industry as a whole is one of the last industry holdouts in terms of automation and innovation,” he said. “Every other major industry has automated to a much greater extent. Construction industry productivity has remained relatively flat for the last 50 years while other industries have seen productivity and efficiency gains. The homebuilding industry is also very fragmented and made up of many small contractors who are very reluctant to changes. The U.S lags behind the U.K., Australia, and even China in terms of construction innovation and automation. Right now, 20-, 30-, and 40-story modular buildings are being erected in these countries.”

Modular housing now represents about 3% of all housing starts, Hardiman says, although it is as high as 8% in some regions. (This does not include panelized houses.)

Fleisher says that modular housing is fairly strong in some parts of the country — notably, New England and the Northeast — while almost entirely absent in areas like the Southwest. “It’s not even a flea on a dog’s back out there,” he said.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

2 Comments

no response

Maybe I'm not asking the right questions, but I've submitted plans to Ecocor and Blueprint Robotics and have never heard back from either of them. Unity charges so much for an estimate that I feel like I'd be tied to them before being able to make an informed decision.

Viable, beautiful?

Many of these types of things seem to have great promise, but how many have actually launched into full production? They seem long on promise and low on delivery, fizzling out... Not unlike the long, long wait for true, viable, replacement EVs and PVs. We are finally getting there in those areas, but still have a long way to go. Automated home creation to high standards seems well behind on a similar curve, making it appear that we still have decades to go before we see meaningful market penetration.

One thing I don't think I've seen yet, though, is the Tesla approach: as with the Roadster, Model S and X, prove that a Passivehaus or Net-Zero home can be "traditionally beautiful" at similar price points, and then move along as rapidly as possible to bring that to scale and affordability.

One of the things I mean here is that many of these new designs (see the companies above) are very simple or urban-modern. Now, there is a market for that, I know. But the much larger market is for homes with more traditionally-beautiful architecture.

Yes, complex perimeters and rooflines and architectural details are bugbears to efficiency-driven building designers, but that's what people want.

Joe Lstiburek had a saying to the effect of, "if it's not beautiful, nobody will want it, and it won't be kept around, so there's no point to it."

In college, I was fascinated by geodesic dome homes because they seemed to promise more efficiency in various ways. I was too young to understand many of the downsides and especially the aesthetic failure of such homes.

Building plain boxes to get a green building may be good for niche markets and demonstrations. But we need to move beyond that to more traditionally or classically beautiful architecture if we want all this to take off.

I don't want to live in and among cities or subdivisions comprised of vast tracts of plain monopoly box houses, uglier than the original cookie-cutter suburban sprawl tracts. Yuck.

Log in or create an account to post a comment.

Sign up Log in