Image Credit: Energy Star

One of the good things about recently proposed legislation that would tie federal tax credits on the purchase price of windows to Energy Star criteria is that the legislation makes ecological and economic sense.

The new bill, proposed by Senators Jay Rockefeller and Chuck Grassley, would modify a provision that, since it took effect on June 1, has offered consumers a tax credit of 30%, up to $1,500, on the purchase price of windows that have a solar-heat-gain coefficient (SHGC) of 0.30 or less and a U-factor of 0.30 or less. It’s called the “30-30” standard and it’s relatively simple to apply. The problem is it doesn’t offer consumers who live in cold climates the flexibility they need to achieve maximum energy efficiency – through wintertime solar heat gain – from their purchase.

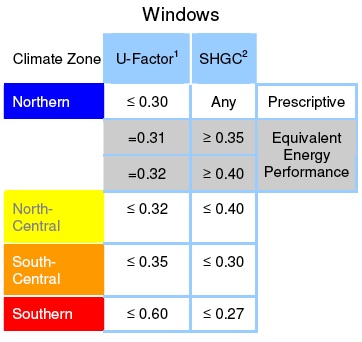

Rockefeller and Grassley, to their credit, want to peg the tax credit to Energy Star requirements that are scheduled to take effect January 4, 2010. The positive, logical thing about these new Energy Star criteria is that they are climate-specific, with, for example, a SHGC “equivalent energy performance” requirement for the northern climate zone of at least 0.35 and corresponding U-factor equivalent of 0.31; for a SHGC performance equivalent of at least 0.40, however, the corresponding U-factor equivalent is 0.32 for that climate zone.

For southern climates, meanwhile, the U-factor maximum is 0.60 and the SHGC is 0.27. Separate criteria also are established for window performance in “north-central” and “south-central” climate zones.

Trade-group backing

Last week, the Window and Door Manufacturers Association weighed in on the issue with a press release that commended the senators while it criticized the 30-30 standard.

“The one-size-fits-all approach of the current tax credit fails to recognize that different regions of the country require different standards to achieve improved energy efficiency depending on climate. A window, door or skylight designed to protect from the cold winters of the north is not ideal to face the heat of a southern summer,” said WDMA Executive Vice President Michael O’Brien. “Established Energy Star standards, widely recognized by consumers, builders and retailers, recognize these differences and have different requirements for four different regions.”

One small irony here is that the tax credit was tied to Energy Star’s regionally based criteria before the 30-30 standard took effect on June 1. The Rockefeller-Grassley bill simply brings Energy Star back into the equation, albeit in the updated form set to roll out on January 4.

The availability catch

Another irony is that obtaining high-solar-gain windows can be a challenge in the U.S., even in northern markets. As GBA’s Martin Holladay pointed out in a GBA post on July 31, many window manufacturers in the U.S. have emphasized low-solar-gain glazing in both their product lineups and marketing, an approach that simplifies things for distributors and salespeople but can confound customers who want to make the most of window installations in cold climates.

Martin cited the tribulations of Scott Pigg, a senior project manager at the Energy Center of Wisconsin who had done an analysis using RESFEN, a software program developed by Lawrence Berkeley National Laboratory to measure the performance of prospective window installations in specific settings. Pigg intended to use the analysis for guidance in selecting windows for his own home, but was flummoxed in his attempt to buy windows, from Marvin Windows and Doors, with a hard-coat low-e glazing option that would increase their SHGC.

“I asked my contractor, and my contractor had no idea what I wanted,” Pigg told GBA. “Then he came back to me and said it would take three extra weeks. Then he said it couldn’t be done. I didn’t believe it, so I called Marvin directly. They said it was possible. Then my contractor said it would cost an extra $200 per window. I asked Marvin about that, and they wouldn’t give me any pricing information.”

Pigg finally gave up and bought low-solar-gain glazing. Perhaps, if the Rockefeller-Grassley bill passes, the return to Energy Star standards will encourage manufacturers in the U.S. to make high-solar-gain glazing more readily available, and make experiences like Pigg’s a thing of the past.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

2 Comments

Tying Window Tax Credits to Energy Star

The bill is a good idea as you quoted “The one-size-fits-all approach of the current tax credit fails to recognize that different regions of the country require different standards to achieve improved energy efficiency depending on climate." however your chart does not follow IECC climate zone boundaries. The country is divided up into 8 zones with differeing U and SHGC values. I hope the implementation recognizes the IECC climate zones and values not set different standards. If you think consumers and builders are confused now. Wait!

Window Manufacturers Need To Be Brought On Board

I wholly agree with the intent of Sen's. Rockefeller and Grassley's bill. Energy star, and building science professionals recognize the benefit of solar heat gain in colder climates, and it baffled me when the .30/.30 ruling was released by the IRS. Where was the expert input on this issue?

I am equally surprised that the WDMA has come out in favor of this new bill. Although I applaud this, I expect that national manufacturers will be slow to embrace an increased list of glazing offerings to the mass market. Some education in the marketplace will need to take place on top of inputs for solar orientation and climate zone, as a minimum, into their quoting tools to help in glazing selection.

Log in or create an account to post a comment.

Sign up Log in