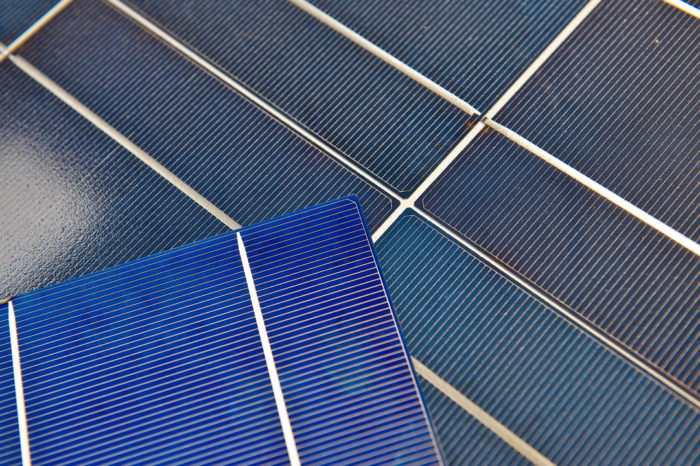

Image Credit: University of Salford Press via Flickr

By MAGGIE PARKHURST and JOEL BINSTOCK

The Suniva trade dispute began when America’s biggest PV panel manufacturer, Suniva, filed an ill-advised petition with the U.S. International Trade Commission (ITC) on Wednesday, April 26, 2017.

The petition was filed under Section 201 of the Trade Act seeking complete relief from “dumping” (when a company sells products artificially below market rates to gain market share and drive away competitors) of foreign manufactured crystalline silicon photovoltaic (CSPV) cell-based solar panels. According to the Solar Energy Industries Association (SEIA), the petition could more than double the cost of solar installations and put more than 88,000 U.S. jobs at risk.

The Suniva trade dispute could have an ever-expanding impact on the entire solar industry. Suniva’s argument is essentially that competing solar-panel production companies overseas, especially in China, are able to take advantage of government subsidies, allowing them to produce artificially cheap panels. They can then flood the American market with these panels at a rate far below competing American firms, making it hard for American firms to compete and stay in business.

Obviously, artificial trade imbalances are in no one’s favor: the subsequent market consolidation occurring as local firms fold and fall out of the marketplace can lead to later monopolistic or oligopolistic pricing tendencies by the “winners” after the market has been cornered.

However, this argument ignores important realities in the American solar panel industry: it’s just not that big. The largest solar industry in America is actually in service, installation, and maintenance, which formed itself based on the realities of cheap overseas material costs alongside the relatively high skill and safety requirements for solar installation and maintenance. Thus, an increase in pricing for solar panels will drive up the price of solar installation jobs, in turn reducing demand for solar projects and eventually reducing overall demand for solar service and maintenance.

Tariffs would double solar costs

Suniva requested that there be a tariff of $0.40/watt on imported modules and a floor price on all modules of $0.78/watt. The ITC ruled 4-0 in finding cause for severe injury to both Suniva and Solarworld. If the ITC’s recommendations to the U.S. president include establishing import tariffs, the solar module costs would effectively double, setting the solar industry back years. Not only would it increase costs for installation and sales jobs, inevitably slowing the market, but it also would affect secondary jobs supporting the industry (asset management, racking manufactures, etc.).

In fact, SEIA predicts loss of solar jobs in all market segments due to the theoretically devastating impacts of the trade dispute. In their models, the utility-scale job market would shrink by 60%, while commercial and residential employment would fall by 46% and 44% respectively.

SolarWorld joined Suniva in the trade case and claims that SEIA is exaggerating the impacts instead of doing a thorough analysis. The company states that cheap imported solar panels have been affecting American manufacturers for decades.

SEIA believes that the imposition of price floors and tariffs for imported CSPV cells and modules would hamper the entire solar industry’s growth by vastly increasing up-front project costs. As one of the cheapest energy sources in the U.S., solar is a major economic force of the country, bringing billions of dollars in investment every year.

However, this incredible growth will sputter if the ITC sides with Suniva and SolarWorld and recommends to the president a vast increase in the market rates for solar panels by instituting protective tariffs.

Consequently, a Section 201 action would create an economic loss for the vast majority of the solar industry for the small benefit of reinvigorating the small set of domestic solar manufacturing firms. Past examples of Section 201 cases in other industries like lamb meat, pipeline, and gluten have shown that the protective measures established did not always restore the industries to sustained competitiveness, as oftentimes foreign competitors enjoy other advantages besides direct government support for an industry, including cheaper labor and material costs, and less overhead due to less-stringent safety and regulatory standards. Needless to say, establishing protective floor-prices and import tariffs are not effective solutions to this proposed domestic manufacturing issue.

There are other options

In fact, there are many other alternatives to tariffs to support real investment in domestic solar manufacturing without sacrificing the strategic market, such as:

- Support domestic panel manufacturing with a tiered investment tax credit.

- Expand federal targets for renewable energy procurement.

- Provide loan support or subsidize the solar supply chain.

- Encourage competitive advantages in materials quality and efficiency to differentiate domestic market from foreign markets.

- Integrate manufacturing firms and installation/service firms to provide internal cost-reductions.

- Provide assistance for technology and workforce development.

GreenTechMedia (GTM) has estimated that the trade dispute could enormously reduce new solar projects by almost two-thirds or slash them by a total of about 47 GW by 2022. This is more solar capacity than what has been manufactured in the U.S in aggregate.

SEIA has already begun a ‘Save America’s Solar Jobs’ campaign. It has been active on multiple platforms to beat this case, including directly lobbying members of Congress and other policymakers, engaging in several legal proceedings with the ITC, conducting research to analyze and determine potential impacts, building a wide network of partners, and raising awareness among people for fair and free trade policies.

Sustainable Capital Finance (SCF) does not support the Suniva petition as over 250,000 workers are serving America’s solar industry currently, and any misguided trade protections for the solar manufacturing industry would threaten the continued health of the booming solar service industry and would be against the larger interests of the solar market and the United States as a whole.

SCF plans to tackle the upcoming challenge head on. We are exploring alternative financing options that will help more projects receive financing even as the costs increase. We are also working with developers and EPCs to help them procure panels in anticipation of potential import tariffs. The best strategy we recommend for our partners is to diversify your module expertise and supply so that you can work with what the market has to offer. With looming uncertainty hovering over the industry in several months, we can say that now is the time to get projects developed and installed.

Maggie Parkhurst is marketing coordinator for Sustainable Capital Finance, which provides financing for solar projects for nonprofits, corporations, municipalities and schools. Joel Binstock is a project analyst at SCF. This post originally appeared at The Energy Collective.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

One Comment

Not an anti-dumping case

This article is incorrect. The ITC petition is not an anti-dumping claim. Under section 201, a claimant merely needs to prove that is is harmed by lower prices imports. So, even if the imports are cheaper because the foreign maker is simply more efficient, or is large enough to benefit from economies of scale, the claim is still valid.

China is already subject to tariffs on solar panels. The ITC decision would impose tariffs generally, including on Canadian and Mexican panels.

I suspect that if Trump imposes tarrifs, we'll see a WTO case.

Log in or create an account to post a comment.

Sign up Log in