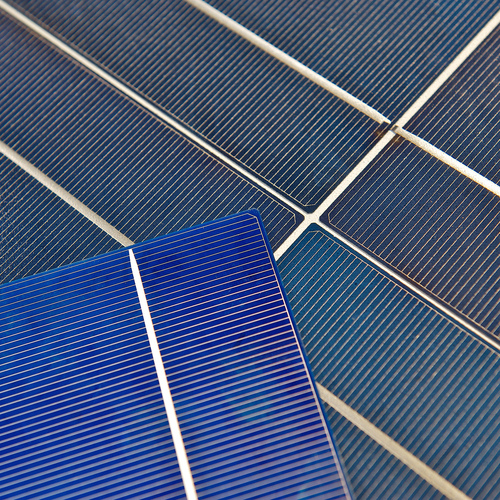

Image Credit: Jon Callas / CC BY 2.0 / Flickr

Cheap Chinese solar cells have powered a boom in the U.S. solar industry. They have helped drive down the cost of making electricity from sunlight by about 70% since 2010, leading to double-digit growth rates in rooftop and utility-scale installations, according to the industry. Last year, for the first time, solar added more generating capacity to the electricity grid than any other fuel, including natural gas. That’s welcome news to those who worry about climate change.

Now, though, the solar boom may be in jeopardy. The U.S. International Trade Commission, an independent federal agency, has begun an investigation that could lead to sweeping trade protections against the imports that would raise the costs of solar power and could bring a halt to solar’s rapid U.S. growth.

If the trade commission finds that imports caused serious harm to U.S. solar manufacturers, it will recommend trade remedies, which could potentially include tariffs on all imported solar products. President Donald Trump, a champion of U.S. manufacturing, would get the final word on any action — a prospect that has the solar industry in a tizzy.

The prospect of global tariffs “poses an existential threat to the broad solar industry and its 260,000 American jobs,” says Abigail Ross Hopper, the chief executive of the Solar Electric Industries Association, the industry’s largest trade organization. Most solar jobs in the United States are in sales and installation, not manufacturing, but tariffs could drive up the cost of solar and make it less competitive.

An Atlanta manufacturer cries foul

The trade investigation began in response to a petition filed by Suniva, a bankrupt manufacturer of solar cells and panels based in suburban Atlanta, with factories in Georgia and Michigan. Suniva, the second largest U.S. solar panel maker by volume, has been joined in the case by SolarWorld Americas, the largest U.S. solar panel manufacturer, which has a factory in Oregon.

U.S. solar manufacturers “simply cannot survive” in a market where foreign imports “have unexpectedly exploded and prices have collapsed,” Suniva said in its petition. SolarWorld Americas said it decided to join with Suniva because “massive overproduction” of Chinese solar cells and panels has “led to the near-destruction of remaining solar producers in America.”

The domestic solar firms have asked the Trump administration to impose steep tariffs on all imported solar cells, which are the devices inside solar panels that convert sunlight into electricity, and to set a floor price on solar panels containing imports. Those measures would roughly double the cost of imported panels, analysts say.

Some industry analysts say higher costs for solar will slow the industry’s growth. According to a report from analyst IHS Markit, demand for U.S. solar photovoltaics could be reduced by 60 percent over the next three years if the trade commission grants Suniva’s petition.

Hugh Bromley, an industry analyst with Bloomberg New Energy Finance, said in a note to clients that Suniva’s accusations are “riddled with holes and hypocrisies.” Still, he adds, “Those may not matter if the case makes its way to President Trump’s desk.”

As a candidate and as president, Trump has vowed to enforce U.S. trade laws as a way to strengthen the nation’s manufacturing base. Slapping tariffs on imported solar panels would benefit not only domestic solar manufacturers but traditional energy producers, including the coal industry, that compete with solar.

A complex case of tangled loyalties

The International Trade Commission (ITC) has already made one statement about the Suniva petition — that, within the meaning of trade law, it is “extraordinarily complicated.” About that, no one disagrees. For starters, Suniva is majority-owned by Shunfeng International Clean Energy, a Chinese company that opposes Suniva’s petition, and SolarWorld Americas is a subsidiary of an insolvent German firm. Yet both are taking a stance against imports into the U.S.

How can that be? In Suniva’s case, the petition is being driven by SQN Capital Management, a New York-based asset manager that made $51 million in loans to Suniva and spent another $4 million on legal fees. In a letter to the China Chamber of Commerce for Import & Export of Machinery & Electronic Products, SQN offered to drop the petition if a buyer could be found for Suniva’s manufacturing equipment, which SQN says is worth $55 million. The Chinese declined to make a deal, and the issue became moot when SolarWorld Americas entered the case and the ITC decided to investigate.

This isn’t the first time that U.S. solar manufacturers have sought trade sanctions. In 2012, the Obama administration imposed modest tariffs on Chinese imports after finding that the Chinese government provided illegal export subsidies to its manufacturers. Two years later, it extended the tariffs to Taiwan. Those moves were prompted by cases brought by SolarWorld Americas.

Nevertheless, solar imports to the U.S. continued to surge — from $5.1 billion in 2012 to $8.3 billion in 2016, according to Suniva — as Chinese companies built factories in Thailand, Vietnam, and Malaysia, which were unaffected by the tariffs. Last year, the U.S. imported $520 million in panels from Thailand, up from almost nothing in 2012, and another $514 million from Vietnam, up from less than $1 million in 2012, according to Suniva.

The goal is global tariffs

That’s why Suniva now wants tariffs imposed globally. “Without global relief, the domestic industry will be playing ‘whack-a-mole’ against [solar cells] and modules from particular countries,” says Matthew McConkey, a lawyer for Suniva, in the petition to the ITC.

Trade experts agree that China has subsidized its giant solar manufacturers. Beijing and provincial governments provided free or low-cost loans; artificially cheap raw materials, components, and land; support for research and development; and a demand that was artificially driven by domestic regulation, according to Usha C.V. Haley and George Haley, wife-and-husband authors of a 2013 book, Subsidies to Chinese Industry: State Capitalism, Business Strategy and Trade Policy.

“Production in China is still heavily subsidized,” says Usha Haley, a professor of management at West Virginia University. “There is little doubt in my mind that it is going to become a monopoly producer — and then, of course, they will raise prices.”

What’s more, a solar industry dominated by a handful of Chinese companies will have little incentive to innovate, argues Stephen Ezell, a vice president at the Information Technology & Innovation Foundation, a Washington think tank. The U.S. industry, which invented solar photovoltaics and still leads the world in solar patents, simply will not have the resources it needs to invest in research.

“These industries are fundamentally about generating the next-generation product,” Ezell says. “We’re getting locked into a lower level of technological development.” In the long run, that would make it more difficult for the global solar industry to dislodge its fossil-fuel competitors.

Incentives for U.S. firms

Still, U.S. firms that complain about subsidies run the risk of being called hypocrites. Suniva, for instance, enjoyed state tax incentives for its Michigan plant, and “many other U.S. solar manufacturers have received tax, grant, and loan guarantee incentives,” says analyst Hugh Bromley. SolarCity, a unit of Tesla, is building a $900 million factory in Buffalo, New York, to make solar panels, with major subsidies.

Other solar manufacturers headquartered in the U.S., including SunPower and First Solar, have located a majority of their manufacturing offshore and so would be affected by any tariffs. In fact, SunPower has joined with the Solar Electric Industries Association to oppose the tariffs. SunPower, First Solar, and SolarCity all declined to comment on the trade issue.

Some analysts believe that the industry will be able to adjust to the tariffs. Setting a floor price for panels will lead developers to choose higher-efficiency, higher-cost panels that will enable other price reductions along the supply chain, says Roberto Rodriguez Labastida, an analyst with Navigant Research. “There will be some shake-ups and adjustments,” he says, but nothing like the meltdown being forecast by some.

The ITC will decide in September whether U.S. manufacturers have been injured. Shara Aranoff, a former chair of the commission who is now a corporate lawyer, says the nonpartisan ITC commissioners will be guided by the law and the facts. “It is one of the most independent agencies in the federal government,” she said.

If the commission finds harm, the issue moves into the political arena. Already, Daniel Kildee, a Democratic congressman from Michigan, and Rob Woodall, a Republican congressman from Georgia, have called for trade remedies. The solar industry is arguing that tariffs will kill many more jobs than they will save, and that there are better ways to protect U.S. manufacturing.

In making any decision, the Trump administration would be free to take anything into account — jobs, the impact of higher solar prices on consumers, and, at least in theory, the environment. Few would expect the environment to be high on the administration’s priority list here. But what will the president do? As with so many issues in Washington these days, that’s anybody’s guess.

This post originally appeared at Yale Environment 360 and is republished here with permission. Marc Gunther writes about foundations, nonprofits and global development on his blog, Nonprofit Chronicles.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

One Comment

Let the chinese gov't continue with their subsidies

because it only hurts them in the long run. Tariffs hurt the consumer at the expense of the favored industry. This is where the name crony capitalism comes from.

Log in or create an account to post a comment.

Sign up Log in