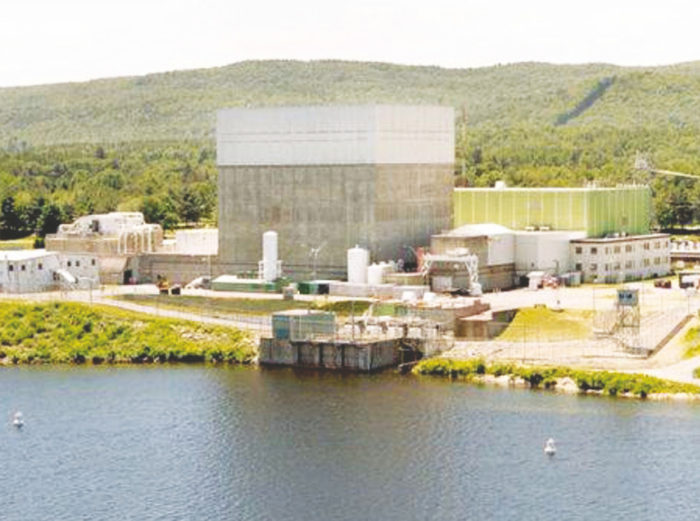

Image Credit: U.S. Nuclear Regulatory Commission

The big energy news in my part of the world this past week has been the pending closure of Vermont’s only nuclear power plant, Vermont Yankee, in Vernon, about six miles south of Brattleboro. The closure is scheduled for the fourth quarter of 2014, at the end of the current fuel cycle.

For a lot of my friends, this was news that they had been hoping for for many years and a cause for celebration. I share with these individuals concerns about nuclear power, especially a fear that nuclear power plants could be targets for terrorist actions. So I feel some relief that after another year or so there won’t be new radioactive material generated ten miles from my house (though I’m well aware that the high-level radioactive waste that’s stored on-site could remain there for decades).

But for me it’s a more complicated issue.

Nuclear power plant workers have high salaries

Our economy in Windham County, and especially the Brattleboro area, benefits significantly from Vermont Yankee (VY). The plant directly employs over 600 people in the tri-state area, with an annual payroll of $66 million and an average wage of slightly over $100,000. This represents 5% of Windham County’s total payroll.

And there are many cascading benefits of the plant to the region’s economy. According to the Brattleboro Development Credit Corporation (BDCC), in addition to VY’s employees an estimated 400 positions in the region are supported indirectly by the plant: local motels, restaurant workers, retail sales positions, etc. And Entergy Vermont Yankee and its employees give a lot to local nonprofit organizations, including United Way of Windham County — where VY is the largest contributor.

Our economy will suffer from the plant’s closure; there’s no getting around that.

Seeking that silver lining

But the closure also offers opportunities. It could be a rallying point for a new, greener focus on regional economic development. Indeed, for the past several months I’ve been part of an initiative of BDCC and Southeastern Vermont Economic Development Strategies (SeVEDS) to identify and strengthen an emerging “green products and services industry cluster” for southeastern Vermont.

We held a meeting in June with about a dozen business owners and leaders in the green building and energy efficiency sectors to discuss how to derive long-term, sustainable, economic growth in this area — including both manufacturing and service-sector jobs — and there will be a follow-up meeting next week.

The 2014 closure of the plant could provide key momentum toward sustainable economic development in the region. It could also stimulate renewed discussion about the broader issues of power generation and centralized vs. distributed power production.

Natural gas has gotten cheap

VY is closing largely because of the low cost of natural gas, which has become the preferred energy source for utility companies. As I’ve written in a previous column, the same fate is befalling some of the nation’s dirtiest coal-fired power plants — and that’s a good thing.

In the short term, the low cost of natural gas may hurt renewables, because utility companies are choosing to build new natural gas plants rather than invest in distributed renewables. But once the price of natural gas goes back up — as I believe it will once demand catches up with supply within the next decade — utilities will find that investing in solar, wind, and other renewable energy systems is less expensive than building new coal or nuclear plants. At least that’s my hope.

What to do with the old VY plant

Meanwhile, the discussion about decommissioning the Vermont Yankee power plant in Vernon is ramping up. At one end of the spectrum is the prospect of SAFSTOR (essentially putting the plant into a long-term holding pattern — up to sixty years — before dismantling it and restoring the site).

I’d much rather see decommissioning begin as soon as possible, so that we can look into how that site could be reused. Unlike some, I’m not optimistic about replacing Vermont Yankee with some sort of renewable power plant, such as a wood-chip-fired power plant that would take advantage of the power distribution lines extending to the plant. Such power plants, I believe, should only be built in locations where the waste heat can be captured and productively used.

Such co-generation or combined heat and power (CHP) systems, in which the waste heat from thermoelectric power plants is recovered, are where we as a nation need to be going with centralized power generation. It is ludicrous that we throw away two-thirds of the primary energy as thermal pollution with conventional power generation. But it would be hard to build a CHP plant in Vernon, much as I’d like to see that happen, because of the distance hot water would have to be piped to buildings and industrial facilities where it could be used.

This doesn’t mean that we shouldn’t decommission and clean up the VY site as soon as possible, however. That should be our priority, which will also provide a several-year spurt of economic activity in the region. That could help us in the longer-term transition to sustainable economic health built on the energy efficiency and green building sector.

Alex is founder of BuildingGreen, Inc. and executive editor of Environmental Building News. In 2012 he founded the Resilient Design Institute. To keep up with Alex’s latest articles and musings, you can sign up for his Twitter feed.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

4 Comments

The effect of cheap gas on renewables isn't very severe at all.

Though the spot price of natural gas is at near record lows, utilities can only get financing new gas-fired generation based on the long-term contract price (which in fact they're paying.) The New England gas grid is limited, and would require large and expensive infrastructure expansion to take much more than the current ~50 grid-share from gas fired plants on the ISO-New England grid. There is also a built-in presumption to their financial models that at some point during the lifecycle of the powerplant carbon emissions will carry a cost- expanding gas fired generation in VT is WAY more expensive than it looks if you're only considering the spot-market price for natural gas.

The lifecycle per kwh cost of wind & PV is primarily in the upfront cost and financing, and known with some precision before the ink on the contract is dry, whereas there is higher long term risk with gas power generation. While the production tax credit subsidies and SREC markets have kick started these industries, the levelized cost per Twh of utility scale wind is already at a price point (and falling) that is competitive with combined cycle gas at the contract price for the fuel, and rational grid operators making long term investment decisions can do the math. At the same time, residential scale PV at $4/watt has a levelized cost below the residential retail price for markets like New England or California, but unlike utilities, homeowners DON'T do math. (See: http://blog.rmi.org/blog_2013_08_21_want_solar_on_my_roof_pay_me_for_it )

But in states where both net-metering and third party ownership of residential rooftop PV is allowed (not Georgia, but most other states), third-party companies who CAN do the math (SunRun, Solar City, Sun Edison, et al) have a viable business model with exponential growth rates. While their activity is currently concentrated in states with high local subsidies for PV (eg CA, MA, NJ) the business model works pretty well for both the homeowner with the rooftop and the third party owner, even without subsidy at residential retail per kwh prices of ~13-14 cents or higher. In 2012 this led to the installation of about 2 megawatts of residential rooftop PV beyond what was subsidized by the state. At the moment the median installed price per watt in the US is hovering around $5/watt, but much cheaper in the more competitive states (~$4/watt in MA), but that's TWICE what they're paying in Germany, using the same panels, racks and inverters. There is a lot of soft-cost to be cut still in the US, and the prices WILL continue to fall as the rate of PV installation rises on it's exponential trajectory. See:

http://emp.lbl.gov/sites/all/files/german-us-pv-price-ppt.pdf

http://www.greentechmedia.com/articles/read/ferc-chair-wellinghoff-sees-a-solar-future-and-a-utility-of-the-future

There is a lot of grid-storage strategies currently being explored, and if/when residential installations are allowed to feed the grid from batteries (currently expressly dis-allowed by regulatory bodies everywhere in the US, except for a few experimental installations in CA and TX) the economics of local distributed renewables will soar, even with expensive Li-ion batteries, since the distributed generator can conceivably sell power at the peak-wholesale price whenever that was more favorable, and time-shift the output of the local array for local use too, relieving quite a bit of grid-infrastructure requirements. This will require some re-structuring of the local regulations and utility business models in order to come to fruition, but this isn't some deep-distant future possibility awaiting a technology or price breakthough, but (primarily) a regulatory change and political will breakthrough. The result would be better grid reliability, with flat or falling retail electricity pricing.

Cloudy Crystal Ball

Alex says, "Closing Vermont’s only nuclear plant will hurt the local economy" and "Our economy will suffer from the plant’s closure; there’s no getting around that." I'm reminded of a relevant quote from a leading economist of the last half of the last century, when the plant was built:

“The only function of economic forecasting is to make astrology look respectable.”

― John Kenneth Galbraith

Change brings uncertainty, yet Alex sounds very certain in the above statements. In fact, we don't know what the overall impact will be, but as the article also says, the Yankee plant closing presents many opportunities. How many jobs will be lost by the closing of the plant? It certainly isn't going to be 100%. If decommissioning begins quickly, the number of jobs related to the plant could go up. On top of the remaining and new jobs at the plant, the new opportunities that Alex mentions could increase the number of jobs in the area.

Or not. In any case, it isn't like we have the choice of having everything continue as it is. The Yankee plant has had licensing and regulatory problems, and the economics of the plant will force closure sooner or later. Closing the plant might hurt the local economy short term, because building the plant created an unsustainable economic model with too much dependence on a single employer. In this sense, building the plant hurt the local economy, by making it less sustainable, less resilient, and less interdependent.

Closing the plant will probably result in a more diverse, decentralized, and sustainable economy, in the medium and longer term. From my point of view, that is the definition of a better economy. Fear of short term risks is a major cause of long term economic problems. I'd prefer to see GBA blogs recognizing and emphasizing this, which the author is fully aware of, rather than endorsing the easy gloom and doom forecasting on a change of this sort.

Response to Derek Roff

Derek,

Thanks for your articulate post. I agree with your position.

It's worth mentioning that many Vermonters have been uneasy for decades because they have concluded that the Vermont Yankee power plant is dangerous and is creating radioactive waste that will remain poisonous for thousands of years. To these Vermonters, Vermont Yankee is not an asset to our local economy. If a plant threatens the safety of a community or is environmentally damaging, the salaries paid to its workers are (arguably) irrelevant -- and are not, strictly speaking, an economic asset, unless one interprets the word "economy" very narrowly, as encompassing only dollars and not our community, our safety, and the health of our environment.

One can think of other types of industries -- tar sands strip mines, coal strip mines, nuclear weapons manufacturing plants, or factories that manufacture land mines -- that pay high salaries but are so dangerous that the local economy cannot be said to benefit from the high salaries paid to the workers. Closing such plants benefits rather than hurts the local economy, if "economy" is properly understood.

Real vs. unfounded fear

I don't doubt that many Vermonters are concerned for their safety with regard to VY but I think it is important to at least base one's fear in reality. The claims of vulnerability to terrorist attacks, for example, are a bit confounding. What would be the nature of such an attack? Crashing a plane into the reactor building would have little or no impact on the reactor or most of its safety systems. Similarly, rocket propelled grenades and launchers would do little as well and both assume such attacks going completely undetected by the various security groups tasked with discovering such efforts. And then there's the recent "study" that claims these plants are vulnerable to certain scenarios. In this case Indian Point in NY and being struck by a ship. Really? Are we so naive and scared that we believe a ship is going to drive up the Hudson completely undetected, hang a right around a sea wall and drive up onto shore and through the reactor building?

Next, the fear that these plants are poisoning people; if this were the case, it would be pretty easy to show. And in some cases, it has been shown but in many cases, such claims are based solely in fear. Just about any industrial operation poisons its surrounding community more than the average nuclear plant. If theres a leak, there should be proof but pointing to leaks that occur in on site wells designed to detect such leaks is different. And if nuclear plants are killing people, why aren't the often thousands of people who enter the actual plant everyday not developing health issues or dying? I'm not saying no one should be concerned but at least base your fears on real proof and real scenarios. It is the only way you can expect to have an impact on real policy. That is, you can't debate or dismiss the nuclear industry on such fear. Your best bet is to hit them where it hurts; dollars and sense. Put more directly, what is the true and total cost of nuclear power including the mining, fuel, regulatory, operating and long term waste management costs compared to say wind and solar? And don't forget the subsidies we all pay in our taxes that go to the nuclear industry despite it mature and profitable state. What does this put the cost per kWh-generated for a particular energy resource?

VT will undoubtedly face some economic impact as a result of VY closing but its debatable as to how much, why and why. Many of the plant jobs will stick around and some new ones might even be added. Not producing energy will probably be the biggest hit since those taxes won't be paid and that capacity made up elsewhere, possibly by more expensive forms. Perhaps not. And there's little benefit to hurrying the decommissioning of the plant assuming the site can be transitioned to a greener one and perhaps rehabilitated into a different energy resources via wind, solar, ng. There is, afterall, a lot of non-nuclear equipment and infrastructure on the site that could be reused.

I personally would like for people to engage in more honest conversations on such matters rather than coming into them with some preconceived notions about the word nuclear equating to atrocity. Nuclear power has its pros and cons just like any other energy resource and it should be measured on those rather than unfounded, misguided, or shortsighted opinions. The goals should be safety, energy independence, and sustainability.

Log in or create an account to post a comment.

Sign up Log in