Image Credit: Energy Efficiency for All

A new study confirms that low-income households, households of color, multifamily households, and renting households spend a much larger percentage of their income on energy bills than the average family, providing new evidence of the urgent need to expand energy-efficiency programs to vulnerable communities.

The report, Lifting the High Energy Burdens in America’s Largest Cities: How Energy Efficiency Can Improve Low-Income and Underserved Communities, offers new insight into the hardships faced by urban low-income households — including African-American and Latino households and renters in multifamily buildings — all of whom pay a disproportionate amount of their income for energy.

The study by the Energy Efficiency for All project (a coalition which includes NRDC and the American Council for an Energy-Efficiency Economy) highlights the energy burdens on families in 48 large U.S. cities. It casts a spotlight on the opportunities to use efficiency to reduce these burdens, while cutting power-plant pollution that drives dangerous climate change.

Energy burdens are not equal

The big picture findings from the report: The overwhelming majority of single-family and multifamily low-income households (those with income at or below 80 percent of area median income), households of color, and renting households experienced higher energy burdens than the average household in the same metropolitan area.

For example, low-income households — many of whom live in older housing with poor ventilation as well as aging, inefficient appliances and heating systems — spend, on average, 7.2% of their income on utility bills, which amounts to about $1,700 annually out of $25,000 in median household income. That is more than triple the 2.3% spent by higher-income households for electricity, heating, and cooling.

African-American households experience a median energy burden 64% greater than white households (5.4% and 3.3%, respectively), and Latino households had a median burden 24% greater than white households (4.1% and 3.3%, respectively).

Meanwhile, Memphis had the highest energy burden for low-income households, with residents spending, on average, 13.2% of their income for energy. The median annual income for low-income residents of Memphis is $19,157, meaning that a family would be paying a whopping $200 a month ($2,400 a year) for energy to keep the lights on and their homes comfortable.

In fact, in 17 of the cities in the report, a fourth of low-income households experienced an energy burden greater than 14%.

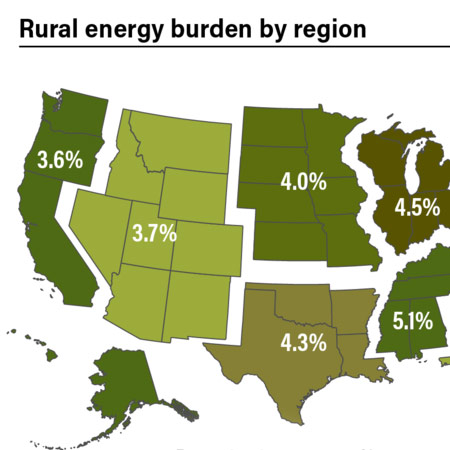

Low-income households in the Southeast and Midwest, while having among the lowest average energy prices, had the highest average metropolitan energy burdens. While this report did not establish a causative relationship, we do know that Southeastern utilities have the lowest investment in energy-efficiency programs when compared to other regions.

Why this report matters

Poverty and discrimination in rental and housing markets drive low-income households and people of color into older, less efficient buildings with higher energy costs. (Property owners may not install the best energy-saving measures and appliances because the owners are not paying the utility bills.)

High energy burdens and poor housing quality then contribute to health problems: poorly heated or cooled homes contribute to asthma, respiratory problems, heart disease, arthritis, and rheumatism. Families struggling to pay energy bills may sacrifice nutrition, medicine, and other necessities, which compound the effects of inequality.

These issues are particularly acute for low-income multifamily households. Because they are largely underserved by existing energy-efficiency programs, the average low-income multifamily household has an energy burden more than three times higher than that of the average non-low-income multifamily household (5.0% and 1.5%, respectively) and had higher utility cost per square foot. In these homes, “energy expenditures run 37% higher per square foot than in owner-occupied multifamily units (i.e. condos or cooperatives), 41% higher than in renter-occupied single family detached units, and 76% higher than in owner-occupied single-family detached units.” Further, from 2001 to 2009, while average rents in multifamily housing increased by 7.5%, energy cost for these renters increased by nearly 23%.

The picture is also shown regionally. Findings from the study show that low-income multifamily housing represented the second highest energy burden (second to low-income in aggregate) in every region of the nation except California and the Midwest.

This is important because multifamily buildings represent approximately 25% of the housing units in the U.S. and comprise 20% of energy consumed by all housing, and more than half of all low-income families live in multifamily housing.

Despite these facts, low-income multifamily buildings are largely underinvested by energy efficiency programs and represents a large untapped resource potential.

Energy efficiency can ease hardships and benefit everyone

While the energy burden numbers are alarming, opportunities abound to ease the hardship on groups that have long been underserved by efficiency programs.

While many utilities operate energy-efficiency programs, as the report notes, much more can be done to reduce the energy burden on low-income households, including targeting efficiency initiatives to the long-overlooked low-income multifamily sector. One earlier study by Energy Efficiency for All found that increasing energy efficiency in multifamily affordable housing could cut electricity usage by as much as 26%.

Utilities can step up efforts to reach out to low-income households, such as offering financing for energy efficiency projects. Another opportunity is EPA’s Clean Energy Incentive Program, an element of the Clean Power Plan to limit carbon pollution from power plants. It rewards states for early investments in energy efficiency in low-income communities.

Bringing low-income housing to the efficiency level of the average U.S. home would eliminate 35% of the energy burden experienced by this population, the study’s authors found. The potential is even higher for African-American (42%), Latino (68%), and renting households (97%).

The 56-page report, coming at a critical time in the debate over climate change, is a valuable tool in guiding policy makers on where to target energy-efficiency investment. Those are real — and critical — dollars. The average family could save as much as $300 annually on utility bills.

Energy efficiency has long been an NRDC priority because it is the cheapest and fastest way to reduce power-plant pollution that harms our health and contributes to climate change.

Cutting energy waste benefits all of us — in cleaner air, a more reliable transmission grid, and a stronger economy. (Efficiency initiatives not only generate jobs, such as work installing insulation, but also save utility customers money they can spend for other goods.) In addition, when low-income households can’t pay their utility bills, it can lead to higher costs for all utility customers.

This report should be on the reading list of utilities, energy regulators, and anyone else looking to make the electric grid cleaner, more affordable, and more reliable.

It won’t be just underserved households that benefit from greater investment in energy efficiency. It will be all of us.

Khalil Shahyd is a project manager with the National Resources Defense Council whose work focuses on the Energy Efficiency for All Project. He also promotes the expansion of green communities in New Orleans. This post originally appeared on the NRDC Expert Blog.

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

16 Comments

Ok but is this a solution in search of a problem?

"...spend, on average, 7.2% of their income on utility bills, which amounts to about $1,700 annually out of $25,000 in median household income. That is more than triple the 2.3% spent by higher-income households for electricity, heating, and cooling..."

What is their total cost of housing as a percentage of income compared to higher income households? I suspect that higher income renters will spend a significantly higher percentage of income on total housing vs. lower income households simply because low income households as defined by the article are more likely to receive a gov't subsidy (i.e. Section 8).

Response to Chris M

Chris,

You wrote, "I suspect that higher income renters will spend a significantly higher percentage of income on total housing vs. lower income households."

Your suspicions are wrong.

http://www.jchs.harvard.edu/sites/jchs.harvard.edu/files/jchs-sonhr-2015-ch6.pdf

"Over 80 percent of households with incomes under $15,000 (equivalent to full-time pay at the federal minimum wage) were cost burdened in 2013." ["Cost burdened" is defined as paying more than 30 percent of their income for housing.] "Just over half of homeowners and three-quarters of renters with incomes between $15,000 and $29,999 were also housing cost burdened. Even those earning $30,000–44,999 commonly face cost burdens, including 37 percent of owners and 45 percent of renters."

In other words, the lower your income, the more likely that your household is "cost burdened" (paying a high percentage of income for housing).

http://www.dailykos.com/story/2016/4/2/1508128/-High-housing-costs-are-making-life-impossible-for-low-income-families

"The typical lower-income household spent far more on housing as a share of income (40 percent) than those in the middle (25 percent) or at the top (17 percent)."

http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2016/03/household-expenditures-and-income

"Low-income families spent a far greater share of their income on core needs, such as housing, transportation, and food, than did upper-income families. Households in the lower third spent 40 percent of their income on housing, while renters in that third spent nearly half of their income on housing, as of 2014. Because their core spending absorbed so much of their income, households in the lower income tier spent considerably less than their middle- and upper-income counterparts on discretionary items."

Response to Martin

Note the blog article states the median annual income of renters is $34.9k/yr and their energy burden is only 4 percent vs. 7 percent for the "low income" group (median annual income $24.9k).

Neither the article or the studies mention whether rent vouchers were included in their calculations. Remember the vouchers are paid directly to the landlord. If the vouchers are not considered "income" for the tenant then the energy burden number is skewed higher for the group that received them..

As for the Harvard Study $15,000/yr is well below 80 percent of the AMI used in the article and nobody or a ridiculously small number of people live on "reported income" of $15k/yr.

Response to Chris M

Chris,

In your first paragraph, you note that low-income households (median income, $24,900) have a higher energy burden (in percentage terms) than a group that making more income (median income, $34,900). That supports what I wrote.

I'm fairly certain that studies that compare what low-income families pay for housing are discussing actual out-of-pocket costs for the family. Having worked in the field of subsidized housing, I also know that Section 8 vouchers are in very short supply, and that most low-income families don't have Section 8 vouchers.

Income should be "after tax"

Note that the proportion of money spent on utilities is rather higher when considered against 'after tax' income. The raw income is something of an illusion. It won't be there to pay your bills, only what you take home can pay your bills. The other part of the formula that is missing is 'gasoline costs'. That is generally higher than the total household utility bill. Together, the average is about $5300 year per household. After tax average of about 15% of income. That is a lot. $441 month. If one took a loan of $100,000 at 3% over 25 years to invest in an energy producing or saving system of PV, reno, etc and (assuming an EV) one could break even on average. What could you do with $100,000 on energy structures?

The landlord / tenant problem is persistent

The energy costs of older rental housing is usually much larger per unit area than more upscale rental or owner occupied housing due to divergent interests: When the tenant is paying the utilities the landlord gets no benefit from investing in efficiency improvements, and since the "payback" is in the long term the tenant has no incentive to improve the efficiency of the building either.

There have been multiple approaches to clearing that hurdle (on-billing payment such as Property Assessed Clean Energy programs, etc) but it's tough to push a string. Taking action requires at least some knowledge and willingness on the part of both landlord & tenant to make these changes happen, which leaves the existing rental housing stock in the well documented energy efficiency doldrums. It's tough nut to crack. No matter what programs are offered, educating the parties isn't always easy. Even the well educated and well-off don't always "get it".

"Shahyd" is a somewhat apt name for an author for the content of this article, meaning "witness" (though also "martyr").

tenant behavior matters too

Installing LEDs and water saving fixtures have made an impact in my own household budget but the bigger factor is changes in behavior. Shutting off lights, changing the thermostat setting, and limiting shower times has an even better ROI since behavior changes don't cost anything.

Whenever I work on an apartment or two flat I'm amazed at the tenant waste since it doesn't cost them anything directly. The last job had two toilets that ran nonstop and a bathtub valve that ran so much it would fill a bucket every two minutes for over a month. At a different job tenants would run their air conditioners and leave windows open on below zero days to air out their apartments from smoking. When you lose connection between what you use and what you pay for the incentive to conserve seems to disappear.

smaller multi-family units

Energy efficiency upgrades benefit the landlord in smaller multi-family buildings in a few ways. 1: A better performing house will lower the utility bill for the tenant, allowing more cash flow for the rent. 2: It is a capital upgrade to the building, adding value. 3: Indoor air quality is improved, making for a healthier rental space. 4: the landlord/lady can sleep better at night knowing they are doing their part in carbon reduction.

Tenant behavior is the other big piece of the puzzle. Tenants need to have a vested interest in the amount of energy they use, or else they will just go on being wasteful willy nilly.

It's been my experience that a tenant will pay their utility bill and cable bill before they pay the rent.

Large multi-family buildings are a different beast altogether, requiring a different approach.

Standard for over-burdened

There seems to be an unstated assumption in this article that low income people should spend the same percentage of their incomes on utility bills as higher income people. There is no basis for that assumption. As incomes increase, the percentage of spending on basic commodities like food and shelter decreases while the percentage spent on luxuries increases. A high percentage of utility bills are related to basics like space conditioning, hot water, cooking, and refrigeration.

Also, we shouldn't expect utility bills per square foot to be constant. Space conditioning is related to surface area which is higher per unit floor area in smaller houses, but less for multi-family. That is what shows up in the data here. Many other contributors, like hot water, are proportional to number of occupants. Low income families tend to have more occupants per square foot.

I am not saying that there isn't a problem with low income people living in inefficient buildings with inefficient systems. I am just saying that the data that is presented here does not prove the case.

NONE of These Studies are Accurate

The subject study and all the studies Martin cites are just gibberish, not meaningful, because:

"Income" is not even accurately defined these days. The unemployment rate is not even defined accurately any more. The fact is, despite the availability of jobs (if they hadn't been available, then they couldn't have been filled by ILLEGALS), the workforce participation rate is the lowest in history.

At least 25% of able-bodied people are no longer even looking for jobs--because they don't need to do so, with free handouts prevalent. The government is an absolute, undeniable disgrace when it reports a 4-5% unemployment rate--you can literally work one hour a month and be considered employed. And, imagine that scenario, which is actually happening: ANY EXPENSE ACTUALLY INCURRED BY SUCH AN "EMPLOYED" PERSON REPRESENTS A HUGE PERCENTAGE OF THEIR INCOME!!! So, very many either have NO or very little "income." Therefore any use of "income" as a basis for calculations and any studies such as those cited is just a disgrace.

No matter who responds to this, or how negatively they respond to this, the following are facts: This is not your father's world where many more people took responsibility for living within their means, most certainly including being able to support the number of babies they make, without help from those of us who actually take proper responsibility for our existence. The concept of "income" has become totally meaningless, in a world where you have the right to live, eat, make babies, have housing and utilities and on and on, while other people of integrity pay for you more and more and more, while you may have very little, if any, legal income that is actually known by the system. There are housing subsidies, universal service programs for utilities, food stamps (increase of 12 million people since Obama) women with infant children (who absolutely BEG people to make more babies and take the "benefit" ( so they can maintain their budget and bureaucracy in this ever increasing communistic state) and on and on. Again, "income" has become very largely meaningless as related to millions of people, even now including millions of ILLEGALS, to whom Obama and other liberal democrats would give even greater benefit of our money---- again, "income" is vey often meaningless, and so are these studies.

Energy bill burden for low-income families

As someone who worked for years for a non-profit agency that developed subsidized housing units for low-income families, I'd like to report what I know from personal experience:

1. It's hard for low-income people to pay their bills. Any middle-income or upper-income readers of GBA who think that poor people have it easy in the U.S. don't know what they are talking about.

2. The low-income population includes saints and sinners, hard workers and lazy people, in about the same proportion as these categories exist among middle-income Americans and upper-income Americans.

3. It saddens me to learn that when an article is written that discusses the special burdens faced by low-income Americans, so many GBA readers find it necessary to explain that this is an issue we shouldn't care about.

Getting incentives aligned

Who should pay the utility bills - landlords or renters? As Dana points out in #6, when the tenant pays the utility bills, the landlord has no incentive to install good equipment and upgrade the enclosure. As Dan points out in #7, when the landlord pays the utility bills, the tenant has no incentive to limit usage. Should utility bills be split?

In theory, market forces should push down rent when the unit is expensive to condition. Are there practical ways to get the actual market to better approach the theory? Should landlords be required to have HERS ratings and disclose utility estimates? Should landlords be required to disclose average past utility bills? Should there be tougher codes governing the standard to which rental building must be maintained?

Response to Martin's 1,2,2

Martin:

1. Yes, it is hard; it's always been hard. I believe that among people actually working for their support should find it easier than they currently do--for example, there should never me corporate executives or anyone else making 40-50 times the amount as their workers. I'm not sure anyone here is arguing your #1---BUT, as I did argue, "income" can be and is largely meaningless these days.

2. I also know a person working in "social service," for 40 years. She knows, and lives daily, the fact that a majority of "benefit" recipients will cheat, lie, steal, make more babies, whatever it takes, to maintain those benefits at the same or higher rate, because the system allows so many loopholes, is pc and "Kind", and because the system itself is a vast bureaucracy. This bureaucracy has a certain incentive for self-survival---more waste, somewhat comparable to the industrial-military complex.

3. Sad, sure. It is sad. I think NO ONE would disagree that it is sad--certainly not me. AND, I don't think anyone, certainly not me, wrote that "burdens faced by low-income Americans" (American-what does that even mean, right now?) ....." is an issue we shouldn't care about."!!! IT MOST CERTAINLY IS AN ISSUE WE SHOULD CARE ABOUT---that's exactly why I wrote!

The true sadness is that the root causes are often not addressed in these studies, so that such studies often drive bad conclusions and even worse "solutions." Although the author did not directly draw this conclusion, there are thousands, probably millions, of liberals who would conclude that low income people need more "public assistance" to achieve energy efficiency. Oh, my, this sounds so kind, and equitable----but only to emotional and illogical people that have no clue as to what "root cause" means..

some additional info

As someone who works for the State of Ohio weatherization program, I’ve given several presentations on this topic. The benefits of weatherization for rental units, not to mention all low-income housing, are ridiculously lopsided. And keep in mind: this is a program that basically pays for itself, yet is only 1/400th of the DOE budget . . . not too shabby for a government program. Some additional info for anyone who likes statistics:

• There are more renters now than at any time in U.S. history.

• Over the next (10) years the adult population in the U.S. will increase by 24.6 million (10% of current population). Estimates are that one-third to one-half of these will be renters.

• Typically, the average person should be spending 30% of their income on housing. Half of all renters are considered moderately rent-burdened (spending 30 – 50% of income on rent). This is considerably higher than a decade ago, and twice the rate in 1960.

• One-fourth of renters are considered severely rent-burdened (spending more than 50% of income on rent). In 2000, this percentage was one in five renters. This group will increase by 11% over the next (10) years (from 11.2 million to over 13 million).

• Since 2000, median income has dropped 10% while rent has risen 5%. So a family of (4) making $50,000 and paying $800/month in rent in 2000 would be making $45,000 and paying $840/month in rent today. In effect, that same family would be making $5000 less per year and paying almost $500 more per year in rent.

• Currently, 30% of the elderly are considered severely-rent burdened. And per U.S. 2014 Census projections, the 65-and-older population will increase by 80% in the next (2) decades (from 41 to 74 million).

• Median monthly rent in the U.S. in 2015 was $1290/month.

• In 2011, 11.8 million extremely low-income renters (earning less than 30% the median income, or $19,000/year) competed for 6.9 million affordable units (almost 2 renters per unit). At $19,000/year, 30% = $475/month. Less than 34% of new apartments were under $800/month, and 5% were under $400/month.

• In addition, several HUD and LIHTC properties are switching from previous subsidized contracts (15 – 30 years) to market-rate rents due to increased demand. Some are even buying out their previous loans early to take advantage of rising rental rates.

Some weatherization figures from a recent study:

• Data per the June 2014 report by SAHF/Bright Power on multifamily weatherization (collected from the HUD Green Retrofit Program and Illinois Energy Saver Program):

• Total of (284) buildings, ranging from 12 – 100 units.

• Energy and water costs for multifamily buildings in the U.S. = $22 billion/annually (25% is estimated waste).

• Weatherization costs ranged from $1600 - $2300/unit.

• Energy savings were $195 - $213/unit (annually), and water savings were $95/unit (annually).

And some statistics from the American Recovery and Reinvestment Act:

• ARRA budget was $5 billion between June 2009 – March 31, 2012

• ARRA weatherized almost 750,000 homes nationally (projected energy savings = $320 million/annually)

• Energy savings (estimated by Oak Ridge National Laboratories) will more than likely exceed costs. Put another way, the program will almost pay for itself over the lifetime of the average water heater (13+ years).

• ARRA employed/trained 13,000 people in weatherization

• ARRA was 2nd out of 200 federal programs in job creation (behind Highway Planning and Construction)

Behavior trumps all

For the last week and adding up I've been cleaning a duplex that had four feet of trash, gagged you when you entered inside, never cleaned toilets, etc... Basically the tenants had been living in a dumpster. Most of the trash was high end food, alcohol and high end products. The tenants had no Money to pay rent! One of them cleaned hotels... The other was coughing and sick all the time cause of the living conditions.

To say every tenant is like this isn't right as well, but behavior trumps all! One thing I've learned by being a landlord is trust but verify often. I've found that most people are not honest, could care less what their actions have on others and don't involve themselves in the community. There is a disconnect from real life.

In addition the same things can be said of most landlords, but understandable after being on the other foot.

Things that I try to do:

1.) Offer unique listings

2.) Air seal first, more insulation when able and picture windows as much as possible

3.). Renters pay utilities always! Effects behavior.

4.). Renters pay trash! Effects behavior

5.) Finding excuses for checking out the condition of property monthly isn't landlords being mean, its protecting the property from being a dumpster.

Really? Could this be a local-cultural issue? (@Stephen E )

"I've found that most people are not honest, could care less what their actions have on others and don't involve themselves in the community."

I've lived a lot of places, and have come away with a very different take on "...most people...", who in my experience are for the most part pretty honest and have some sensitivity to the effects of their actions on other. Involvement in the community at seems highly individualized, can't really generalize on that one.

That said, when there is no marginal cost to utilities neglect & abuse occurs, but it's not universal. On a Deep Energy Retrofit project on a 3 -family I was involved with a few years ago the utilities have until now been included. The Manual-J loads for the three units are comparable, as is the occupancy, but one of the three units (occupied by college students) was using between 5-10x the energy as the lowest energy use unit (occupied by a visiting professor from Korea.) On a routine maintenance visit to clean and test the mini-splits the high-use unit had a couple of video game units and large monitors running, the AC setpoint was at 60F, and one of the windows was partly open, with none of the occupants even in the (too cold) apartment. While this is clearly a case of abuse/neglect, in the handful of years this place has been rented out, this is the ONLY tenancy that has been a problem, despite primarily youthful (mostly college student) tenants.

My in-laws have held residential rental properties in MA for decades, tenants across a wide range of income & neighborhoods (including some with mental health and/or substance abuse problems), but the rate of destructive problem tenants or situations that led to evictions have been very low, certainly not "...most people...", or even a high single-digits percentage. Clearly YMMV.

Log in or create an account to post a comment.

Sign up Log in