One of green residential construction’s growing pains has been the disconnect between what an appraiser might declare a new, energy efficient house is worth and what it actually costs to build.

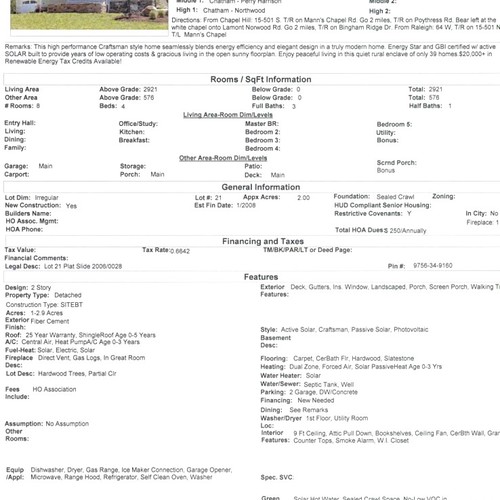

It’s certainly not a new problem, and, fortunately, it continues to attract attention. Back in December, GBA Advisor Michael Chandler, founder Chandler Design-Build in North Carolina, wrote about his experience with the issue – an appraisal on a $400,000 project whose high-performance foam insulation and solar technology were valued at 50 cents on the dollar – and the need to educate Realtors, appraisers, and bankers about green building, and do it on a nationwide scale.

We also noted that the appraisal problem can be particularly onerous when new or recently upgraded homes are located in rural areas, where MLS listings with comparable green features can be scarce or nonexistent.

Force-fitting for a loan

About two weeks ago, Chandler’s experience with the $400,000 home – and the green-home appraisal issue in general – was reprised in an article published by the Christian Science Monitor.

“We had to go back and strip out some energy features like the solar water heaters and cut back on insulation and add square footage, making it bigger and less (energy-)efficient to get to the $400,000 appraisal,” he told the paper. “Houses that are dramatically more efficient than normal, on average cost $15,000 to $20,000 more than houses built to code standard, but that’s not being reflected in the appraisals.”

Since green-home construction is nowadays one of the few sectors showing signs of life for residential builders, there’s added urgency to the push for education programs that can help appraisers measure the value of green-home features and more quickly build a database of relevant data, conventions, and guidelines.

The CSM story notes that progress in that area might get a boost from some lenders in the banking community, who have begun to offer $1,000 off closing costs for homes that qualify as energy efficient. The Department of Energy points out on its website that there are several green mortgage products on market, but acknowledges that they’re not yet widely adopted. However, the DOE also notes that programs being developed in Maine, New York, and Colorado are designed to inject capital into mortgage products to “buy down” the interest rate that is charged to borrowers as an incentive to finance energy retrofits.

The fledgling nature of green-product insurance

Another actuarially measured component to green-home ownership, insurance, also has been trying to find its way in the emerging market. In a story published April 7, Insurance Journal presented an overview of the concerns that accompany some of the new insurance products being written to protect green construction components, including wind turbines, fuel cells, and garden roofs.

The basic issue, some insurers say, is that many green-construction products are still too new to have a well-understood risk profile. Documentation on risks associated with vegetation on roofs is starting build, in part from claims pegged to leaking roofs, for example, but the deployment of wind and fuel cell energy sources in green buildings has not been the focus of many claims so far.

David Cohen, senior director of real estate for Commercial Insurance at Fireman’s Fund Insurance, told Insurance Journal that insurers also are homing in on green-construction defect issues.

“What everyone always historically or traditionally associates with construction risk is construction defects. Down the road, will there be any construction defect?” Cohen asked.

“I think it really depends on exactly what you’re doing in terms of your building,” Cohen said. “If you’re building to the more basic level of LEED certification, for example LEED certified or Silver level, you’re probably not doing anything exotic in terms of the building’s system or technology” and the building would pose no more risk for construction defect than a traditional building. But as builders move up in LEED certification to Gold or Platinum, Cohen added, more unproven technologies are likely to come into play. “Certainly any time you have new technology,” he said, “you’ve got that unknown potential risk or construction defect risk.”

Weekly Newsletter

Get building science and energy efficiency advice, plus special offers, in your inbox.

8 Comments

Green Building and Construction Defect Risk???

I find it curious that David Cohen sees green certified buildings as having a higher potential for defects than code minimum construction. Having built to LEED and NAHB green and Energy Star I can guarantee that all of these programs increase oversight and reduce the risk of water and mildew damage and enhance durability while improving energy performance and indoor air quality.

Builders who are willing to pay for additional inspections during construction are motivated to build better homes. Sam Rashkin makes a very persuasive case that these homes (Energy Star 2011 certified) represent a ten percent or better reduction in risk for the insurance industry. They are also a very effective hedge against the real potential of dramatic near term increases in the cost of energy.

NOT building green is the risky behavior.

Great Artcle

Great article GBA- very helpful! Most of us builders are bored to death with the thought of insurance companies or appraisers and often consider them "necessary evils" of construction. The opposite is the case. Appraisers, realtors, and insurers can take a cardboard box and sell it if the "market" approves all the while we builders are crying foul. We have to balance good green construction and the market. If the market won't pay for it, as in the poor guy's $400,000 home mentioned here, he winds up wasting money. Since the "market" is just another word for the large group of generally non-construction-educated homebuyers, we must promote good education of homeowners and realtors while incrementally building more green as much as the market will pay for it.

Green Appraisals

The problem isn't the Homemowners or the Realtors. It's the Bank Appraisers. We have remodeled Green and skipped the steps that are really exotic, just making it energy efficient and long lasting. The Homeowners love it and offerr the premium, but the aprpaiser just looks at BR, BA, square footage & garage numbers. They don't look at the extra cash that the Buyer will have from energy efficiencies. Doesn't this add to the overall affordability for the Mortgager? And the new more efficient features that (without getting too exotic and technical) will not need to be replaced for a couple of decades over the course of the loan!

Green Appraisals

The fact of the matter is that value is market derived and not some figment of the appraisers' imagination or lack thereof. It is an unfortunate reality for both traditional builders and builders of energy efficient properties that cost and value are not always the same. In some instances super-adequacies exist and features that cost a premium to build/install are not recaptured by the market. Ideally, green construction should be compared to green construction and when that is not possible, some consideration should be given to heightened efficiency. Will it justify the cost? That is something the market will determine and not the appraiser. Take for example early solar panels. While they provided energy savings to the homeowner, the economic life was short, the output was limited and the panels were seen by many in the market place as an eyesore. As an appraiser, I whole heartedly believe in green construction and I have taken the steps to educate myself on the subject. I believe that continuing to build traditionally is to build functional obsolescence, but that does not mean that I can enter into an assignment with a foregone conclusion that the value is there. It must be supported by the market in some way.

green home

Attitudes to energy are changing. Until fairly recently, this may not have been a particularly big deal. Most people now would pay more for an energy-efficient home. I believe that in the future, a green home will be more important than a fashionable home.

Educating appraisers and insurance professionals

Thank you for this article. Owning a 2008 green built home with a large solar array, my husband and I have found vast spreads in insurance "replacement costs". Since we designed and built this home ourselves, we have complete records on the construction costs. It is encouraging to see some insurance carriers finally recognizing not only the higher replacement costs involved (eg: solar panels, closed cell foam insulation, low VOC paint & floor finishes) but also the reduced risks (eg: reduced failure rate on tankless hot water heaters). The insurance industry as a whole is still running years behind the building trend and will continue to do so unless they EDUCATE their agents and appraisers!

Insuring the green home

The article about insurance and appraisal of a green home was excellent and illuminates typical issues with insurance, appraisal and limitations of both with regard to so-called "green construction". It also points out certain misunderstandings about the insurance industry, its distribution system and the general process of valuation of a home. Having spent more than twenty years in the insurance industry as agent, office manager and agency owner in more than one state, I am surprised that the underwriting and delivery process hasn't progressed.

It appears to me that the basic purpose of building "green" is to build a better, more efficient structure and to reduce the dependence on depletion of natural resources for our struture needs. In so doing, those of us who chose to develop green homes or buildings are deviating from what is a traditional pathway to creating structures. The operating term here is choice.

The insurance industry and the appraisal industry (especially for the banking sector) is reactionary. They deal with what is and do not set social, economic or domestic policy. I once insured a very fine custom built home located on anprivate island approximately three miles from the nearest mainland landfall. While a vacation home, it was built to much better than new home standards of the time, had a very expensive cedar shake roof that was pressure treated to meet fire protection standards of the town in which it was located, and was totally uninsurable in the standard market. Coverage was arranged in part through the Underwriters at Lloyds. This was not a multi-million dollar mansion, but a home with a worth replacement cost equivalent in 2010 dollars of around $350,000 at the very maximum. The issue was lack of fire protection or lack thereof, and the trust officer at the bank handling the trust affairs of the my client insisted that the house be insured regardless of the cost. The premium at the time was around $6000 in 2010 dollars. All of which involved choices made by the building owner and the banker.

So why should it be assumed that the general insurance market embrace the new "green" construction? If it costs 15-25% more to build a green home than a more normal home without those neat, "green" add ons, or additional cost items, why should the insurance industry embrace this? The purpose of insurance policies is to make whole losses sustained, but homeowners and fire insurance policies are underwritten on a broad base of data for a "typical" home of a certain value in a certain locale. I think it unreasonable to expect an insurance company to underwrite a home that would cost twenty-five percent more to rebuild than another home of idential size and characteristic that wasn't "green", if the premium remained the same.

So also the situation with appraisers. The appraisal industry and the banking industry behind it are not risk takers. They merely look at what is and report or deal with the nature of the market in which they exist. If there is a vibrant market for a three bedroom, two bath home in the area with a considerable number of houses on the market, the appriaser has scant reason to justify appraising a home that has many green features that the owner expects to appraise at 25% more than the others of the same nature.

A few years ago I was costing out a new home that I wanted to build using insurlating concrete forms. I asked several insurance companies for quotations including my own carrier that I have used for more than twenty five years. All the "local" carriers declined to quote since it was not a "normal" form of construction. My regular carrirer issued a quotation that was about what a normal stick built home would cost, BUT the policy had it been issued would have been an actual cash value policy instead of the more common "replacement cost" form. The reason was realistic and obvious: in a structure fire concrete walls do not normally fare well, so what might have been a repairable loss could well become a constructive total loss in a home built with ICF's. The insurance carrier would provide coverage but the burden for guaranteeing full value of coverage incase of loss was going to rest with me, and not some automatic inflation guard endorsement.

I believe that this is the way it should be. If people wish to build a 'green home", they need to understand that they are attempting to establish a new standard in high value and high performance structures. They may have to underwrite a certain amount of the risk in being at the leading edge, and if they are expecting someone else to validate or otherwise insure their sense of social or environmental responsibility they will likely be sorely disappointed if they look to the insurance and banking/appraisal industries. I think that history shows that there is no insurance for leaders and trendsetters. Doing what is right may be only something that is done because it is right, and it may cost more in the short run.

Have we forgotten the definition of value?

Good discussion. As an Energy Wise House Flipper, I live with this potential problem on every project. We are able to sell most of our Green Renovated homes for about 10% - 15% over the comps in the area that are derived simply from Beds, Baths, & Footage in the radius and the last 3 months. ... But that includes a superior renovation from the "lipstick on a pig" that most house flippers do. It seems that the appraisal industry and the banks have forgotten the definition of value from Real Estate 101, which is, "the price that a willing buyer and a willing seller agree upon" Actually they choose to ignore this definition and go with the actuarially safe formula that Roger alludes to in the previous post.

We've found it easy enough to sell projects with very complete Energy Packages as long as we also include the Wow! Package. Then we do our level best to educate the Appraiser on what is actually in the house. Usually we are successful. If we dont get the appraisal we need, we move to a Plan B. Rather than just take a loss because of a low appraisal, we will do something else, perhaps refinance the property and lease it until the market catches up. The refinance allows us to get our capitol back and continue our mission ...Saving The Planet, One Foreclosed House At A Time ... I discuss this and other challenges of Energy Wise House Flipping weekly on a webinar at GreenEarthEquities.com.

Log in or create an account to post a comment.

Sign up Log in